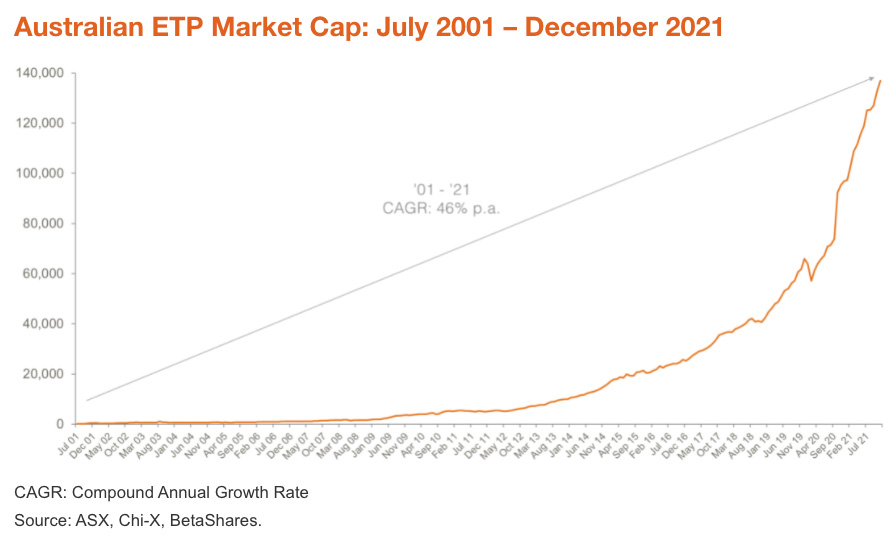

The Australian ETF industry grew rapidly in 2021 aided by record inflows and strong market conditions according to BetaShares.

Funds under management for ETFs trading on the ASX and Chi-X had a market cap of $136.9 billion as at end of 2021 up from $95 billion for the prior year.

BetaShares said that the growth for the year was assisted by market appreciation, which, at 45% of the year’s total growth aided the industry growth substantially. The company also noted that there are now 1.7 million Australians investing in ETFs, representing investor growth of 33% compared to the year before. Investors had a choice of 280 Exchange Traded Products on the ASX and Chi-X.

Also read: CBA, Suncorp and Westpac Kick Start 2022

International equities received the largest inflow at $11.7 billion, followed by Australian Equities at $5.5 billion and Fixed Income at $2.9 billion (up from $2.4 billion in 2020).

Top 5 category inflows (by $) – 2021

Category |

Inflow Value |

| International Equities | $11,776,576,903 |

| Australian Equities | $5,494,767,550 |

| Fixed Income | $2,923,703,789 |

| Multi-Asset | $1,746,883,638 |

| Listed Property | $627,236,492 |

“In terms of category flows we saw a very similar pattern to 2020, with 2021 flows heavily dominated by equities – international equities in particular picking up the lion’s share (over 50% of total flows). Like the year before it, fixed income flows were muted, as yield pressure caused investors to eschew the asset class. However, multi-asset class or diversified ETFs rose in popularity, particularly with younger investors using them as the core to their portfolio or to get started with investing,” BetaShares said.

“In terms of 2022, we believe the industry will continue to grow strongly, although we doubt it will be as assisted by the market as occurred in 2020. We forecast total industry FuM at end 2022 to be in the range of $180-$190B.”