A report from T. Rowe Price Head of Multi-Asset Solutions APAC Thomas Poullaouec and team covering an AU/APAC focus.

MARKET PERSPECTIVE

- Uncertainty persists for the global economic outlook as hawkish central banks battle with high inflation in the face of weakening growth expectations.

- The US Federal Reserve has signaled a moderation in the pace of tightening but remains committed to taming inflation, acknowledging the potential for a higher-for-longer terminal rate.

- Heading into the winter months, the European Central Bank (ECB) faces a more challenging energy-driven inflation battle. Having remained steadfast, the Bank of Japan may be forced to ease yield curve controls as inflation takes hold and rate differentials have weakened the Yen. The Reserve Bank of Australia is pivoting faster than other Central Banks as they worry about the lag effects of the past hikes.

- Emerging market central banks are nearing the peak of their rate hiking cycles but may need to hold rates firm to defend against weakening currencies. Uncertainty surrounding Chinese economic growth is increasing as officials ease economic policy while balancing COVID- lockdowns and recent unrest.

- Key risks to global markets include central bank missteps, persistent inflation, potential for a sharper slowdown in global growth, China’s balance between containing the coronavirus and growth, and geopolitical tensions.

MARKET THEMES

Took the Pain, Now the Gain?

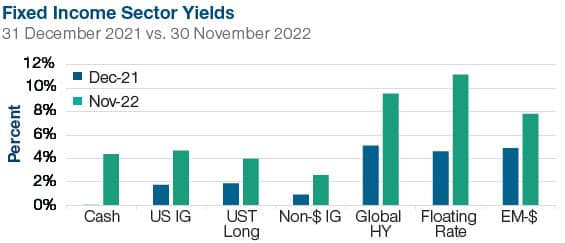

2022 is shaping up to be one of the worst years of performance across global fixed income markets as yields were driven sharply higher by central banks battling decades high inflation. The pain was not unique to fixed income markets as equities broadly moved in sync, leaving investors in diversified portfolios with few places to hide. As painful as the year has been, fixed income markets are looking more attractive today than they have in more than a decade. With yields now at higher levels and expectations for inflation moderating amid slowing growth next year, fixed income markets could be well positioned for positive returns as central banks’ tightening slows. Even for investors on the sidelines awaiting a better entry into risk assets, cash is finally getting compensated. Credit markets also look more appealing today with high yield bonds yielding more than 9%, providing attractive income and a buffer should spreads widen. And while there is a high probability of recessions hitting major economies next year, credit fundamentals remain relatively strong, supporting our analysts’ expectations for a modest increase in defaults towards longer-run averages. So as markets enter 2023 still facing significant risks to the growth outlook, fixed income markets could prove their value, through both higher income and a return to providing diversification benefits.

Also read: Three Lessons From the 70s’ Great Inflation

We Expect an Earnings Recession in 2023

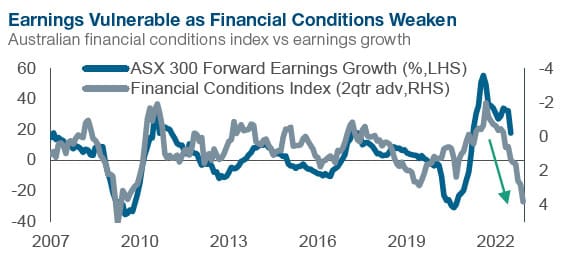

Our base case for 2023 is that Australia is likely to experience an earnings recession even if we do not suffer an economic recession. The reality is that the starting point for earnings is at a historically very high level. Although earnings have held up reasonably well until now, that’s largely because the impact of the rate hikes that we’ve seen domestically is really only just starting to bite. The real pain will be felt next year when fixed rate mortgages originated during the COIVID period roll off to considerably higher variable rates. Ironically, the more resilient the consumer might be in the short term, the more the Reserve Bank of Australia will need to tighten in order to curb aggregate demand. We expect the lagged impact of rate hikes to drive a slowdown in aggregate demand in 2023. The chart below shows that an index of financial conditions for Australia from Credit Suisse bears a close relationship with Australian Securities Exchange 300 12-month forward earnings per share (EPS). The average decline in ASX earnings during an earnings recession has been close to 30%.

PORTFOLIO POSITIONING

- We are underweight stocks, remaining cautious on the weakening outlook for growth and earnings amid still elevated inflation and active central banks.

- We remain modestly overweight cash relative to bonds given attractive short-term yields, while longer rates remain vulnerable to inflation and potential headwinds from duration if rates rise further.

- Within equities, we are balanced between value and growth. The slowing growth backdrop is unfavorable for cyclicals, while higher rates weigh on growth-oriented equities.

- Within fixed income, we are overweight high yield, where attractive valuations offer reasonable compensation for risks and fundamentals remain generally supportive. Defaults rates are expected to rise from today’s historically low levels towards longer-run averages with higher yields providing a buffer should credit spreads widen.

- AUSTRALIA BACKDROP

Positives

- Consensus expects the RBA to moderate the pace of tightening going forward, reducing the pressure on yields rising

- Demand on industrial metals has room to expand given geopolitical developments

- The banking sector outpaced expectations in their earnings, lifting the overall stock market.

Negatives

- Consumer spending is slowing in advance of mortgages being reset in 2023

- The housing market is in contraction mode as evidenced by the drop in prices and activity levels

- Inflationary pressures remain, dampening expectations for a clear pivot in policy setting.

From the T. Rowe Price Australia Investment Committee, as at 30 November 2022