How much would you expect to earn on a 30-year investment? This week the Australian Office of Financial Management (AOFM) announced it was in the market to raise 30-year funds for the Commonwealth government.

The bonds will pay around 1.75% with maturity due June 2051. Pricing is yet to be finalised but expected to be 98 to 105 basis points (100 basis points = 1%) over the implied bid yield for the primary ten-year Treasury Bond futures contract – what a mouthful!

The new issue is expected to raise between $13 and $15 billion. That would put it in line with earlier issues of $17 billion over five years this month and the largest ever raise of $19 billion for 10.5 years in May as well as a shorter dated issue for 4.5 years of $13 billion, also in May.

The government has been borrowing at record levels to fund its support for pandemic related payments such as JobKeeper and JobSeeker.

The 1.75% for a 30-year investment may not look attractive but certain institutional investors have mandates requiring them to hold minimum allocations to AAA-rated sovereign investments. Other countries that meet the criteria have negative rates, while the US 30 year Treasury bonds yield 1.26%.

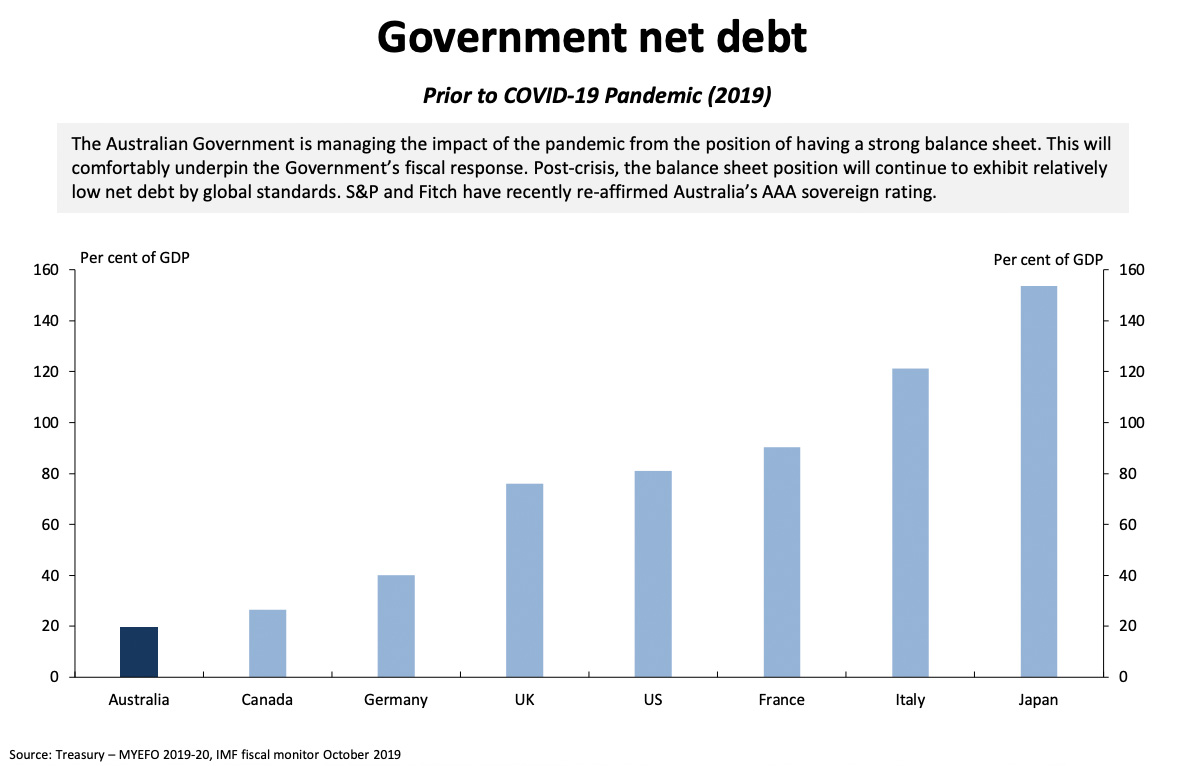

Our government net debt as a percentage of Gross Domestic Product (GDP) is also attractive. While it is forecast to jump from around 20% to 45% it is still well below other developed countries.

The AOFM reported 2019-20 Treasury Bond issuance to 30 June 2020, was $128.2 billion and Treasury Indexed Bond issuance was $1.65 billion. Guidance for 2020-21, until the October budget is announced, is for Treasury Bond issuance of around $4-5 billion in most weeks.

Assuming the AOFM issues in 50 weeks in the coming year, then issuance is expected to be between $200 and $250 billion, a significant increase over 2019/20.

The funds will support the budget deficit which is forecast to hit $185 billion or 9.7% of GDP, but could be higher if the government provides additional support related to the pandemic in its October budget.

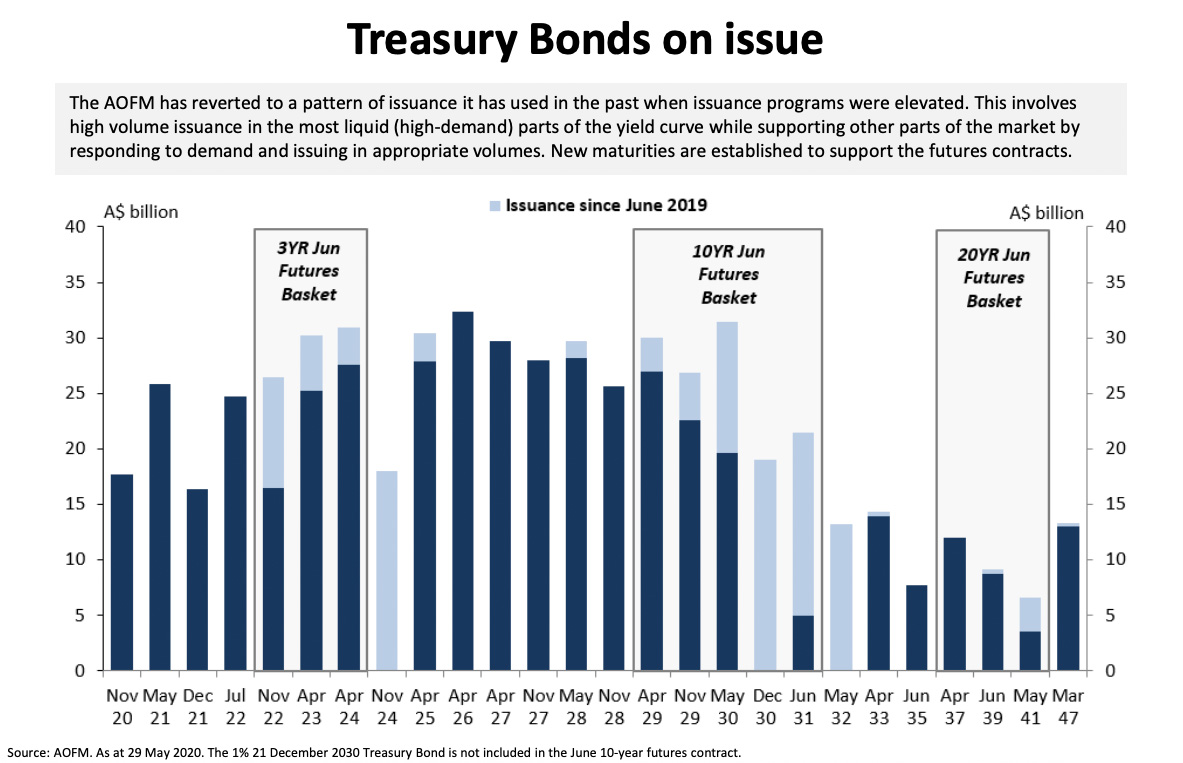

The AOFM targets the most liquid maturity buckets for new issuance – 3, 10, and 20 years, see the graph below.

These bonds are fixed-rate so are subjected to significant interest rate risk given the very long term. To learn more about government bonds, see Government Bond Basics.