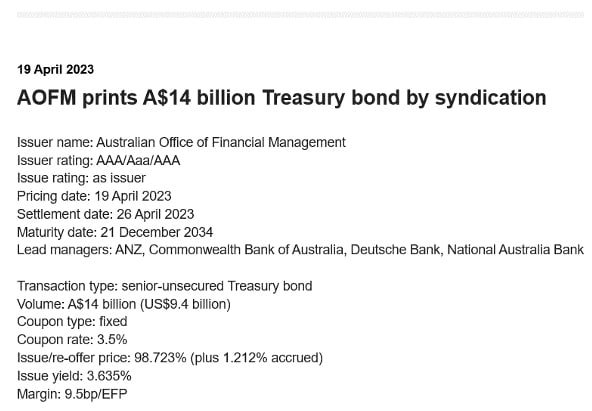

Yesterday, the Australian Office of Financial Management, on behalf of the federal government, printed an A$14 billion treasury bond, but could have printed more, with the issue attracting bids of A$61 billion.

Government bonds yields have been relatively volatile and the issue yield was very attractive at 3.635%, after the syndicate banking group (ANZ, CBA, Deutsche and NAB) set the bond price at 9.5 basis points over the yield implied by the 10-year government bond futures contract.

Also read: Vanguard Drops Fee for Bond ETF

Interestingly, the issue yield is practically the same as the current 3.6% cash rate implying very little expected movement in future interest rates. In other words, the market thinks the settings are appropriate to bring inflation back to within the RBA’s target 2-3% range.

The bond is a benchmark bond and matures in just under 12 years on 21 December 2034.