Australia’s economic momentum appears to be “peaking” after months of surprising resilience in the face of volatile geopolitical and economic uncertainty, according to a new asset allocation report from T. Rowe Price.

In its latest Global Asset Allocation Viewpoints for Q3 2025, T. Rowe Price said investors should not be lulled into complacency with global financial markets continuing to defy expectations, maintaining strength near record highs.

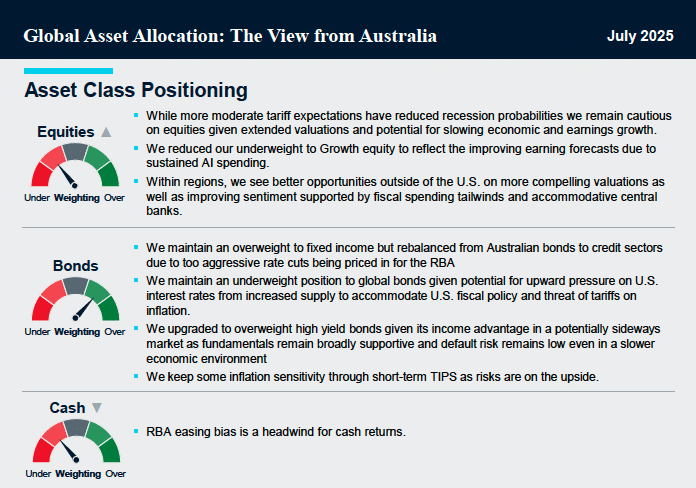

The company recommends an underweight positioning for equities, overweight for bonds, and underweight for cash.

The report by Thomas Poullaouec, Head of Multi-Asset Solutions for Asia Pacific and his team warns of significant risks that could test the resilience of both investors and policymakers in the months ahead.

T. Rowe Price has moved its global risk posture to a “near-neutral” position, balancing optimism around policy support with mounting headwinds.

In Australia, after months of outperforming expectations, economic momentum appears to be tapering off. However, ongoing fiscal and monetary support are expected to cushion the slowdown.

In the U.S., the outlook is mixed. Modest growth is expected, with consumers showing resilience, but trade tensions and political uncertainty loom large. Meanwhile, the U.S. Federal Reserve remains on pause, monitoring inflation trends closely.

Elsewhere, slower growth across non-U.S. economies is tempered by improved inflation conditions, which are allowing central banks more policy flexibility. In regions like Europe and China, increased government spending is also helping to support growth.

Yet the broader picture remains complex. Risks including continued global trade disputes, the threat of inflation, potential missteps by central banks, and heightened geopolitical instability all represent serious downside factors.

Markets Defy the Risks – for Now

According to the report, markets are pricing in a very optimistic scenario. Despite a backdrop of ballooning deficits, elevated interest rates, and political noise, equity valuations are climbing.

“One would think the prevailing narrative of ongoing trade disputes, intensifying geopolitical tensions, ballooning fiscal deficits, and rising interest rates would cast a shadow over risk assets,” the report said.

“That hasn’t been the case as markets are now trending near record highs and have not looked back since the post-Liberation Day trough. Investors seem to be viewing the markets through a different perspective, either expecting many of these risks to fade with little impact or anchoring on pockets of positives.”

However, the report warns that this optimism could quickly unravel if economic or geopolitical developments begin to disappoint. In short, markets are not priced for setbacks.

U.S. Federal Reserve Under Pressure

A particularly concerning development is the intensifying political pressure on U.S. Federal Reserve Chair Jerome Powell. After repeated public criticisms from President Trump over his reluctance to cut interest rates, the President is now threatening to name a successor well before Powell’s term ends in May 2026.

Such a move could undermine the perceived independence of the central bank, sowing confusion in financial markets.

“The idea that a successor could be named well in advance of Powell stepping down could create a chaotic environment. Should it happen, Powell could be perceived as a lame duck and markets would look to the incoming Chair for guidance on future policy,” the report states.

“While the Fed doesn’t always get policy right, its independence is critical to maintaining the credibility of U.S. financial markets and assets.