By NAB Corporate and Institutional Banking

The Australian dollar primary market had a record start to 2024, with A$61.1 billion raised in financial institution (FI) and A$7.9 billion in corporate sectors, an increase of around 20% and 85% respectively, compared with the same period in 2023.

Investors were attracted to the A$ market’s resilience in primary and secondary markets, despite a volatile 2023-24, including numerous geopolitical and/or macro headlines.

For corporate issuances, stale secondaries saw Australia lag the 2023 rally. However, primary deals are coming, with flat to negative new issuance concessions suggesting investors recognise this trend in 2024. Broad order books are helping drive these outcomes, with more investors supporting transactions, delivering power to issuers.

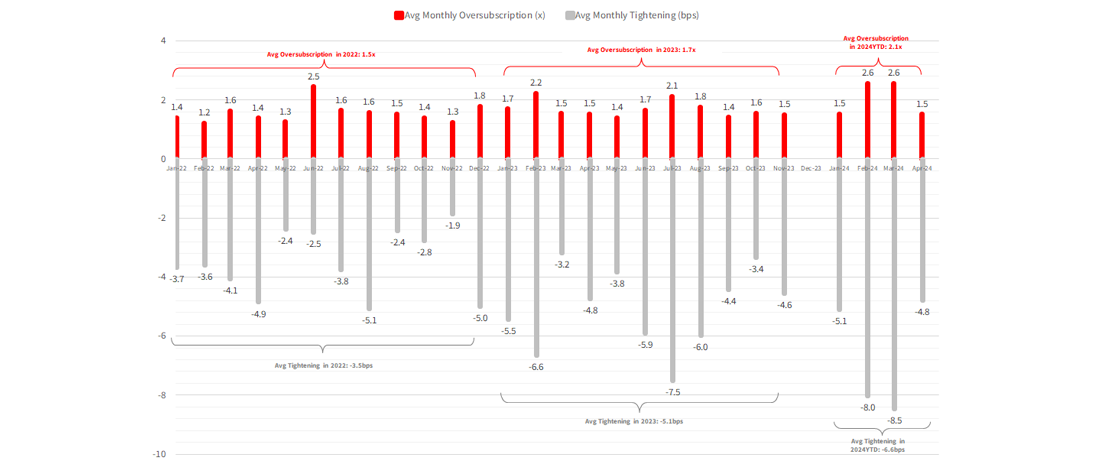

For FI, A$ oversubscription ratios reflect growth in oversubscription ratio averages and record order books achieved in quick succession from investors seeking A$ paper. Tightening Initial Price Thoughts (IPT) to reoffer has also allowed borrowers to leverage strong order books to price aggressively at final guidance.

Chart 1 – A$ FI oversubscription ratios and price progression (2022 – 2024YTD)

Source: NAB Syndicate, Bloomberg as of 10 May 2024

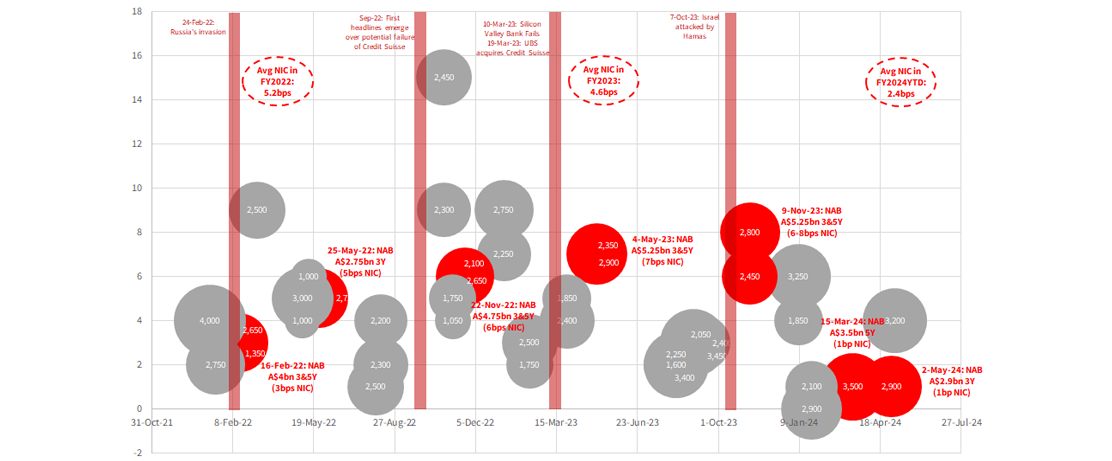

In a similar vein, major bank A$ senior new issue concessions crunched tighter as investors sought the most liquid, high-quality, repo-eligible A$ paper.

Chart 2 – Major bank A$ senior new issue concessions (2022 – 2024YTD)

Source: NAB Syndicate, Bloomberg as of 10 May 2024

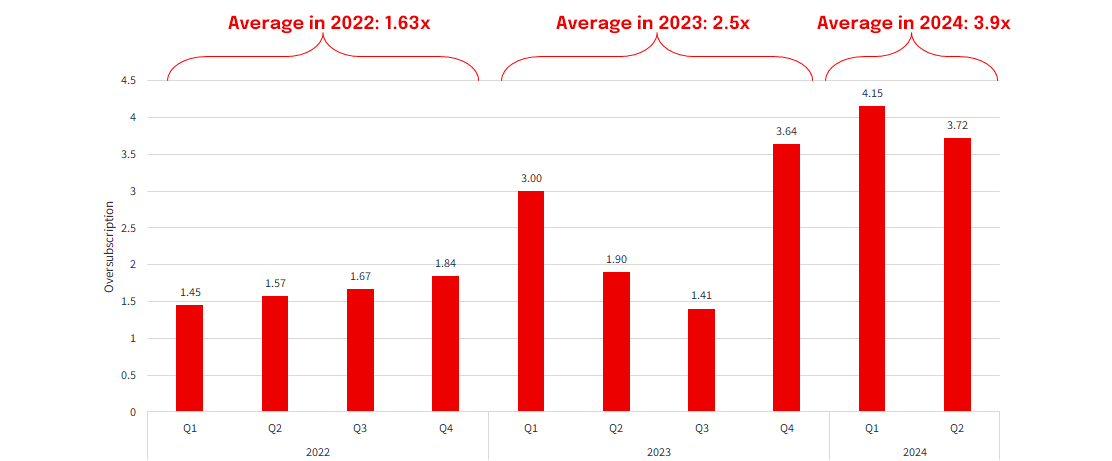

Corporates have enjoyed robust funding conditions with an increased growth in liquidity supporting corporate issuers.

While price discovery remains heightened for some sectors because of stale secondaries, airport and utility issuers have seen a moderation of pricing discovery because of the steady supply of trades.

Also read: There’s More To Life Than Term Deposits

The domestic investor landscape continues to grow as the competitive landscape for super fund flows increases.

Chart 3 – Oversubscription in corporate issuances (2022 – 2024YTD)

Source: IGM, NAB Debt Capital Markets, Bloomberg as of 10 May 2024

Drivers of outcomes in A$ primary markets this year:

Investor liquidity in A$

- APRA-regulated superannuation funds saw a material increase in AUM, from A$3.2 trillion to A$3.5 trillion between September 2022 and September 2023 with an accompanying 1% rotation of allocation from equities to fixed income.

- Stabilisation in the macro environment also led to an increased focus on longer tenors with investors comfortable going out to 10-years.

- An increased participation from middle market accounts has shifted power towards issuers, so continued expansion of the buyer base is great news for borrowers looking at Australian Medium-Term Notes (AMTNs) for funding.

Reduced US$ bond volumes in Asia ex-Japan

- According to Bloomberg, Asia ex-Japan G3-denominated bond volumes in FY2023 dropped 63% compared to FY2021. In comparison, A$ FI volumes hit a record 210% increase vs FY2021.

- A$ corporate volumes increased by 85% in 2024YTD vs the comparable period in 2023.

- Among numerous reasons for the drop in Asia ex-Japan US$ bond volumes, a key driver from our perspective was the slowdown in China’s economy, as well as high-profile defaults in Chinese real estate.

- A$ primary markets have stepped in – with favourable exchange rates, resilient secondary market spreads and greater primary market execution certainty, drawing investors and borrowers.

- Asia is a big participant in the bullish turn in the corporate AMTN market, in part driven by attractiveness of A$ yield with investors showing early engagement and demonstrated price leadership, as well as driving volumes in allocatable final order books.

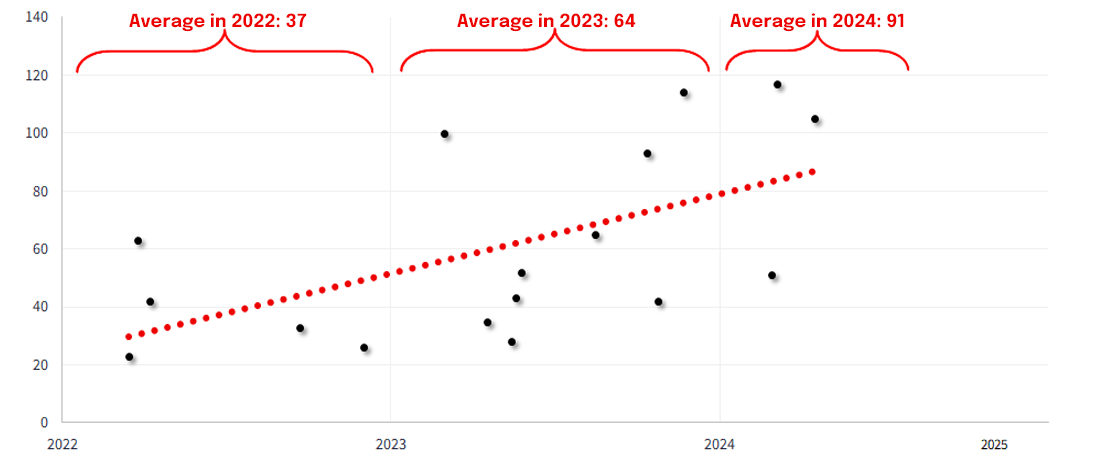

Growing investor universe and granularity in A$ order books

- Granularity of order books in A$ primary transactions, particularly in Tier 2 has increased.

- Overall, the A$ market continues to grow given the parallel growth in government issuance. Higher coupons on offer are also attracting a broader investor universe, with increased interest from sub-institutional accounts.

- Another notable shift has been the investor participation in corporate order books trending upwards *.

Chart 4 – Number of investors in corporate order books (2022 – 2024YTD)*

Source: NAB Debt Capital Markets, *based on NAB-led trades as of 10 May 2024

Will trends continue?

It remains to be seen. Geopolitics, interest rates, economic stimulus and sector resilience will all potentially drive bond market appetites and portfolio allocations in the second half of 2024. Globally, headlines from Iran/Israel and the US election are all potentially yet to weigh in on sentiment. Economic rebound/stimulus in China may also lead to a further rebound in issuance volumes, while more global stability should continue to drive lowering of credit spreads and the confidence to lock in longer spreads over time.

Within the rates outlook, expectations of a Federal Reserve rate cut have also been pushed back given recent strong inflation in the US. This may impact the relative attractiveness of AUD for regional investors. In Australia, apart from investors forced to buy during the pandemic, fund managers have reduced tenor in their portfolios because of the current interest rate environment. A return to a more normalised rates environment may allow more duration in portfolios in FI and Corporates.

But the question is: if supply and appetites continue to grow, how high will these levels be maintained, particularly when the world is debt-saturated?

At NAB, we are closely monitoring these influences to continue to provide clients with quality advice based on global and regional market experience and our world economic view.