From Greg Peters, Co-Chief Investment Officer at PGIM Fixed Income

Marked by slower growth and rising risks, the global backdrop is becoming increasingly complex. Unpredictable trade policy calls into question forward-looking assumptions in nearly every economic category, including trends in inflation and employment.

The uncertain conditions make a compelling case for investors to rely on fixed income characteristics proven to be a bit more predictable over time: stability and income.

Updated expectations

- Global economy: The global economy remains resilient so far, but cracks are forming. In the U.S., moderation remains our base case with expectations for below-trend GDP growth. Still, continued tariff uncertainty is increasing potential for recession or stagflation scenarios. In contrast, we expect more stability in Europe and Asia.

- Interest rates: While still patient at this juncture, the Fed may need to resume easing, with up to two rate cuts possible by year-end if tariffs hurt growth. We expect long-term rates to remain in a historically wide range, with the 10-year U.S. Treasury between 3.75% and 4.75%.

- U.S. dollar: The U.S. dollar is weakening due to rising deficits, debt costs, and tariff uncertainty, making unhedged local currency bonds more appealing.

Elevated yields boost bond appeal

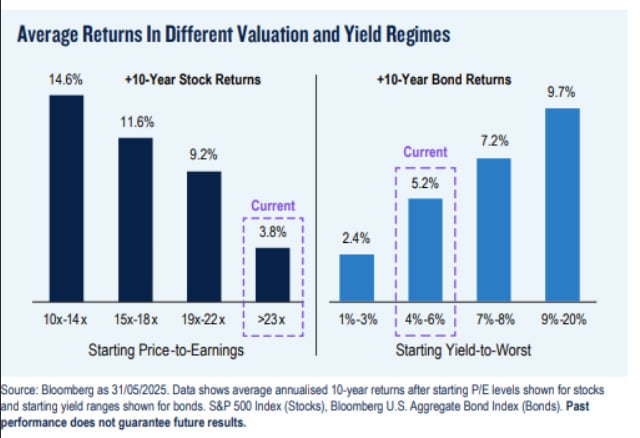

Amid stock market gyrations, bonds are proving their worth as a stabilising force, offering safety and steady returns. During the 2022–23 Fed tightening cycle, stocks and bonds had an unusually strong positive correlation, but this has returned to typical low levels. Amid recent market volatility, bonds outpaced stocks, reflecting a more normal dynamic. With high valuations despite the recent sell-off, equities could struggle if macro conditions worsen.

As the chart shows, when bond yields are between 4%–6% and equity valuations are high (price-to-earnings ratios over 23x), bonds show a historical propensity to outperform stocks over the next decade.

Also read: Emerging Market Debt Back in Focus for Australian Institutions

Opportunities across the yield curve

- Barbell approach: Given heightened interest rate uncertainty, investors may benefit from balancing short-term positions with long-term allocations for near-neutral duration exposure with a smoother return profile.

- Focus on quality: High-quality bonds are particularly attractive, serving as a steady income source while diversifying equity risk. Senior collateralised loan obligations currently offer attractive value compared to many fixed income asset classes, as does investment-grade corporate debt given a shifting preference for lower-risk exposure.

- Go global: Given significant U.S. policy uncertainty and a weakening dollar, investors may benefit from playing international yield curves with more stability and value.

Dislocations drive active opportunities

Amid a moderating economic backdrop with rising downside risks, fixed income remains attractive for investors seeking long-term yields. Bonds offer potential for solid returns and portfolio stability, while intermittent volatility creates opportunities for active management.