Article by Manuel Hayes, Senior Portfolio Manager, Insight Investment

High yield corporate credit has emerged as one of our asset class picks for 2022 (see: thoughts for 2022). Further, we believe key myths around the market help create mispricing opportunities that investors can take advantage of.

MYTH 1: DEFAULT RATES ARE BETWEEN 3% AND 5%

Reality: Defaults have stayed quite low and given that balance sheets are relatively strong we expect defaults to come in below average for rest of 2022.

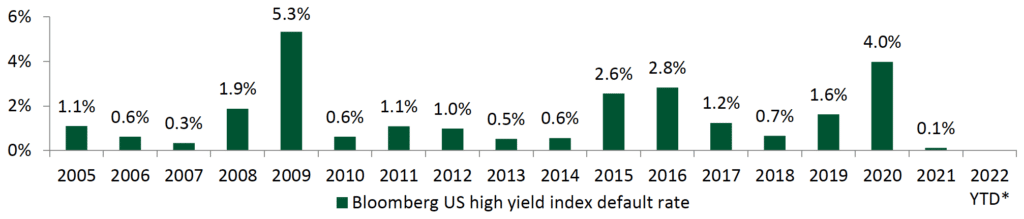

Many will be surprised to learn that the Bloomberg US High Yield Corporate Index has only seen an average 1.5% pa default rate over the last 15 years (Figure 1).

Figure 1: US high yield default rates have been a lot lower than you might think

Historically, it has required a financial crisis (such as the start of the pandemic in March 2020 or the 2008 crisis) for US default rates to approach 4% or above. In 2021, defaults were the lowest in 15 years.

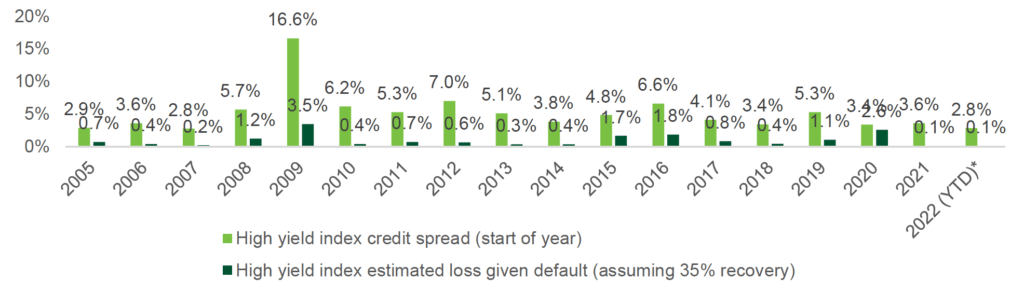

As such, assuming conservative recovery rates of ~40%, in line with the long-term average2, high yield credit spreads have generally been priced to overcompensate for default risks (Figure 2).

Figure 2: US high spreads at ~400bp offer potentially compelling compensation for default rates.

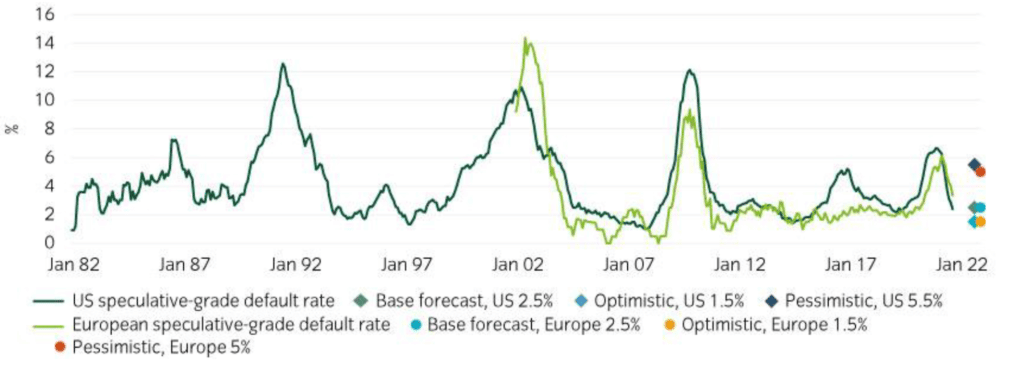

Rating agencies report higher default rates

The high yield default rates investors are used to hearing from the ratings agencies are typically 3% to 5% on average, and much higher during periods of stress (Figure 3).

Figure 3: Rating agencies have reported higher default rates

Ratings agency default analytics are not based on the high yield indices that investors are most likely to be exposed to, but the entire population of corporates for whom they have assigned a credit rating.

We believe these broader default samples are useful for top-down macro-level analysis or modelling. However, for high yield investors concerned about compensation for risk, index defaults have more direct relevance.

This could be compared to how a climate scientist would never solely focus on global average temperatures to understand climate dynamics in the arctic – where temperatures are rising twice as fast.

MYTH 2: HIGH YIELD IS VULNERABLE TO RISING RATES

Reality: US high yield returns have been positive in rising rate environments

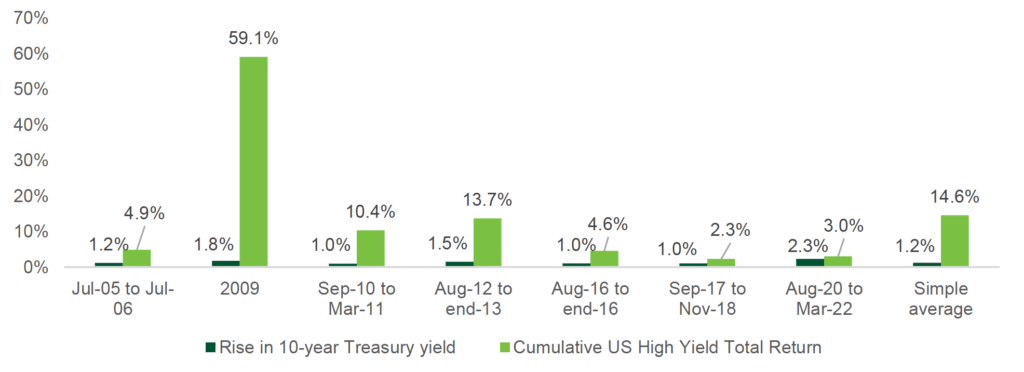

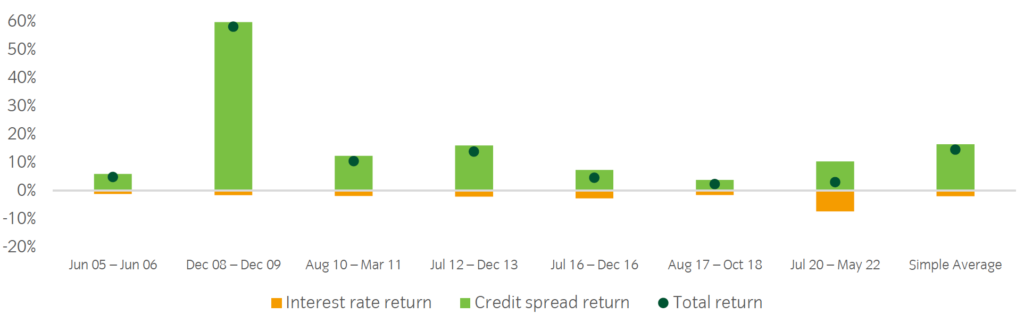

Since 2005, there have been seven periods in which 10-year Treasury yields have risen by ~1% or more.

US high yield markets have consistently delivered positive total returns through each of these seven periods (Figure 4).

Figure 4: Despite the rates sell-off over the last two years, high yield total returns have been positive

On average high yield returned close to 15% during these periods, or 7.5% when excluding the outlier of 2009, (when markets were rebounding from the 2008 crisis).

High yield is more naturally resilient to rising rates

High yield has less interest rate (or ‘duration’) risk than government or investment grade bonds, as high yield tends to be shorter dated on average.

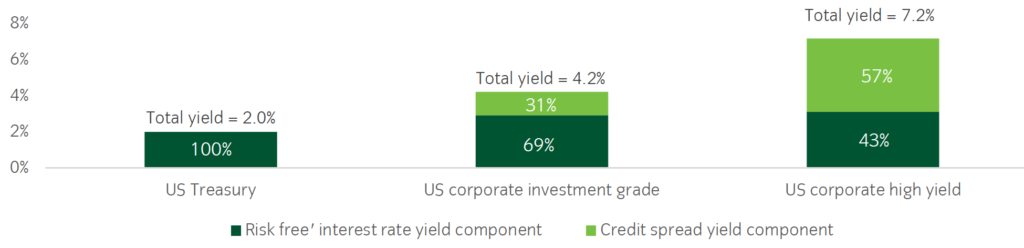

Further, bond yields on high yield credit are mostly comprised of credit spread (Figure 5).

Figure 5: High yield all-in index yields have risen to 7%, with a relatively low contribution from government yields

As such, changes in credit spreads have had more of an impact on high yield returns than changes in interest rates.

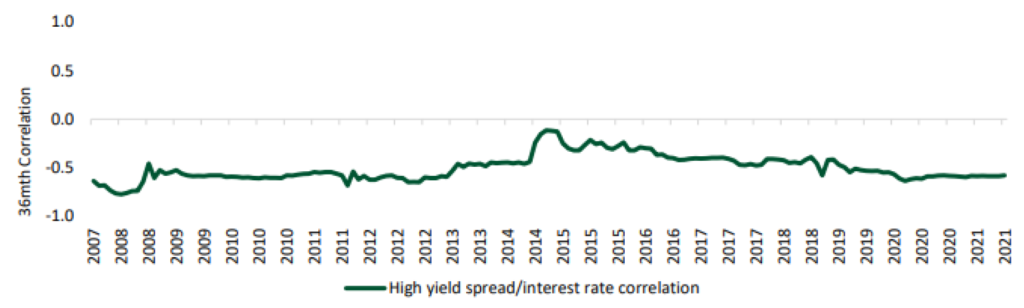

This is particularly important because interest rates and credit spreads tend to be negatively correlated (Figure 6). This is because central banks typically raise interest rates when the economy is growing, which is good for corporate balance sheets, and therefore credit spreads.

Figure 6: US high yield credit spreads have been negatively correlated with their benchmark Treasury bond yields

As such, when rates have risen, gains from credit spreads narrowing have heavily outweighed losses from interest rate risk (Figure 7).

Figure 7: Since the 10-year Treasury yield began to rise in 2020, the rally in credit spreads has outweighed the drag from interest rate risk

MYTH 3: LIQUIDITY IS IMPOSSIBLE TO SOURCE

Reality: Specialists can tap ‘hidden liquidity’ from the ETF ecosystem

For most market participants, two-way liquidity in the high yield market did indeed deteriorate rapidly following the 2008 financial crisis, as new banking sector regulations took hold, making it less attractive for market makers to hold large inventories of bonds on their books.

As bonds are almost universally traded over the counter, one bond at a time, two-way liquidity became harder to source, particularly during times of market stress when the number of sellers overwhelmed buyers, exacerbating price swings.

Other investors have found new sources of liquidity

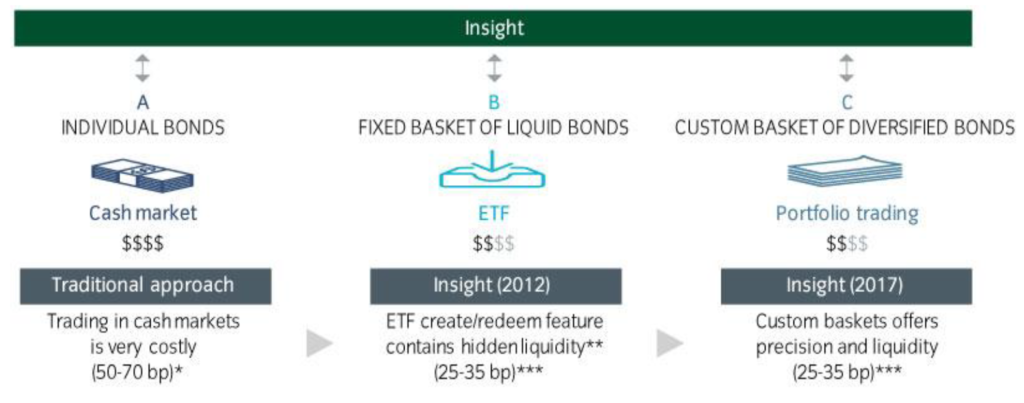

However, after the 2008 crisis the fixed income ETF market developed rapidly, providing a new source of bond market liquidity.

Skilled investors experienced within the fixed income ETF ecosystem were therefore able to unlock ‘hidden liquidity’ within the ‘create and redeem’ feature, similar to the programmatic trading that has been a staple of the equity market for decades.

It has opened the door to trading large, customised baskets of bonds within hours for relatively low trading costs. In our experience, market makers even prefer trading diversified bond baskets because they can hedge them more efficiently and cost effectively.

Figure 8: The ETF ecosystem offers the potential to execute highly liquid basket trades

In our view, this type of trading could help investors target alpha within smaller and traditionally less liquid issuers. Investors can also aim to eliminate much of the drag on returns imposed by high transaction costs.

HIGH YIELD – THE ASSET CLASS TO WATCH FOR THE NEXT 12 MONTHS?

In our view – high yield corporate credit is emerging as one of the key asset classes to watch.

The global economy is transitioning from the rapid ‘early cycle’ rebound, to a more moderate ‘mid cycle’ trajectory. In our words, GDP is shifting from ‘very high’ to ‘high’.

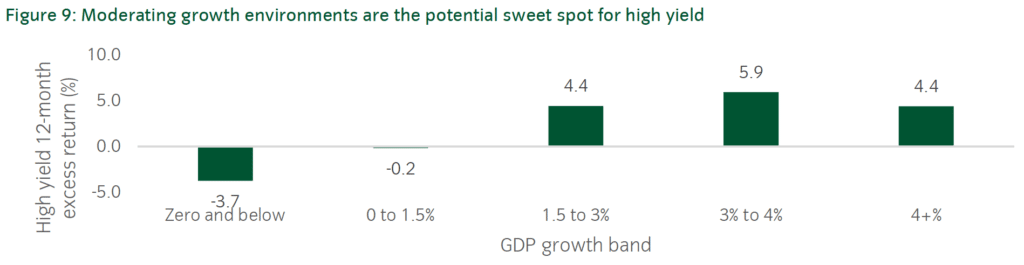

Whereas this has traditionally suited equities less (sometimes leading to a dreaded ‘mid cycle adjustment’), moderating growth has historically been a sweet spot for high yield credit on average (Figure 9).

Figure 9: Moderating growth environments are the potential sweet spot for high yield

We believe, this is because corporates are less likely to raise leverage (with the aim of maximising equity growth) when GDP is moderating, while rising revenues and corporate profitability continue to generally improve the creditworthiness of corporate borrowers. As such, it could be a compelling time for investors to partner with managers able to overcome the high yield market’s liquidity challenges, with the ability to fully understand and price market risks.