Capital Group has issued its 2026 capital market assumptions, which outline the firm’s long‑term expectations for returns, correlations and volatilities across major asset classes over a 20‑year horizon. Estimates for equity and fixed income returns have edged modestly lower relative to 2025. The firm maintains a constructive long‑term outlook, supported by steady inflation trends, productivity gains and a broader opportunity set for diversified, long‑term and actively managed portfolios.

Active management continues to contribute meaningfully to global markets through price discovery and effective capital allocation. Capital Group’s long‑term investment approach is informed by decades of experience across market cycles. In 2025, investment professionals held more than 22,000 company meetings worldwide, providing insights that help shape the firm’s long‑term assumptions.

“Our 2026 capital market assumptions reflect a world where near‑term uncertainty and structural shifts sit alongside long‑term opportunity,” said Alexandra Haggard, Head of Asset Class Services for Europe and Asia-Pacific at Capital Group. “While our return expectations of major asset classes have eased slightly over a 20-year horizon, as long-term investors, we continue to see a constructive landscape presenting investment opportunities across global markets supported by innovation cycles, advances in AI, and inflation that remains anchored near central bank targets. AI remains a structural driver of long‑term economic resilience through its productivity gains, and in a more complex environment, this only heightens the importance of active investing and thoughtful navigation.”

Also read: Australian Economic View – February 2026 – Janus Henderson

Capital Group’s 2026 capital market assumptions note:

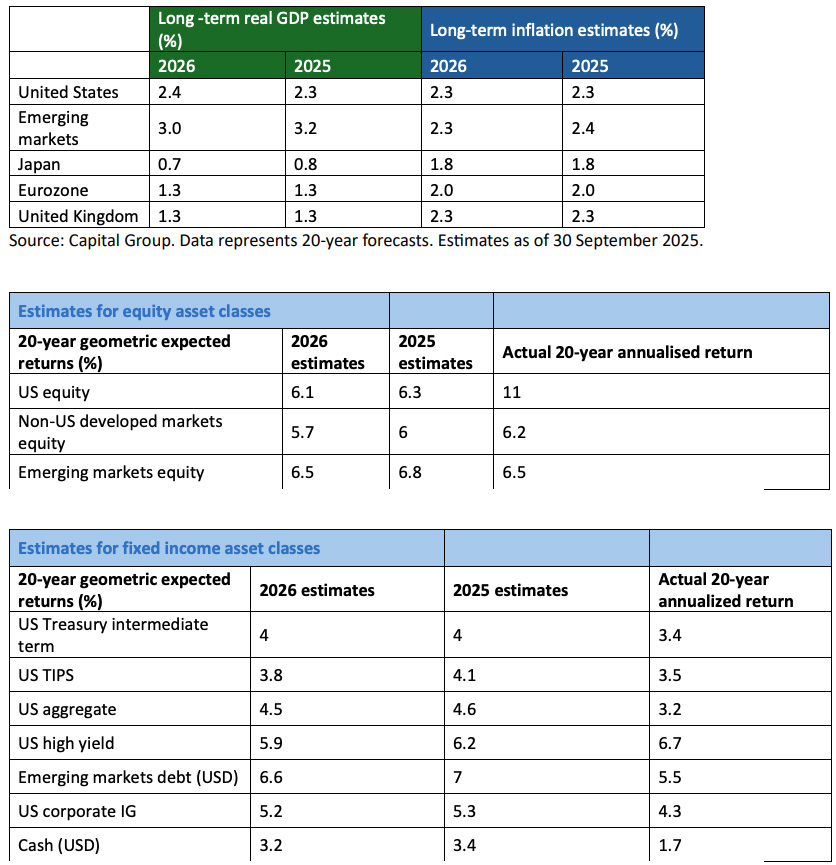

-Real GDP: Growth expectations are broadly steady. The US is slightly higher at 2.4%; the eurozone and UK remain at 1.3%, and emerging markets (3.0%) and Japan (0.7%) edge lower.

-Inflation: Expectations are broadly unchanged and remain close to central bank targets — around 2% in Europe and Japan, and 2.3% in the US and UK. Short‑term inflation is near 3% in the US and Japan. India is expected to sit above 3%, while Europe and the UK are closer to 2%.

-Equities: Return expectations have been modestly reduced following strong market performance and elevated valuations. Forecasts now stand at 6.1% for US equities, 5.7% for non‑US developed markets and 6.5% for emerging markets.

-Fixed income: Returns are expected to be slightly lower due to softer starting yields, even as higher long‑term rate assumptions provide some offset. Conditions remain far better than the unusually low‑rate environment of the past two decades. The 10‑year US Treasury yield is projected at 4.2% over a 20‑year horizon (vs. 3.9% last year).

-Currencies: The US dollar is expected to depreciate modestly at –0.5% per year. The yen and yuan are expected to appreciate relative to last year, while the euro and pound are projected to weaken further, leaving the overall impact on the USD broadly balanced.

Source: Capital Group. The 2026 estimates are as of 31 December 2025, with valuations as of 30 September 2025. The 2025 estimates are as of 31 December 2024, with valuations as of 30 September 2024.