Returns on investments just keep getting lower. As cashed-up investors look to alternative investments, fixed income funds have been beneficiaries.

Fortunately, some funds have been sympathetic to investors’ plight and the need for income and dropped fees accordingly. However, others persist with a high fee agenda, are the fees worth it?

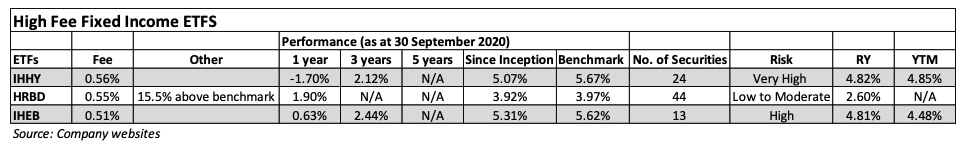

Searching through the FINA ETF Finder, I found three ETF with fees over 0.50%.

Most fees seem to average in the 0.20 to 0.30% range. Some, that predominantly hold very low risk assets such as BILL, ISEC and IYLD have very low fees of 0.07%, 0.12% and 0.12% respectively.

In itself, high fees aren’t bad, especially if the fund manager is managing a large diversified portfolio and trading and making high returns. Let’s look a little more closely at three high fee ETFs – iShares Global High Yield Bond (AUD Hedged) (IHHY), BetaShares Active Australian Hybrids Fund (HRBD) and iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF.

Summary

The three ETFs have different risk profiles and both iShares funds invest in other iShares funds. Does that mean they double up on the fees? One for entry in the Australian based fund and another when it invests in the underlying fund?

It would seem the Australian funds manage currency risk with a small number of trades, but does that warrant the high fees?

iShares Global High Yield Bond (AUD Hedged) (IHHY)

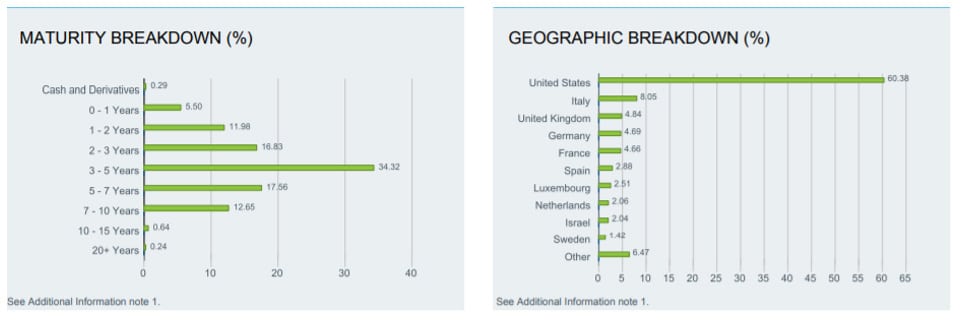

IHHY is a fund that invests in another iShares fund. It has only 24 investments, with more than 100% invested in the other fund, the remaining investments are currency hedges. The underlying fund has more than 1800 investments, predominantly in the US high yield market.

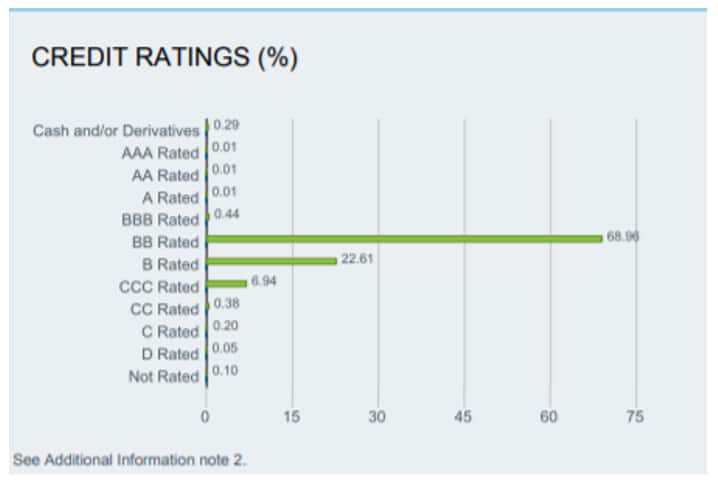

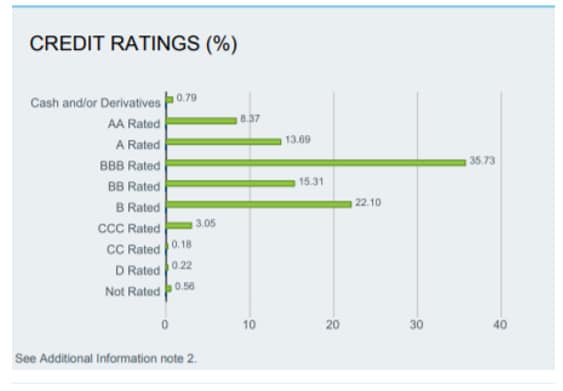

This is a very high risk fund with practically all investments rated in the sub-investment grade, high yield ‘BB’ credit rating range or lower. Over 7% of investments are in the ‘CCC’ range or lower.

Simply, if you consider the return since inception of 5.07% against the Benchmark return of 5.67%, the difference is 0.60%, almost the same as the 0.56% fee.

BetaShares Active Australian Hybrids Fund (HRBD)

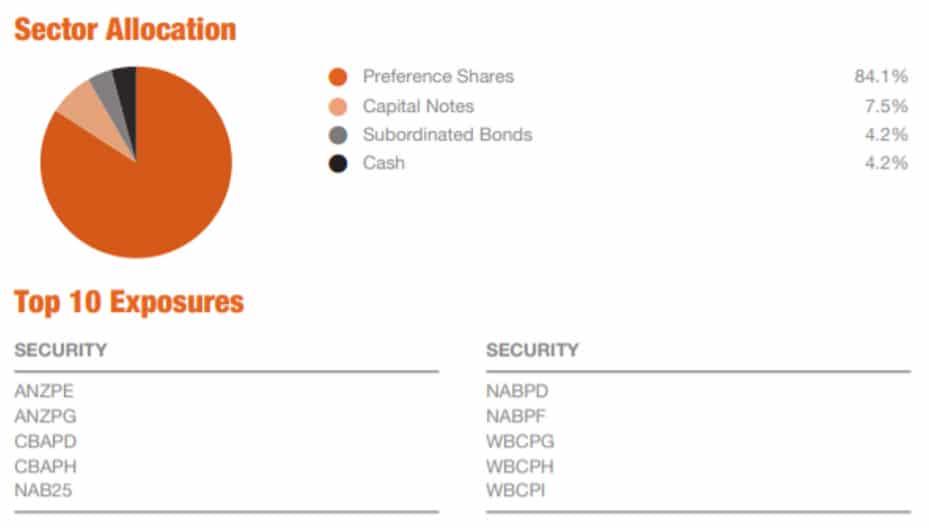

HRBD is a much lower risk investment, predominantly in ASX listed hybrid securities. While the fund doesn’t break down credit ratings, it does include major bank hybrids which are rated as investment-grade BBB- and it does have allocations to cash and other bonds, although these makeup less than 10% of the fund.

The fund charges a 0.55% fee as well as a 15.5% performance fee for any additional returns that exceeds the Solactive Australian Hybrid Securities Index. The fund has performed well since inception with a 3.92% yield, after costs compared to the benchmark yield of 3.97%, just 0.05% of a difference, indicating outperformance by the fund manager.

None-the-less, investment in the securities in the index would have achieved the same result.

This particular ETF provides monthly income that includes franking but is concentrated in Australian financial companies, particularly the major four banks and not recommended for investors wanting to diversify.

iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF (IHEB)

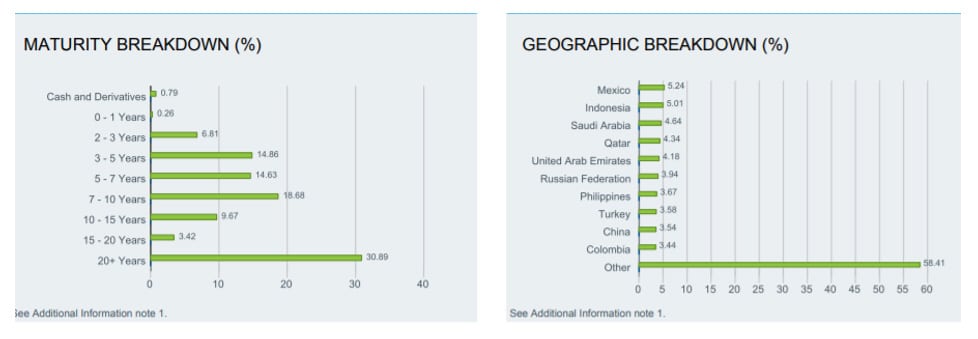

Like IHHY, this fund invests in another iShares fund. It has very few direct investments, with more than 100% invested in the other fund, the remaining investments are currency hedges. The underlying fund has over 500 investments.

Roughly 60% is investment grade and 40% high yield. Part of the higher yield can be attributed to the longer term to maturity of more than 20 years of 31% of its portfolio. Further, many emerging market economies are highly volatile and so this fund could see significant swings in its value and performance.

Even though it is lower risk than IHHY, it has outperformed the fund. The yield since inception is 5.31% compared to the benchmark 5.62%. The 0.31% difference is better than fees charged but the ETF has still not matched benchmark yields.

Summary

ETF managers should consider lowering fees as interest rates decline, especially if they fail to match benchmark returns.

Of the three funds reviewed in this article, HRBD has shown the most consistent performance relative to its benchmark, despite being lowest risk and having the lowest number of investments. However, it is easy to replicate, whereas the iShare funds are not.