From Principal Asset Management

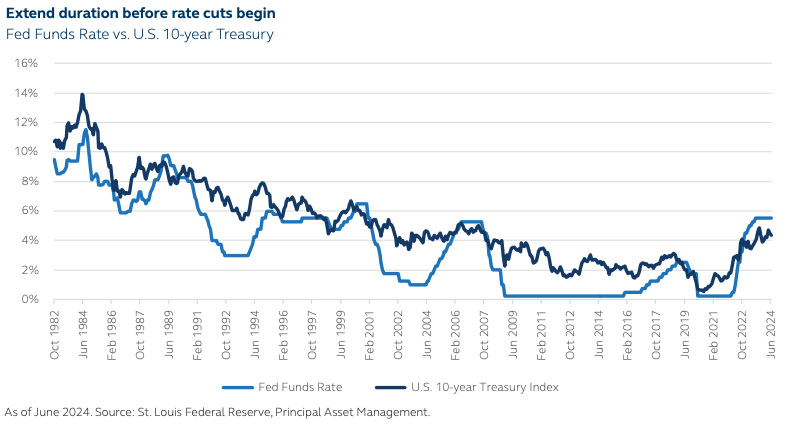

With the economy slowing and inflation moderating, the Federal Reserve (Fed) should be gaining the confidence it needs to start rate cuts in 2024—possibly as early as September. While the timing of the first cut is still uncertain, what is clear is the Fed’s desire to begin a rate cutting cycle sooner rather than later—to cut before the data shows that the economy has weakened significantly. As shown in the chart below, yields often drop before the Fed cuts; therefore, investors do not have to wait for policy adjustments to start to benefit from extending duration.

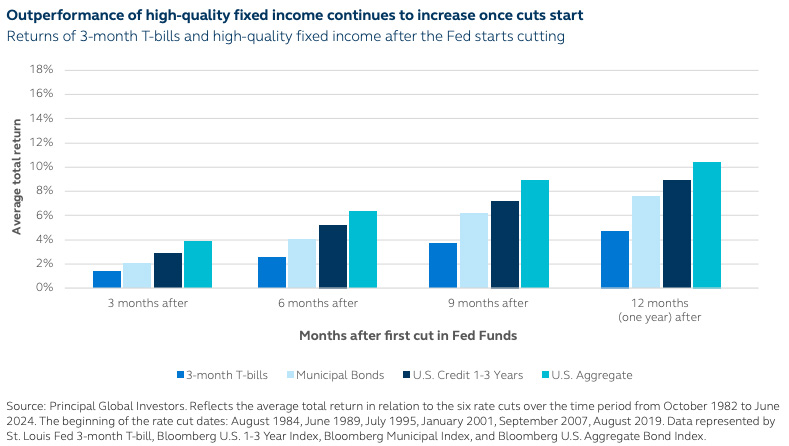

Historically rate cutting cycles tend to be long with the average rate cutting cycle lasting 26 months and the average drop in Fed Funds falling 441 bps.1 As the Fed begins cutting rates, cash and cash equivalents will fall until the rate cutting cycle is over. Over a long rate cutting cycle, investors remaining in cash and cash equivalents will continue to see their income and total return fall relative to longer duration alternatives. As the chart on the next page demonstrates, high-quality fixed income has outperformed 3-month T-bills after the start of rate cuts.2

High-quality fixed income does well with cuts regardless of the type of landing. There have been six rate cutting cycles since 1982—three times the U.S. economy went into a recession within 12 months after the first cut and three times the U.S. economy avoided a recession—yet in all six instances, high-quality fixed income had positive returns.3

Also read: Beware Outdated Perceptions When Comparing Credit Markets

From short to long duration, we believe now is the time to extend duration by investing in high-quality fixed income. Investors who are in cash and seeking to maintain income and liquidity could look at short duration investment grade credit as a lower-risk option. For investors seeking ballast for equities, intermediate duration core fixed income offers attractive yields and the potential to benefit from price appreciation should a meaningful slowdown occur. For tax-sensitive investors seeking to maximize after-tax income or for investors concerned about the potential for future tax increases, the value of the municipal tax-exemption is at its highest level since 2008. Extending duration in high-quality fixed income as the Fed begins a rate cutting cycle has the potential to meet a broad set of investor objectives.

1. Since 1982 there have been six rate cutting cycles. Source: St. Louis Federal Reserve, Principal Asset Management.

2. The returns on high-quality fixed income include the returns on the Bloomberg Municipal Bond Index, the Bloomberg U.S. Investment Grade Credit 1-3 Year Index, and the Bloomberg U.S. Aggregate Index.

3. The returns on high-quality fixed income include the returns on the Bloomberg Municipal Bond Index, the Bloomberg U.S. Investment Grade Credit 1-3 Year Index, and the Bloomberg U.S. Aggregate Index.