From PGIM

The expansion in global credit markets provides levered companies with several financing options.

Depending on a company’s financial health, these options can include publicly issued high yield bonds, broadly syndicated loans, or private loans from banks or direct lenders.

As the private credit market has grown in size and breadth of participants, more sizeable transactions have opened the door for larger companies (EBITDA>US$75M) with larger scale, stronger revenue growth, more resilient margins, and experienced management teams.

While just one of the many privately placed loans funded through PGIM’s Large Cap Private Credit strategy, there are several attributes PGIM seeks out when sourcing private credit investments. These include:

- attractive economics,

- tighter security documentation, and

- more favorable fundamentals

Larger scale, large cap private credit has historically lead to lower defaults and higher recovery rates.

Cross-Market Dynamics

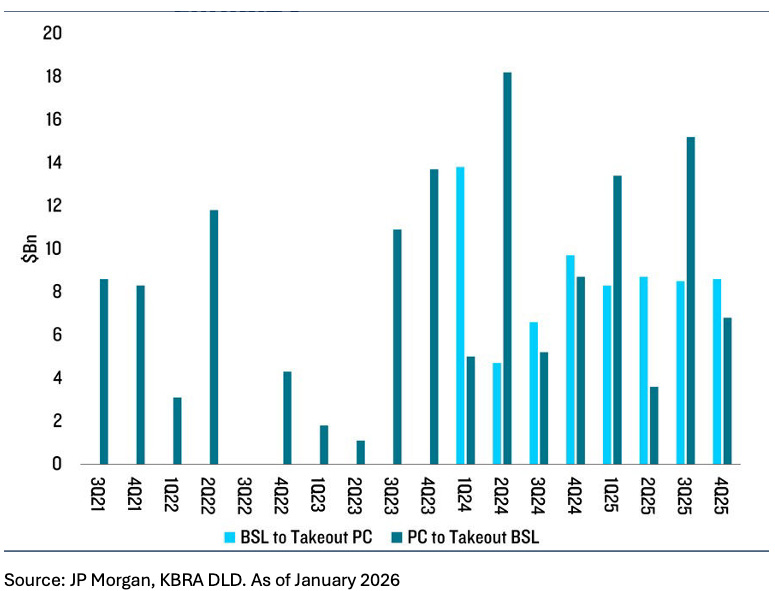

Increased competition between private and public syndicated markets has fuelled a surge in cross-market refinancings.

While 2022-2023 saw a notable increase in the volume of broadly syndicated loans (BSLs) being refinanced by direct loans, 2024 and 2025 brought near equilibrium to that trend.

Refinancing volumes across private and public markets has reached near parity.

In 2025, the volume of broadly syndicated loans refinanced in the private credit market totalled US$39 billion, only slightly greater than the US$34 billion in direct loans that were refinanced with BSLs.

This give-and-take speaks to the growing convergence of public and private credit over time, the fungibility of capital, and the shifting relative value between the two markets based on prevailing market dynamics.

Evolution into Large Cap

Although much of the expansion in private credit has focused on direct lending to small and middle market companies, the subsequent growth phase in direct lending finance now includes direct lending to large companies with EBITDA from US$75 million to US$1 billion.

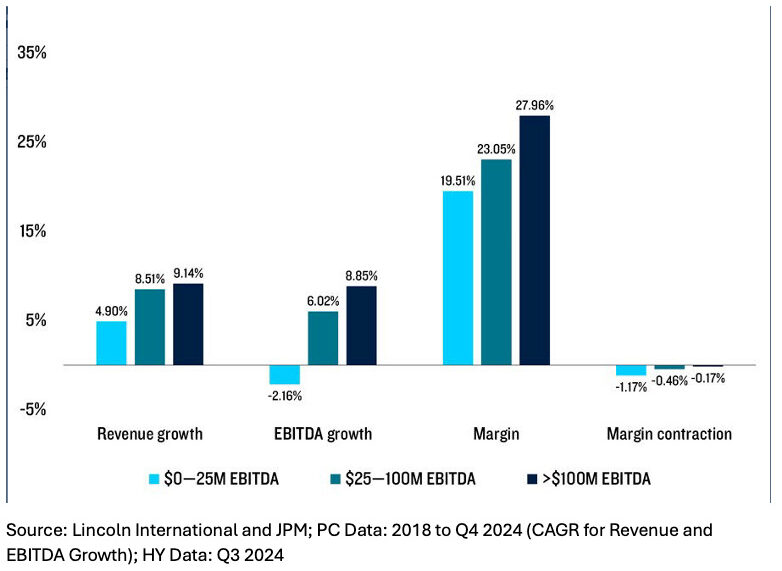

The size difference historically indicates stronger credit profiles consisting of stronger revenue growth, greater cash-flow stability, often higher profit margins, greater resilience with more stable/defensible market positions, and more sophisticated and experienced management teams.

The credit costs of large-cap borrowers are slightly lower than the middle market cohort, but once adjusted for a lower expected credit loss experience, the illiquidity premium of large cap private credit is more attractive in our estimation.

Credit comparison across small, medium, and large cap private credit

i) We’ve come to this conclusion based on the beneficial attributes of large cap private credit, including: typically, stronger security and covenants compared to the broadly syndicated loans market;

ii) larger scale, which has historically led to lower defaults than the private credit mid-market; and

iii) stronger fundamentals (e.g., stronger revenue growth, EBITDA growth, and margins than smaller caps). The strong security protections of all private lending helps to protect private loans from aggressive LME defaults.

Strong First Lien Security Protection

The share of broadly syndicated loans issued with weak security documentation is at an all-time high.

Carve outs, unrestricted assets and collateral, and overall fewer lender protections have enabled many public leveraged finance borrowers to undertake LMEs.

These are distressed exchanges where the company inflicts principal loss to the lenders—often to the benefit of either shareholders or other creditor groups—and have become a mainstay in the broadly syndicated loan space.

By contrast, private credit transactions generally benefit from stronger security over the borrower’s assets, leading to higher recoveries in the event of default.

Over time, sponsors may look to explore creative ways to raise additional debt on weaker terms. Therefore, restrictions on collateral transfers and asset-drop rules are critically important aspects of each private credit transaction that PGIM underwrites.