Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Market outlook

The RBA raised interest rates to 3.85% this week. This is likely to represent the start of a

series of increases over time. Over the past month the Australian economy has shown resilience and a new, potentially large, source of growth. In light of this, our updated outlook is for the RBA to continue its hiking cycle later this year.

The labour market, while showing modest growth, has been more sustained and lowered the unemployment rate. Inflation is proving stubborn, and while the latest data exhibited some signs of underlying easing, the RBA’s favoured measure of Trimmed Mean remains elevated. The latest consumer sentiment figures show the tensions. Households are hesitant in the face of potentially higher rates, but are currently spending at average levels. This could change quickly.

The emerging source of growth in the Australian growth is in the capital expenditure side.

Rising spending on datacentres and the required infrastructure to support them is

compounding an already tight capex cycle. This has the potential to push the supply side of

the economy tighter, and buoy overall demand side GDP outcomes.

Monthly focus – Make Way For AI Investment

The AI investment boom is upon us, we knew it was coming but the third quarter of 2025 showed that its appearance was perhaps sooner than expected. The trajectory is by no means guaranteed. There is a desire by policy makers, and players alike, to facilitate progress but some perspective on quantum, and constraints, provide a useful guideline to the path ahead. The AI sector influence on the economy initially shows up in investment. The productivity enhancements come later. Australia is seen as having a comparative advantage in terms of global geopolitics, economic conditions and availability of renewable energy sources. Given this, it is reported that the build and placement of data centres (DC) in Australia is higher than in comparative countries. Australia will benefit from setting up DC in Australia that service both local and non-Australian clients.

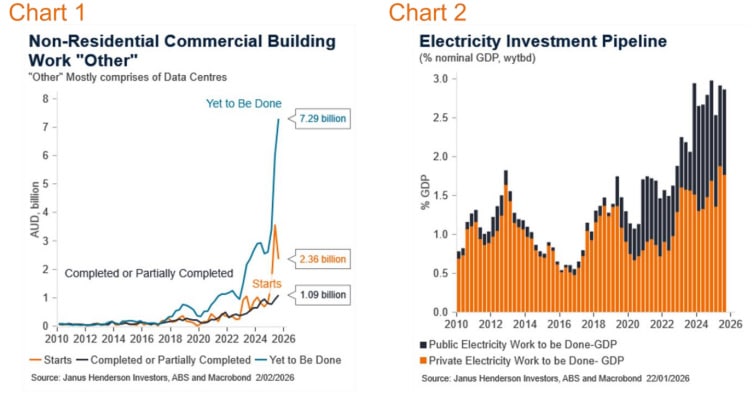

The rise in DC building has been dramatic. This captured economist’s attention in the third quarter data set, surging ahead. To Q3 2025, per quarter, actual building steadily rose at A$1.1bn, starts have surged to A$2.4bn but all eyes on the work yet to be done (WYTBD) at A$7.3bn. WYTBD are committed, approved developments that are expected to proceed in the next year. While not all will go through, a significant proportion is expected to be developed. The Q3 data for starts is also indicative of the possible pathways. It may not be a smooth process; delays can be expected. These represent a powerful rise in the sector. Mapped against the overall economy though, it may be smaller. The datacentre WYTBD is around 0.25% of nominal GDP at this stage. There have been numerous announcements regarding the pipeline for DC build commitments that will not be in the official ABS data.

Also read: Unlocking Blue Finance: A Commonwealth Guide to Blue Bond Issuance

If we assume the A$7.6bn increase, then deflate by target inflation, the rise in real private non-residential capital expenditure is an admirable 20%. Assuming it isn’t implemented all at once and smooth the spend over multiple years, this would imply an approximate 0.4 percentage point rise in the contribution to real GDP per year. This is not to be ignored, but equally it doesn’t suggest another boom period.

However, if the media announcements are to be believed, there is a long-term pipeline of around A$150bn. If, and this is a big assumption, this comes about, then there could be a significant contribution to real GDP over a decade. This includes spending on the inputs, such as energy and water, as well as software.

There are challenges to the projected implementation of datacentre construction. There has been a crowding out of construction as the public sector utilised available labour and inputs to building, creating roadblocks to rapid build out in the private sector. This will ease as the public build moderates.

Energy and Transmission

Energy is significant for DC and AI. DC are energy intensive and have huge energy, and thus transmission, needs. Increasingly, DC are saying they will provide their own energy, predominantly through renewables.

The electricity building on WYTBD is larger than that of DC, and while AI and DC are a large part of this, the changing needs of the entire energy sector is also behind the ramp up. The WYTBD now equates to just shy of 3% of GDP on a nominal basis. Much of the acceleration since 2024 has been in the public sector, while private plans have been flat, after a sharp rise though 2022-2023. That will need to change if private energy generation is to be used to meet the new AI needs.

Given the increasing focus on the social aspect of energy, and water, usage, often referred to as the energy trilemma of reliability, affordability and sustainability, combined with tight supply and rising costs, it should be expected that heavy users such as DC, and others, will meet their energy needs outside of the public provision. This can be represented as a capital expenditure tailwind, or an investment headwind. It is likely there is a bit of both. Some investors will be able to go ahead with private access to their energy, and water, needs. Others will see the costs, delays and social license as too high a barrier.

Spending on actual AI itself will likely increasingly factor into the equation. Overall software spend has already surpassed the late 1990’s boom and should further increase. As AI becomes cheaper per user, and other versions appear, this growth may slow. The generalised rise in overall spend thus far is also likely to represent the increased digitisation of lives and workforces that was already underway. AI adds to this. We would consider the contribution to growth to maintain on a steady path from here.

Views as at 5 February 2026