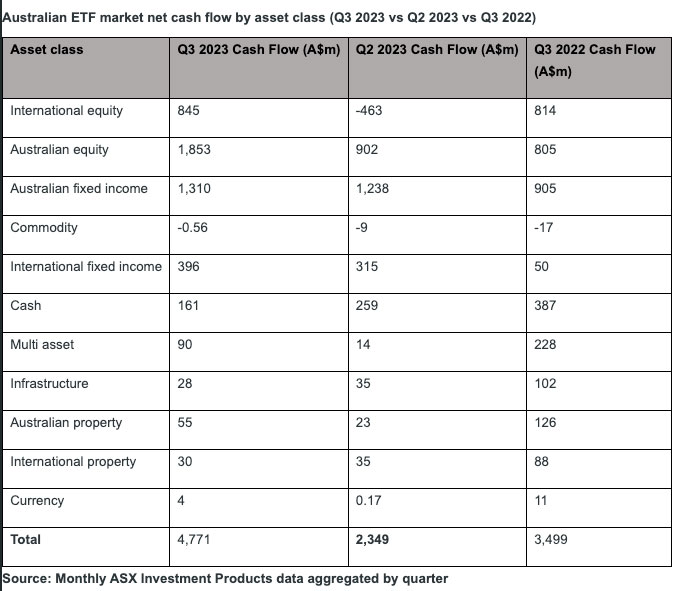

Fixed income remained in favour with investors in Q3 with domestic bond ETFs recording A$1.3 billion in flows in Q3 (up nearly 6% since Q2) and global bond ETFs recording A$396 million (up 26% since Q2).

A resurgence in Australian equity ETF flows in Q3 2023 saw the industry experience its strongest quarter this year, according to data recently released by the Australian Securities Exchange (ASX) and Vanguard.

“Stronger flows into equity ETFs in Q3 suggests investor confidence is returning, likely a result of stabilising interest rates over the last few months in Australia,” said Adam DeSanctis, Vanguard’s Head of ETF Capital Markets, Asia-Pacific.

“That being said, markets are often navigating uncertainty so it’s important for investors to maintain a long-term perspective. Market volatility due to further rate changes, or heightened sell-offs due to geopolitical unrest, are usually short lived, while long term market performance remains resilient.

“Fixed income markets remain robust. While there has been downward pressure on bond prices in the near term, the silver lining is that bonds are expected to produce higher returns over the long term for investors with a sufficient investment horizon. Also, investors who have been impacted by recent sell-offs can reinvest in bonds with higher coupon payments given interest rates are likely to stay higher for longer.

Also read: Small Parcel Bonds Now Accessible to Advisers

“Interestingly, despite the pickup in equity flows, fixed income flows did not drop in Q3 – an encouraging sign that investors are also diversifying their portfolios and finding merit in a balanced asset allocation that includes both shares and bonds, and not simply fleeing to cash (the value of which erodes with inflation)”.

ETF growth continues

The Australian ETF industry continues to grow year on year despite global market and economic uncertainty, recording A$153 billion in AUM as at the end of September 2023.

The last 10 years has seen AUM increase almost 18-fold, growing from A$8.9 billion in AUM in September 2013.

There are now also more than 300 ETF products listed on the market.

“ETF awareness and uptake, particularly amongst retail investors in recent years, has grown exponentially and is now the investment of choice for many. This is particularly true for broadly diversified ETFs such as VAS, which, despite the rapid increase in thematic products, remains favoured by investors on the whole,” said Mr DeSanctis.