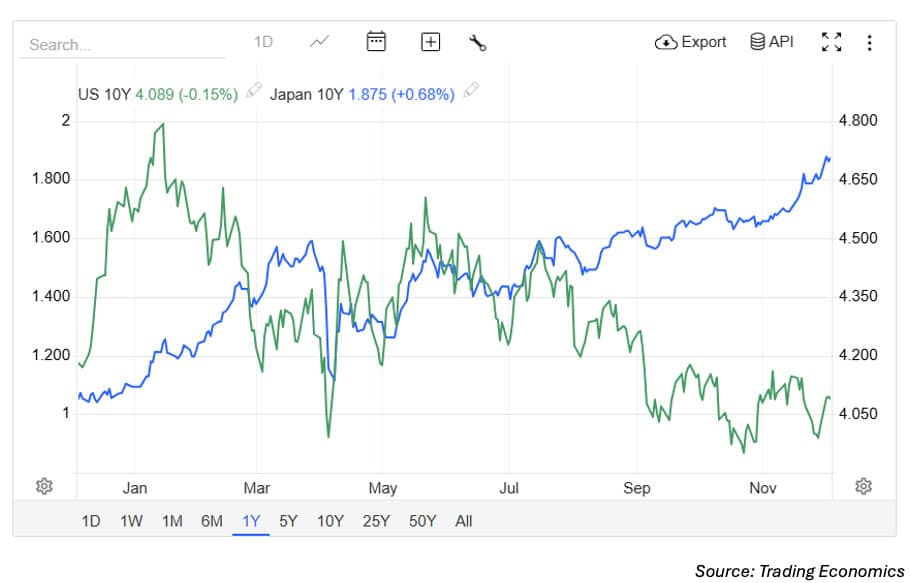

For years, Japanese investors have invested offshore, capturing better rates, while other investors have borrowed in yen and invested globally (known as the yen carry trade). However, the trade has been unravelling as Japan raises rates, while other global economies are cutting. Fears are, that will leave some sizeable gaps and see asset prices fall. This set a definite ‘risk off’ tone this week, where higher risk assets, notably cryptocurrencies lost billions.

See a comparison of the US 10 Year Treasuries versus the Japanese 10 Year below, which shows the impact of rate changes.

Our lead article this week is from Justin Tyler and Mark Mitchell from Daintree Capital discussing global market trends. They assess US equity and bond market correlations, their views on Australian interest rates and how they have positioned Daintree’s two portfolios. Interestingly, both portfolios have decent allocations to structured credit.

Sticking with the local versus global theme, I had an excellent chat with Clive Maguchu from State Street Investment Management last week. It’s one of our best podcasts this year as we weighed advantages, risks, and hedging amongst other factors when considering the Australian market versus global fixed income investment.

Emma Lawson from Janus Henderson is back with her popular Australian fixed income view. Lawson focuses on domestic household consumption, which I found interesting.

What happens if interest rates rise? Philip Brown from FIIG Securities took the possibility of higher rates to explain what this could mean for investors.

It’s great to see more products coming to market. This week, Betashares launched a new ETF, ECRD, and Royal London Asset Management has launched a new global high yield fund.

In Australian corporate bond issue news:

- Ausgrid has launched a five and or 10-year deal. Price guidance is 115-120 basis points over semi quarterly swap and 145-150 basis points over semi quarterly swap, respectively

- NatWest Markets has launched a 3.5-year senior unsecured operating company, fixed and or floating rate bond with price guidance of 100 basis points over semi quarterly swap

- Westpac has priced a $1.6 billion one-year senior unsecured floating rate bond at 36 basis points over 3-month BBSW

- Royal Bank of Canada has raised $950 million for a one-year senior unsecured floating rate bond at 43 basis points over 3-month BBSW

- BNP Paribas has priced a $750 million, perpetual non call 5.5 year Australian dollar Additional Tier 1 with a 7% coupon

- Suncorp has priced a $1.5 billion dual tranche five-year senior unsecured deal:

- $900m floating rate tranche at 80 basis points over 3-month BBSW

- $600m fixed rate tranche with a 4.7% coupon

- Zagga has raised $65m in a four-year senior secured bond at 420 basis points over 3-month BBSW, roughly equating to 7.85%

Have a great week!