From Marsha Lee, Head of Australia and New Zealand at Calastone.

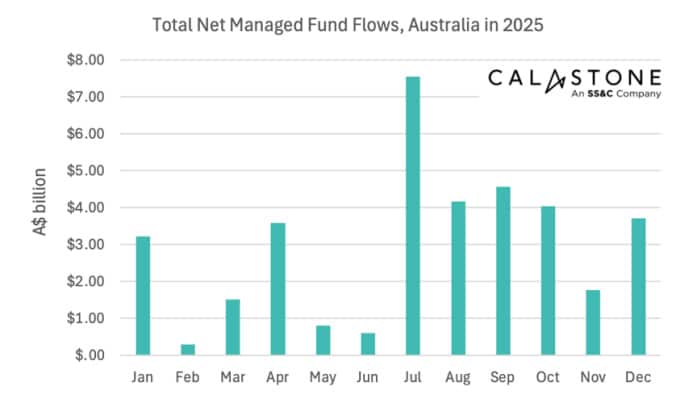

Australian managed funds attracted $35.9bn of net inflows in 2025, led by fixed income strategies as investors prioritised stability amid ongoing trade and geopolitical uncertainty, according to Calastone’s latest fund flow data. As market conditions improved through the year, equity demand rebounded, signalling a gradual but confident re-engagement with risk assets.

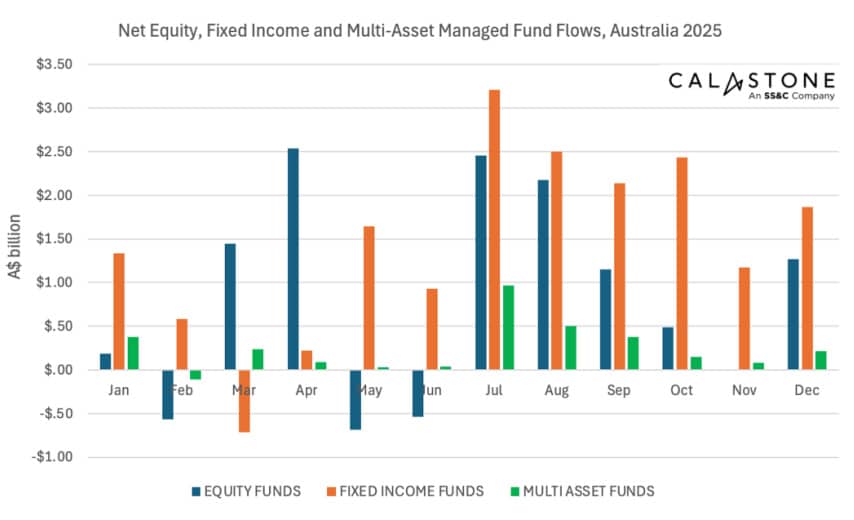

On the back of very strong 2024 inflows, fixed income funds surged further into record territory in 2025 as demand for yield and capital preservation remained strong. Record flows of $17.3bn affirmed the continued ascendance of fixed income strategies within Australian portfolios.

As conditions stabilised, equity funds experienced a remarkable comeback, gaining $9.9bn in 2025 as fears of a global recession receded throughout the year. Multi-asset funds grew by $2.9bn, attracting most flows in the second half of the year and signalling the sustained return of diversification within portfolios.

Fixed income funds gained momentum in 2H 2025

The trading patterns of fixed income funds showed greater momentum in the second half of the year, after a volatile start due to tariff policy uncertainty. Flow momentum accelerated in May, reversing March outflows (-$714mn) as markets normalised. Fixed income funds continued to absorb bouts of turbulence through the rest of the year and remained consistently positive. The strongest month was July (+$3.2bn).

Marsha Lee, Head of Australia and New Zealand at Calastone, said: “Fixed income was clearly the anchor allocation for Australian investors in 2025. Even as sentiment shifted through the year, demand for bonds remained resilient. What’s also notable is the way investors rebuilt equity exposure as market conditions stabilised – steadily and with conviction.”

Also read: The Real Problem With Japan’s Bond Market

Sustained revival for Equity funds with July the strongest month for re-risking

Equity fund flows were more sensitive to shifts in risk appetite in 2025. After a similarly unsettled first half of the year, equity demand stabilised and strengthened steadily, netting consistent inflows from August onwards, except for a flat November. Net inflows surpassed $9.9bn, more than making up for 2023 outflows and tepid 2024 inflows.

The strongest month was July, when equity funds attracted $2.4bn of net inflows, signalling a decisive return of investor confidence and a willingness to increase exposure to risk assets as inflation trended lower and markets moved past recession fears.

Multi-asset strategies regain footing as diversification returns

Multi-asset funds recorded $2.9bn of inflows in 2025, supported by stronger demand in the second half of the year as investors returned to balanced allocations and diversification benefits re-emerged. Inflows peaked in July (+$970mn), coinciding with the strongest month for equity flows (+$2.4bn), and remained positive through to year-end.

“What stands out is that investors remained active throughout 2025. They leaned into fixed income for stability, and then steadily rebuilt equity and balanced allocations as conditions improved, signalling cautious confidence rather than complacency,” Lee said.