Fixed income markets should benefit from continued central bank easing in 2026. We expect lower interest rates in the US as policymakers respond to weaker labour market trends, and lower rates in Europe because of further declines in inflation. A resilient global economy and policy measures should keep fiscal concerns in check, allowing yields across the curve to reflect the growth and inflation outlook. The core scenario is positive for credit markets, notwithstanding tight credit spreads and signs of increased leverage.

Central bank policy, as always, remains key to the bond market outlook in 2026. Major central banks are forecast to take short-term interest rates to or below estimated neutral levels in response to growth risks and falling inflation expectations. The International Monetary Fund’s recent growth forecasts were better than those made earlier in 2025 but still suggest advanced economies will struggle to meet long-term average growth rates in the years ahead.

That implies a more supportive stance from central banks as long as inflation remains close to targets. For next year, this suggests substantial reductions in US interest rates to below 3%. Additional US Treasury market yield curve steepening is likely to result. However, demand for yield remains strong, not least from the US insurance sector which has become a significant source of structural demand. Long-term yields are unlikely to significantly deviate from the trading range established in 2025.

Credit bounce

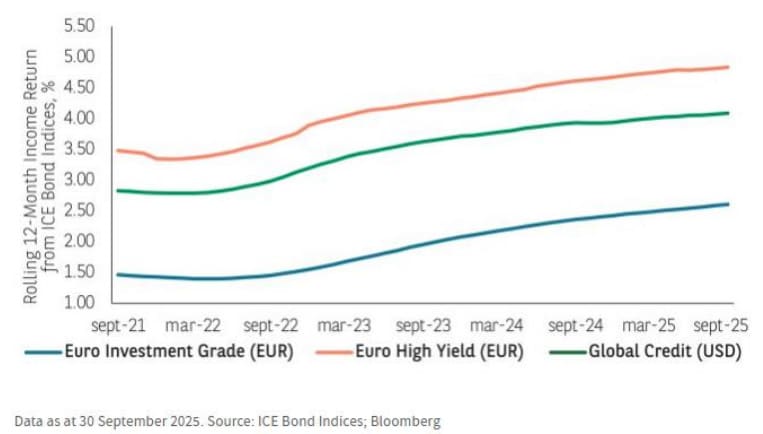

Credit market activity has remained buoyant in 2025 with credit spreads narrowing over the course of the year despite elevated levels of issuance. Excess returns have been positive and underlying corporate fundamentals remain solid. Looking forward what will determine credit market performance is whether investors continue to value diversified exposure to corporate risk more highly than balance sheet-challenged sovereign debt. In which case, prevailing yields in credit markets are attractive and should deliver attractive income-driven total returns.

Also read: Many Unanswered Questions

However, from a credit spread point of view, current valuations are tight, and the key risk is credit markets will experience periods of underperformance relative to government bonds. Catalysts for this are weaker economic data, equity market volatility or evidence of growing credit stresses in either private or public markets.

Geographically, US markets are most at risk from any deviation from the benign core scenario. Tariffs and the impact of immigration controls on labour supply could combine to keep inflation higher for longer. This not only complicates the Federal Reserve’s decision-making but also reduces expected real returns from US fixed income. It could also negatively impact the dollar. Any sense of increased politicisation of monetary policy (fiscal dominance) will tend to increase inflation expectations, steepening the US yield curve further and underpinning inflation breakeven levels. If growth also turns out to be weaker, investors could also focus on the US fiscal outlook, again widening spreads in the US rates and credit markets.

In the absence of a growth or credit shock, carry will be a major theme for bond investors, delivering most of the total return. As such, high yield and emerging market bonds continue to be interesting from a total return perspective. Again, after a robust performance in 2025, investors need to be mindful of valuations but improved credit quality in high yield and better macroeconomic performance in emerging markets are positives for those markets. Significant drawdowns in fixed income markets tend to only occur in response to a growth or credit shock. Neither is in our core scenario for 2026 which means investors should be able to benefit from solid bond income returns.