-

Next 10 years could see higher growth and lower inflation compared with our 2023 long-term forecasts, partly due to productivity gains from the adoption of Artificial Intelligence (AI). Delays in climate policy will increase risks and result in greater economic costs moving towards 2050.

-

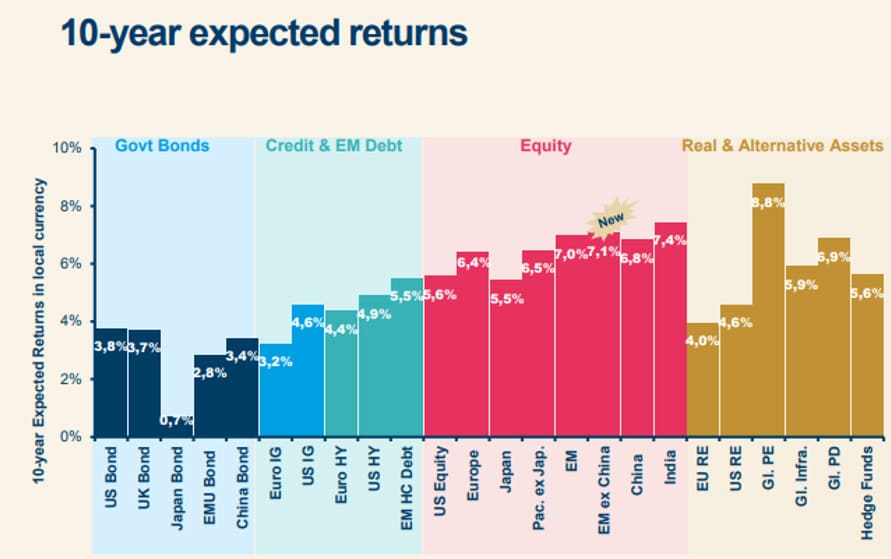

10-year expected returns are slightly lower compared with last year’s forecasts, in particular Developed Market equities. Bonds have the potential to deliver better returns than in the past decade, and regain the role as key performance engine in asset allocation.

-

Equities will see a reordering in terms of regional preferences, with the renewed appeal of global and Emerging Markets. India should offer the highest return potential, while Europe is gaining appeal among developed markets.

-

Emerging Market bonds and real and alternative assets are attractive for their diversification benefits, warranting a greater role in investors’ strategic asset allocation.

Amundi, Europe’s largest investment manager, has released its latest annual Capital Market Assumptions that offer investors updated forecasts across 40 asset classes, with the addition this year of Emerging Markets ex-China equity.

The new macro assumptions factor in changes in energy transition trajectories and the impact of AI on productivity growth. The new 10-year expected returns are the basis for strategic asset allocation that points towards important changes in risk-return expectations and the role of different asset classes in portfolio construction.

Vincent Mortier, Group CIO of Amundi, said: “The next decade should see a change in the relative attractiveness of different asset classes. Bonds are the anchor and their renewed appeal extends to Emerging Markets. EM equities should also be favoured, in particular India. European equities should also regain some appeal.”

Monica Defend, Head of Amundi Investment Institute, added: “Climate change, the energy transition and geopolitics will likely drive countries towards different growth paths. New winners may emerge, while central banks will have to manage a delicate equilibrium, maintaining price stability and affordable debt servicing costs to finance the transition.”

Central Scenario 2024: Increasing Risks Due to Delays in Climate Policies

Compared to last year, we revised our 2024 central scenario to reflect evolutions around climate change, geopolitical tensions, and the potential long-term impact of AI on the global economy. Our 2024 central scenario accounts for a higher probability of delays in climate policies and reduced prospects of reaching a 1.5-2°C target by 2050.

Also read: Global AT1 Hybrids Back on Track

These adjustments have important macro implications for the next decade, with overall some lower transition risks and higher physical risks, as costs are being spread over a longer time period:

- Central banks will have to reconcile monetary policy objectives, high debt levels, and the need for relatively low long-term yields to fund the transition.

- Inflation – Our short-term inflation forecasts remain above central banks targets but have been cut from last year because the costs of the energy transition are spread over a longer time period. Over the medium-to-long term, an increase in productivity driven by AI together with more general cost reductions will drag inflation down towards central banks’ targets.

- Growth – Conversely, Developed Markets (DM) 10-year growth levels are revised upwards because of delayed climate policies and some positive effects stemming from the adoption of AI. We assume this adoption will be gradual, given the need to assess the social and energy costs of AI. Moving towards 2050, higher physical risks from extreme weather events and the diminishing effects of AI should bring growth down.

- Emerging Markets’ annual growth will be 2.3% higher than DM on average over 2024-2033. This growth advantage will diminish over the two subsequent decades as the road to net zero appears more challenging for many EMs.

However, we also see some EM countries, such as Chile and Indonesia, benefitting from the transition, namely the ones rich in critical minerals.

- A carbon tax would have a significant impact on growth and inflation, particularly affecting EM and low-income households. A fair transition is at the heart of the case for carbon taxation.

Strategic Asset Allocation: Diversification Shines with New Asset Classes in Focus

10-year expected returns are on average slightly lower compared with last year’s expectations, but we see a change in the asset class relative preferences. Lower expected returns and higher volatility will also have important implications in terms of strategic asset allocation.

- Reordering of asset class profiles. After last year’s strong comeback, the long-term view on high quality bonds remains positive. EM Debt, Hedge Funds and Private Debt are the asset classes offering the most appealing return potential with medium risk. Among developed market equities, the US market should lag overall (5.6% annualized expected returns for the next 10 years), due to expensive valuations, while Pacific ex-Japan and European equities may offer better returns (around 6.5%). Indian equities, EM ex-China and Private equity stand out as the asset classes with the highest return potential (above 7%). Healthcare, IT and Communications Services, and Financials are expected to be the global sector winners.

- A more diversified Strategic Asset allocation. Portfolios will have to be even more diversified to cope with higher expected volatility in risky assets and to enhance return potential. We continue to see fixed income as a key portfolio engine, in particular high-quality assets. Higher equity volatility will require investors to look for additional sources of diversification, such as EM debt.

- Real and alternative assets in focus. Real and alternative assets will help enhance portfolio long-term risk-return profiles and deserve around 20% allocation. Hedge Funds and Private Debt are favoured for investors who want moderate risk while Private Equity is for investors with a higher risk appetite. Infrastructure is a good diversifier that could benefit from significant investments aimed at climate mitigation and adaptation.