Dr Noah Weinsberger, Managing Director and Dr Xiang Xu, Senior Associate, at PGIM have drafted a very valuable, technical paper assessing stock bond correlations. Here we publish the key take aways.

Stock bond correlation is considered an important input for multi-asset portfolio construction.

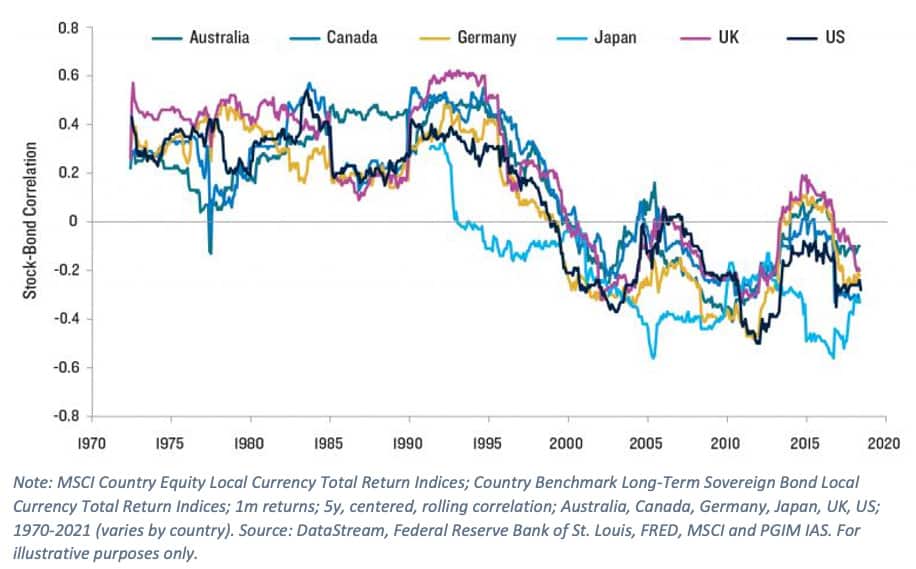

For the last 20 years, Developed Market (DM) local stock bond correlations have, by and large, been negative, matching the US experience (see graph below). Negative stock bond correlation provides an implicit hedge of one asset to the other, dampening overall portfolio risk. A shift in local stock bond correlation regime from negative to positive would alter the expected risk reward characteristics of a portfolio of local assets.

During this regime, stocks and bonds have hedged one another, dampening overall portfolio risk for a given level of equity allocation.

This paper explores DM stock bond correlations, their relationship to each other, and their common macroeconomic drivers, if any.

Also read: Bank Bill Swap Rate Riding A Wave

A global CIO assessing the risk of a shift from negative to positive stock-bond correlation must consider both local and US economic developments. Historical evidence suggests that policy rate uncertainty, fiscal sustainability concerns, and worries about monetary policy independence are all linked to such a shift, which would likely be widespread across the DM complex.

Positive stock-bond correlation would alter the expected risk-reward characteristics of a balanced multi-asset portfolio. In such an environment, history shows that it is difficult to find a find low-risk assets with equity hedging properties.

Five takeaways from the research:

(1) DM stock bond correlations are highly synchronized. DM local currency stock bond correlations tend to move together, switching regimes (i.e., sustained periods of positive or negative correlation) as a group. Emerging Market (EM) local currency stock bond correlations are less cohesive and tend to be positive.

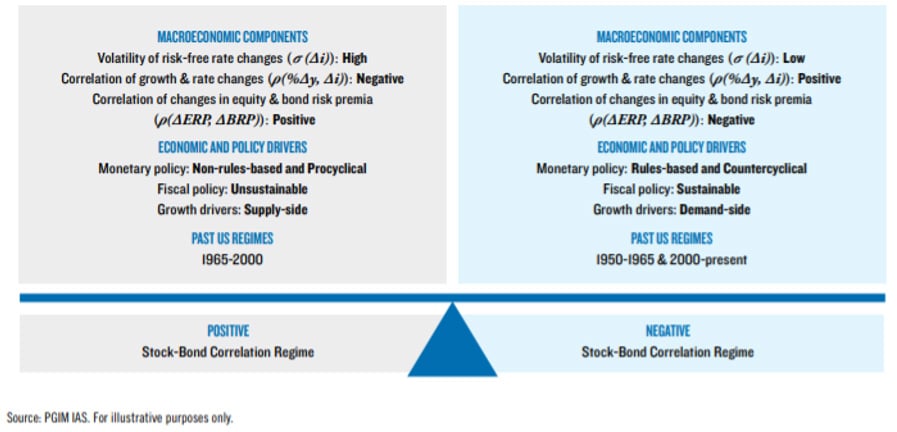

(2) Macroeconomic conditions and policy settings determine stock bond correlation. The volatility of risk free rates, the co-movement of economic growth and risk-free rates, and the co-movement of equity and bond risk premia determine stock bond correlation. These conditions themselves relate to fiscal policy sustainability, monetary policy cyclicality, investor risk preferences, and the balance between supply and demand-driven growth. Sustainable fiscal policy, rules based and countercyclical monetary policy, and demand side shifts support negative stock bond correlation. Unsustainable fiscal policy, non-rules based and procyclical monetary policy, and supply side shifts support positive stock-bond correlation.

(3) Both global and local macroeconomic conditions determine local stock bond correlation. US macroeconomic conditions – a proxy for common global macroeconomic factors – play a prominent role in determining DM local currency stock bond correlations and help explain the synchronicity of DM stock bond correlations. Local conditions net of US effects, particularly local risk premia, are also important.

(4) A shift in US stock bond correlation regime from negative to positive would likely be matched by a correlation regime change in other DMs too. Should US economic and policy forces increase the likelihood of a switch in US stock bond correlation regime, the risk of a similar switch in stock bond correlation regime in other DMs would rise too.

(5) In a positive US stock bond correlation regime, when US bonds are a weaker hedge to US stocks, other DM bonds do not provide a better hedge. When US stock bond correlation is positive, the correlations between US stock returns and DM (hedged USD) bond returns are also positive, meaning that DM sovereign bonds are also not a reliable US equity hedge. Other potential hedging assets, particularly commodities, are more reliably negatively correlated with US stocks and could be a hedge, but at the cost of significantly higher portfolio volatility.

Stock Bond Correlation, Macroeconomic Components and Economic Policy Drivers

To read more, please go to the PGIM website.