Income Asset Management (IAM) proposes two model portfolio solutions for wholesale investors.

The two models provide investors with a conservative and transparent portfolio allocated to;

(i) Wholesale Investment Grade (WIG) Model

(ii) Tier 2 (bonds) Model

These portfolios aim to generate a higher risk-adjusted income stream, whilst preserving capital.

Portfolio Construction

We believe the case for bonds is compelling.

At today’s starting yields, bonds offer potential for attractive returns and can help cushion portfolios in a downturn. The mid part of the yield curve for Australia duration is most appealing given the shape of the yield curve and our economic and interest rate outlook. Currently, there are many high-quality corporate bond names at 6% yield within the Australian BBB / A corporate and bank credit curve, with historically low credit risk.

We remain constructive on spread performance for Tier 2 bank paper given

• Major bank supply remains constrained,

• The strong performance of recent stress tests performed by APRA on Australian banks, and

• The relative attractiveness of Tier 2 paper compared to senior unsecured bond spreads.

We see potential for 50bp spread tightening across the Tier 2 curve.

Portfolio Notes

- Yields for floating rate notes are a guide only. Returns are subject to movements In BBSW over the life of the issue.

- Yields for Subordinated Debt (Tier 2) are priced to the call date.

- Returns and pricing shown are indicative only and reflect wholesale market pricing.

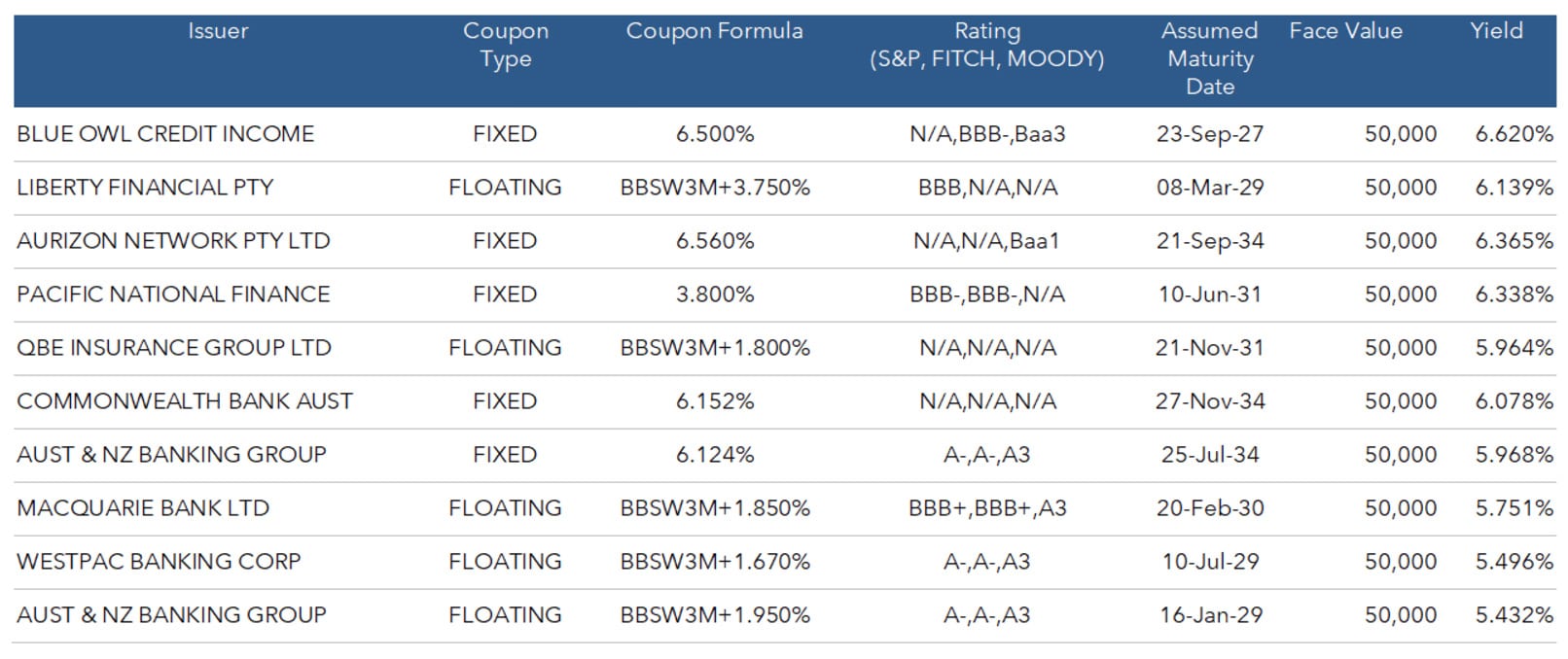

Wholesale Investment Grade (WIG) Model

Broad parameters

For the Wholesale Investment Grade (WIG) Model:

- The maturity profile is governed by liquidity and cash management requirements, with the objective to avoid excessive re-pricing risk by having laddered maturities.

- The portfolio must be invested in securities with a minimum issue size of A$100m.

- The portfolio must be denominated in Australian Dollars.

- The portfolio must be invested in corporate and Tier 2 bank (and insurance) securities with an investment-grade rating only.

- The portfolio is for investors who are looking to manage risk and earn higher than average yield, while striking the right balance between fixed and floating rate securities in the current interest rate environment

This Wholesale Investment Grade (WIG) Model portfolio has 10 AUD-denominated securities with equal weightings of 10% (In face value terms). It assumes an investment of A$50k face value.

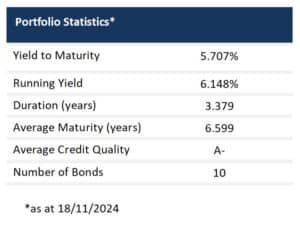

Statistics

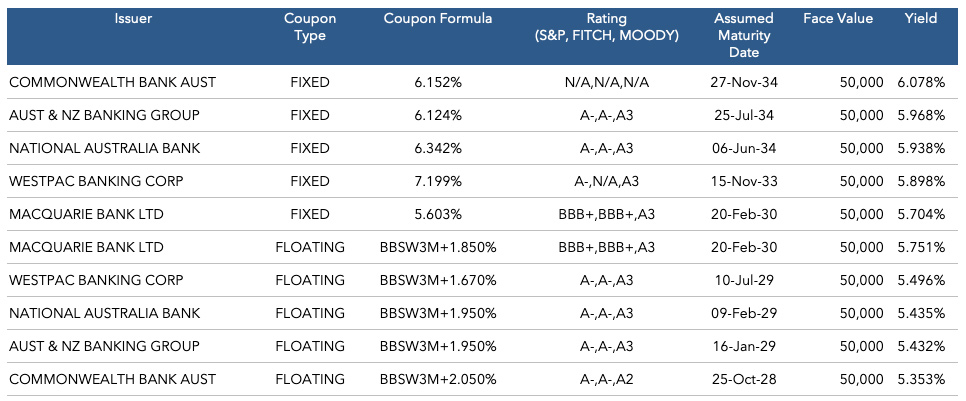

Tier 2 (Bonds) Model

Broad parameters

For the Tier 2 (Bonds) Model:

- The maturity profile is governed by liquidity and cash management requirements, with the objective to avoid excessive re-pricing risk by having laddered maturities.

- The portfolio must be in securities with a minimum issue size of A$100m.

- The portfolio must be denominated in Australian Dollars.

- The portfolio must be invested in Tier 2 bank securities with an investment-grade rating only.

- The portfolio is for investors who are looking to manage risk and earn higher than average yield, while striking the right balance between fixed and floating rate securities in the current interest rate environment

This Tier 2 (Bonds) Model portfolio has 10 AUD-denominated securities with equal weightings of 10% (in face value terms). It assumes an investment of A$50k face value.

Statistics