Key takeaways

• Uncertainty has driven many investors to take flight from markets and shift into cash-like investments. However, an analysis of past rate cycles suggests that this may not be the optimal approach.

• The current uncertain market environment may indeed warrant a more defensive stance, but we think this can be better achieved by investing in high-quality fixed income.

• The approaching peak in central bank rates, combined with high starting yields on bonds, provides a great opportunity to lock in attractive returns in fixed income for years to come.

High inflation, geopolitical tensions, collapsing banks and ongoing concerns about recession have all combined to create a highly uncertain environment for investors. In the face of all this, it is no surprise that some may want to opt out of markets altogether.

Sitting on the sidelines can feel like the safer option, particularly when “cash” is offering yields not seen in over a decade. However, this may be a detrimental strategy. Our analysis suggests that, over a multi-year horizon, investors are better served by a “fight” than “flight” response.

Fixed income is the perfect tool for that fight. Indeed, it is in recessions when bonds shine: at such times, fixed income benefits from central banks cutting rates and can provide a powerful defensive hedge within a broader portfolio.

Lessons from history

Historical analysis can provide useful guidance on how bonds and cash perform through different parts of the market cycle. As 2022 illustrated, a rising rate environment is bad for bonds; investors were clearly much better off in cash. But as rate cycles around the world move towards their peak, are we at an inflection point where it makes sense to shift back into fixed income? History would suggest the answer is yes.

An analysis of every sustained US rate hiking cycle since the 1980s1 highlights some interesting patterns.

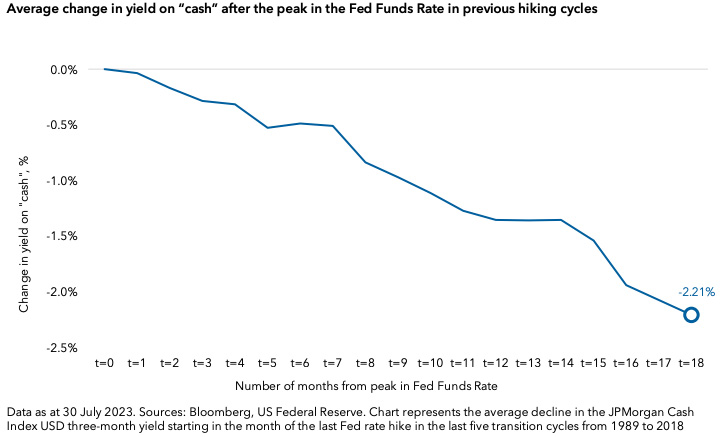

1. “Cash” yields decay quickly after the peak in Fed Funds rate

The first point to note is that yields on cash-like instruments have tended to decay very quickly following the last interest rate rise of a hiking cycle. Over the last five rate hiking cycles, the JPMorgan Cash Index USD three-month yield was an average of 2.2% lower 18 months after the last US Federal Reserve (Fed) hike. This is because central banks typically step in with rate cuts to dampen any slowdown in the economy. As a result, investors in cash-like instruments such as term deposits and money market funds see their returns diminish quickly at this stage of the cycle.

2. The end of a rate hiking cycle is good for bonds

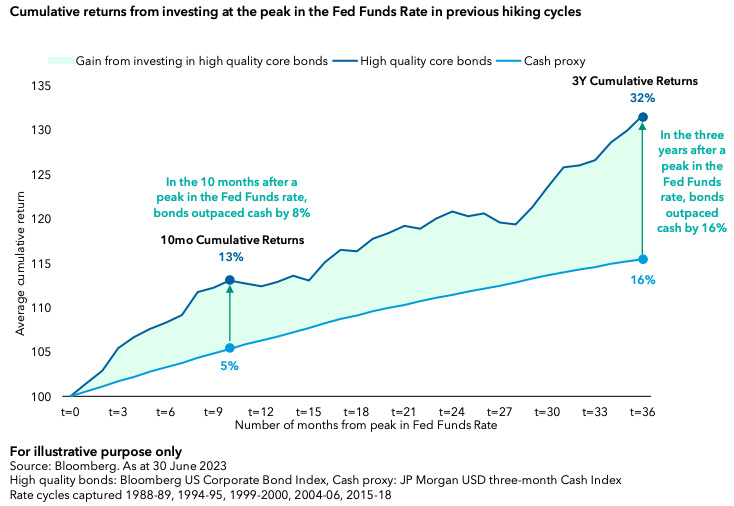

High-quality fixed income has, on average provided stronger returns than cash-like investments following the peak of a rate cycle. Over a three year timehorizon, the gap between high-quality bonds (proxied by the Bloomberg US Corporate Bond Index) and a cash-like investment (proxied by the JP Morgan USD three-month cash index) is a cumulative 16%. That was the cumulative gain to an investor from shifting out of cash and into fixed income.

3. Time in the market matters

With perfect foresight, an investor could align their shift into fixed income exactly with the peak point in the rate cycle. But our experience suggests this sort of market timing is difficult, if not impossible.

Knowing this, is an investor better off being “too early” or “too late” in shifting out of cash and into fixed income?

In prior rate cycles, the bulk of gains for bond investors came in the first 10 months after rates had peaked. This makes intuitive sense — rate cycles typically hit their peak when recession looms. Central banks react quickly to this, cutting rates (often aggresively) to dampen the economic downturn2. This front loads a significant portion of the return advantage of fixed income.

Our earlier analysis highlighted an average three-year cumulative return benefit of 16% from being in fixed income over cash. Half of this uplift happens within the first 10 months after the peak in rates (see previous chart) — waiting on the sidelines for too long risks missing this investment opportunity.

The key lesson here for investors is to avoid the temptation of perfect timing and get invested sooner rather than later.

Applying these lessons to the current environment

History rhymes but does not repeat. Today, central banks around the world are dealing with a challenging task: to bring down stubbornly high inflation, without tipping their respective economies into a severe recession. Compounding their difficulties is the risk of financial system instability, highlighted by the troubles in the US regional banks earlier this year. Policymakers must therefore tread a fine line, leaving open a broad range of potential outcomes for financial markets.

When we look forward, discussions among our fixed income portfolio managers and analysts tend to cluster around two potential scenarios, both of which are positive for high-quality bonds:

1. The economy remains resilient and central banks leave rates higher for longer. In this case, bond investors will continue to benefit from the current elevated yields and the premium offered over cash.

2. The economy enters a significant recession and central banks aggressively cut rates in response. In this scenario, bonds would be expected to receive an additional return boost from falling rates.

A more negative scenario in the back of our minds is a re-acceleration of inflation, which could lead to rates rising and spreads widening — essentially a repeat of 2022.

This is likely a lower probability outcome, however. While still above central bank targets, inflation is on a clear downward trajectory and the full impact of the past 18 months of interest rate hikes has not yet flowed through the economy. Additionally, weakness in the financial system has likely raised the bar for further significant hikes. While another hike or two from the Fed is certainly a possibility, another 500 basis points is less likely.

Additionally, it is worth noting that, if this low-probability scenario did occur, the impact on fixed income returns would likely be more muted than in 2022. This is because yields are much higher today than at the start of 2022, providing a strong cushion against falling bond prices.

Implications for investors today

Many investors perceive cash-like investments as a safe harbour today: a place to wait out the uncertainty in the macro environment and volatility of financial markets. We believe this may end up being the riskier path to take.

History shows that the end of a rate hiking cycle offers an exceptional investment opportunity for fixed income. And consideration of the likely scenarios that could play out today confirms this.

Investors have the opportunity to lock in today’s attractive yield levels and potentially benefit from future rate cuts. In contrast, investing in cash could mean locking into a cycle of diminishing returns over the next few years. Investors will most likely be better off in fixed income and we believe now is the time to make that shift.

1. Based on the US Fed Funds Rates. Rates cycles captured 1988-89, 1994-95, 1999-2000, 2004-06, 2015-18.

2. Across all the periods in this analysis, the average time between Fed pausing further hikes to right before the first cut is approximately eight months.