Anna Kirkby, Investment Specialist at Fidante, looks at the benefits and risks from the growing asset class of private credit.

The Australian private credit market has grown considerably in recent years. This has been driven by a number of factors including changes to bank lending practices and regulations. Further, increased merger and acquisition activity and private equity sponsorship has driven demand for private lending partners in transactions such as leveraged buyouts.

Despite recent growth, the Australian market is still in its early stages of development compared to other regions such as the US and Europe where the asset class has a longer history and has reached significant size, combined worth an estimated $1.3 trillion according to Preqin.

Private credit offers an opportunity for investors to benefit from the diversification, lower volatility and enhanced risk return dynamic offered compared to traditional fixed income, but as with all investments there are risks that need to be considered.

Five key benefits of private credit

1. Attractive risk-adjusted returns

Private credit can provide enhanced returns compared to public markets. Being less developed, private credit markets are generally less efficient and less competitive than public markets.

Borrowers value the speed and certainty of execution available through non-bank lenders. They are often willing to pay a premium for a tailored capital solution with flexibility and in terms that are a better fit for their funding needs than traditional lenders. Lenders are generally rewarded for complex deal origination and structuring through upfront fees, in addition to the loan margin, which can contribute to higher investor returns if they are passed through to investors.

2. Illiquidity premium

As private credit is not publicly traded, once issued, loans are not actively bought and sold. They are generally held to maturity, commanding an illiquidity premium. . The illiquidity premium on private credit investments can be meaningful; alternative investment adviser Cliffwater estimates that investors receive an illiquidity premium of 2.5% for moving from liquid US leveraged loans to illiquid US direct senior loans.

Also read: Investors Hunt Down Income Amid Economic Turbulence

3. Lower volatility and diversification

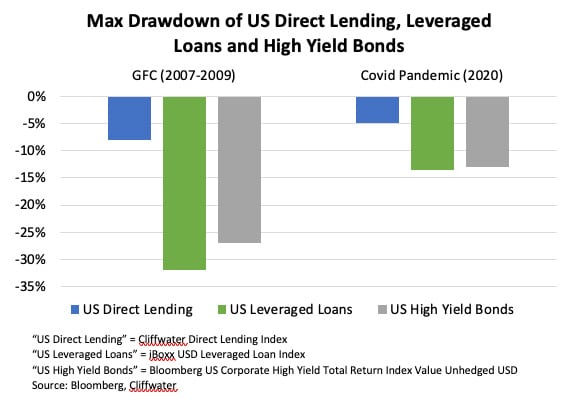

When marked to market, private credit assets will exhibit capital price volatility. However, they have historically demonstrated lower volatility of returns than publicly traded credit, complementing other defensive assets within a portfolio and helping to smooth portfolio returns. Data from US markets shows that historically, private direct lending has exhibited lower volatility than public leveraged loans and high yield bonds, with notably milder drawdowns during market downturns including the GFC and the early 2020.

Also, the varied suite of borrowers in private credit markets provides sector diversification away from public credit markets which are dominated by financials in Australia.

4. Protection from higher interest rates

Private credit loan facilities often have a floating rate and therefore can provide protection against higher interest rates. Floating rate coupons rise in line with increases to the prevailing bank bill swap rate. This can reduce correlation to traditional fixed income assets that carry interest rate risk and improve portfolio diversification.

5. Meaningful downside protection

Private credit transactions can include strong downside protection in the form of security and covenants. While private lending can span the whole capital structure including unsecured and mezzanine financing, the vast majority of private credit deals are secured to assets. The underlying security provides downside protection as in the event of default the assets can be sold to reduce losses.

Assessing the risks of private credit

While private credit presents a significant opportunity, investors should also be aware of the three main risks involved in this growing asset class.

1. Illiquidity Risk

As most private credit investments do not have established secondary markets, they cannot easily or quickly be liquidated meaning investors may be subject to extended holding periods. Investors should be aware of both the opportunity cost of locking into an illiquid investment and the risk of investing into a fund where the redemption terms may not match the liquidity of the underlying portfolio. For example, open-ended private credit funds may offer periodic liquidity such as monthly and quarterly windows, but only a certain proportion of the fund may be available for redemption and redemptions may only be fulfilled on a best endeavours basis.

2. Credit Risk

As private credit usually involves sub-investment grade lending, credit risk is an important consideration for investors. This refers to the risk of loss if a borrower fails to meet loan requirements including payments of interest and principal. This risk can arise due to adverse macroeconomic conditions, a financing mismatch between resources and obligations and borrower-specific factors. Along with structural protections like covenants, rigorous due diligence of potential deals and risk management processes can help to protect against the likelihood of loss. A manager’s track record and experience through multiple cycles, including in workouts of impaired loans, are important criteria indicating whether a manager has the appropriate skillset to build and manage a robust private credit portfolio.

Another aspect of credit risk involves movements in credit spreads. When investments are marked to market, the capital price of loans in the portfolio can fluctuate as credit spreads widen or tighten. In a private credit fund this marking to market is important to ensure investors enter and exit at fair value.

3. Income Risk

While floating rate investments benefit investors when interest rates are rising, they have a negative impact when interest rates are falling. Coupons received from a floating rate private credit portfolio will decrease as interest rates fall, meaning the income stream from private credit can fluctuate over time.

Summary

As the Australian private credit market continues to develop, it presents a compelling opportunity for a broad variety of investors to consider this asset class. The importance of manager discipline in understanding and quantifying credit, liquidity and complexity risks cannot be overestimated. Offering attractive risk-adjusted returns and historically lower volatility compared to traditional fixed income securities, private credit should be considered when constructing robust and well-diversified investment portfolios.