Over the duration, global high yield duration has declined

By Mitch Reznick and Mark Dove, Federated Hermes

This article is taken from Federated Hermes Limited’s 360 degrees 2H 2025 Fixed Income Report.

The duration of the global high yield (GHY) market is below its long-term average and quite a distance from its peak. Figure 3 shows duration at around three years, which is by far the lowest it has ever been. This compares to a long-term average of just over four years. This 25% decline in duration requires us to consider valuations in a new context.

Against a regular market backdrop in which credit curves are positively sloped, spreads of a three-year bond should be tight to the spreads of a four-year bond. This means that we cannot compare today’s GHY valuations on a pure like-for-like basis versus credit spreads when duration was much higher. The need to assess valuations normalised for duration is compounded by the improving credit quality of GHY over time. In other words, given the lower duration and higher quality of GHY today compared to a few years ago, spreads should be tighter.

While we believe spreads are on the rich side of fair in a historical context, we do not think they are as rich as one would think by comparing spreads to the simple long-term average. There are certain constructive aspects of GHY as a short-duration, relatively high-quality asset class: expected lower volatility and lower credit losses.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. Generally speaking, as interest rates rise, bond prices fall, and factors such as time to maturity and coupon rates are drivers of a bond’s duration. High yield is a lower duration market compared to investment grade. In addition to shorter maturities and higher coupons, a typical high yield bond has embedded call options. This allows the issuer to redeem the bond before its stated maturity. As such, and depending on market conditions, high yield bonds often trade as if they will mature at the call date rather than the maturity date. This happens because the rational investor assumes that the company will refinance the bond at a lower cost of capital available in lower rate and/or spread-tightening environments.

Why is duration falling?

Global high yield markets are shrinking. Since 2020, the European high yield market has been contracting at a rate of 3% per year and US high yield at 1% per year.2 The drivers behind the shrinking market are affecting the level of duration.

Also read: Global Asset Allocation: The View From Australia

First, high-quality issuers, which can borrow further out the maturity curve, have been leaving the high yield market and taking their duration with them to the investment grade market. So-called ‘rising stars’ – moving from high yield to investment grade – have exceeded the amount of ‘fallen angels’ – falling from investment grade into high yield – over the past few years (see Figure 4).

In addition, we believe the rise of other leveraged finance loan markets, such as direct lending and collateralised loan obligations (CLOs), have trimmed supply into the GHY market by taking market share.

Since 2022, we have also seen a consistent rise in average coupons within the high yield market, as older bonds issued in the lower rate environment are redeemed and new bonds are issued. The effect of this is to bring duration down on the index, as a higher coupon bond will have a lower sensitivity to changes in interest rates, all else equal.

Finally, we should add that although these factors are material in driving down duration, we acknowledge that changes in spread can accelerate changes in duration as well. For example, as spreads are tightening, refinancing becomes more likely and bonds will trade to call. This in turn can lower duration. The reverse is true: as spreads widen, bonds trade to maturity, raising duration.

Putting on those duration-tinted glasses

In normal, functioning markets, credit curves are positively sloped. This makes sense. Investors expect to be compensated for the incremental increase in uncertainty as the ability to predict outcomes with any measure of confidence declines over time. Predicated on this universal principle, we should be paid more for four years of risk – the long-term average for duration in GHY – versus three years of risk, which is the current duration of the market.

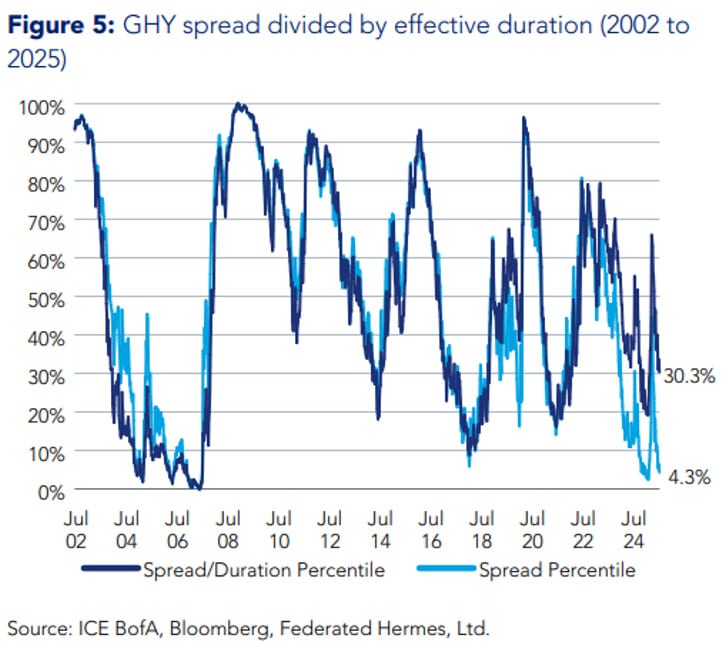

We should expect spreads today to be lower than the long-term average (and median) because the duration is lower. In order to understand to what extent GHY markets are rich versus fair in this context, we adjusted spreads for duration over time by dividing the GHY spreads by the duration of the market over a 20-year-plus period on a weekly basis. This ‘spread per unit of duration’ approach normalises spreads for duration over time. We then determined to what extent the duration-adjusted spread levels of GHY are rich versus the past by creating percentile buckets.

The results are shown in Figure 5. Whereas GHY spreads on an unadjusted basis are inside of the five-percentile bucket, over a 20-year-plus period, duration-adjusted spreads are at 30%.

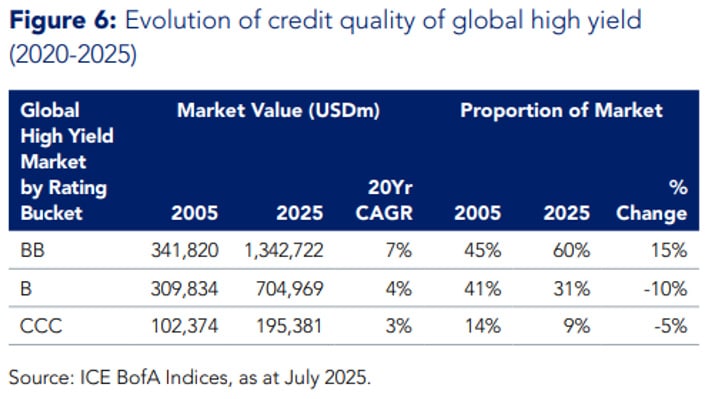

Our view is that, on a duration-adjusted basis, GHY spreads are on the rich side of fair, but fall short of market perceptions. This point is even more salient when we consider the improvement of credit quality over that same period (see Figure 6). Over a 20-year period, higher-rated credit in the GHY market has grown faster than any other category on an annualised basis. Based on this growth, it is now 60% of the market versus 45% two decades ago. The double-B category has taken share of the market from both single-B and triple-C which have both shrunk over time. This is a material shift.

Beyond the credit-supportive factors that we identified at our recent Multi-Asset Credit Strategy Meeting (MACSM) – macro, fundamentals, technical – this helps to explain where spreads are on both a notional and duration-adjusted basis through this 20-year period as observed in Figure 5.

What does all of this say about global high yield valuations?

GHY spreads are on the rich side of fair. But less so when adjusted for duration. Simple averages indicate that GHY is on the cusp of 20-year tights but, on a duration-adjusted basis, we are nowhere near that.

In addition, we have seen a substantial improvement in credit quality over the past twenty years. These two factors position GHY as a high-quality, low-duration product. Given these two characteristics, GHY is a compelling product in the context of profound interest rate volatility, particularly at the long end of the curve.