I recently came across this paper by FTSE Russell providing an overview of Emerging Markets and some of its indices. Even though the paper was published back in May 2020 and some of the charts are dated, it gives a great insight into the sub sector. Here we selectively republish part of the paper.

Emerging Market (EM) fixed income has developed into a substantial and investible asset class, combining local currency and hard currency categories. It is a very different asset class to the one that suffered major dislocation and contagion after the Asian and Russian shocks in 1997/98. Contagion within the asset class has been more limited in recent years, both in local and hard currency classes. Empirical evidence does not support the view EM fixed income is a purely risk-on asset class, and the variable correlations of returns with other asset classes offer portfolio diversification benefits.

The coronavirus shock is a major challenge for emerging markets, but this is a major global shock for all markets, with a substantial global policy response unfolding. But it should be noted that following the GFC in 2008/09 and the initial spread widening, EM fixed income benefited from spillover effects from G7 quantitative easing programs, and the subsequent global search for yield, which has intensified as the universe of negative yielding bonds, has expanded.

Emerging market definition

The World Bank defines an emerging market economy as one with a per capita income of less than $4,035. But the designation often describes economies in transition from developing to developed economies, like the G7, and emerging market can apply to an economy that was formerly highly developed but has regressed to being an emerging market economy (i.e., Argentina).

The term “Emerging Market” was coined by World Bank economist Antoine Van Agtmael in 1981. Most EM fixed income index providers, including FTSE Russell, use IMF and World Bank definitions of emerging markets.

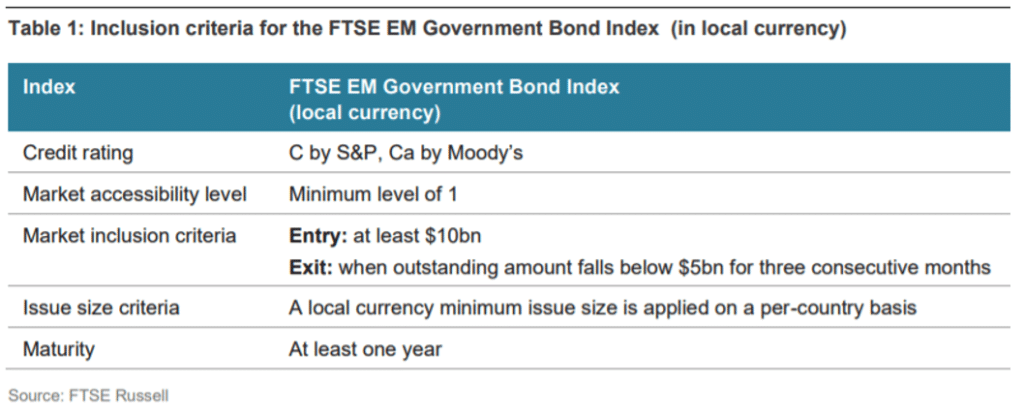

The list of EM countries is reviewed every September. For the purpose of the FTSE Emerging Markets Fixed Income Index inclusion, emerging markets are obliged to meet a set of criteria based on liquidity and credit quality, and an assessment of accessibility for foreign investors as outlined below.

The rapid growth in EM fixed income markets

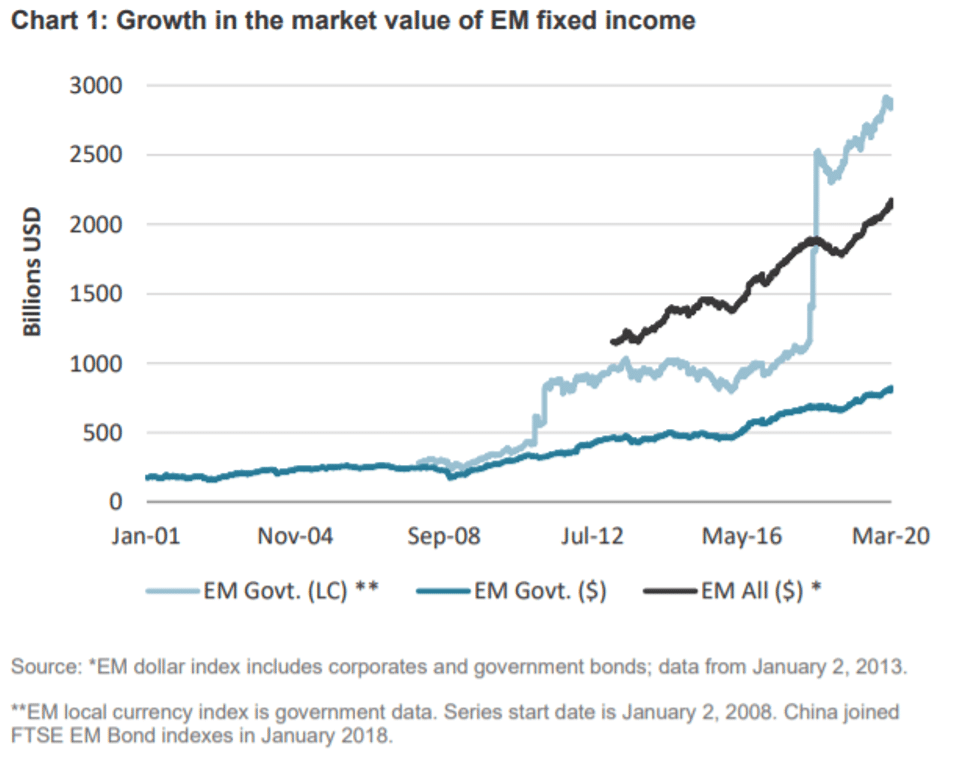

Issuance by both EM sovereigns in local currencies (LC) and EM corporates (mainly in US dollars) increased sharply, and particularly after the GFC in 2008. Chart 1 shows the growth in market value of EM fixed income, as issuance has surged in recent years, although please note the introduction of China into the EM local currency index approximately doubled the size of the market in 2018.

Characteristics of emerging market debt

- EM issuers in local currencies

Emerging market issuance in local currencies exposes investors to EM currency risk. This market is dominated by sovereign issuers, but default risks are low, since the sovereign issuer has monetary sovereignty in the same way that developed market borrowers do. Therefore, an issuer could print local currency to repay the debt, in the same way that the US or UK monetary authorities can. The foreign exchange risk introduces more volatility into the performance of this debt, but also adds more portfolio diversification possibilities. Successful EM economies have also generally experienced appreciating exchange rates. Since the debt is issued in local currency, local interest rates and inflation are key factors in driving returns, but the performance of US Treasuries and G7 interest rates has also become an important factor.

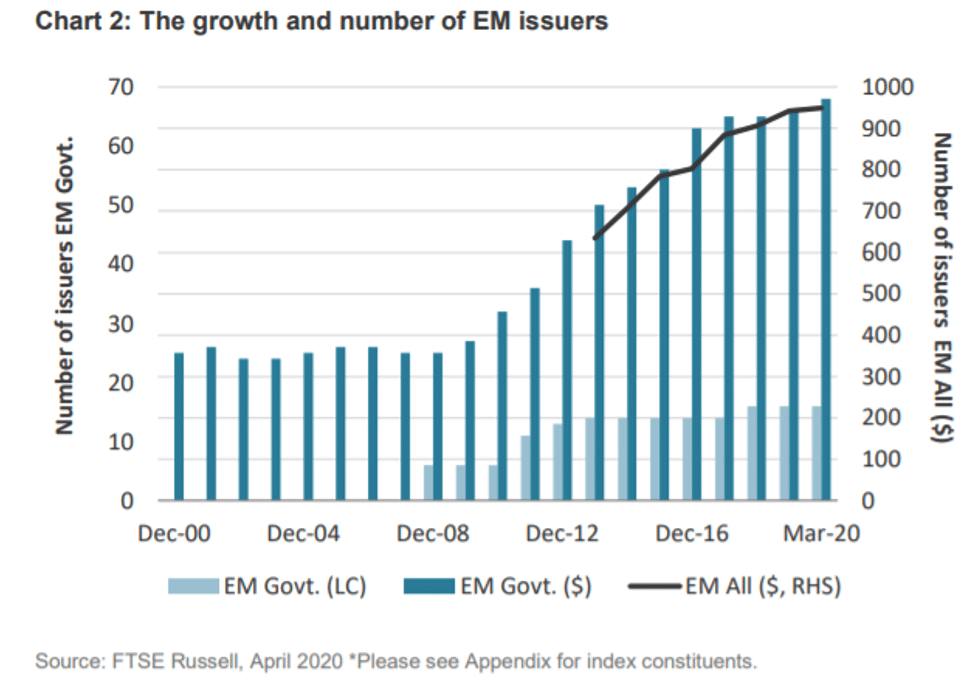

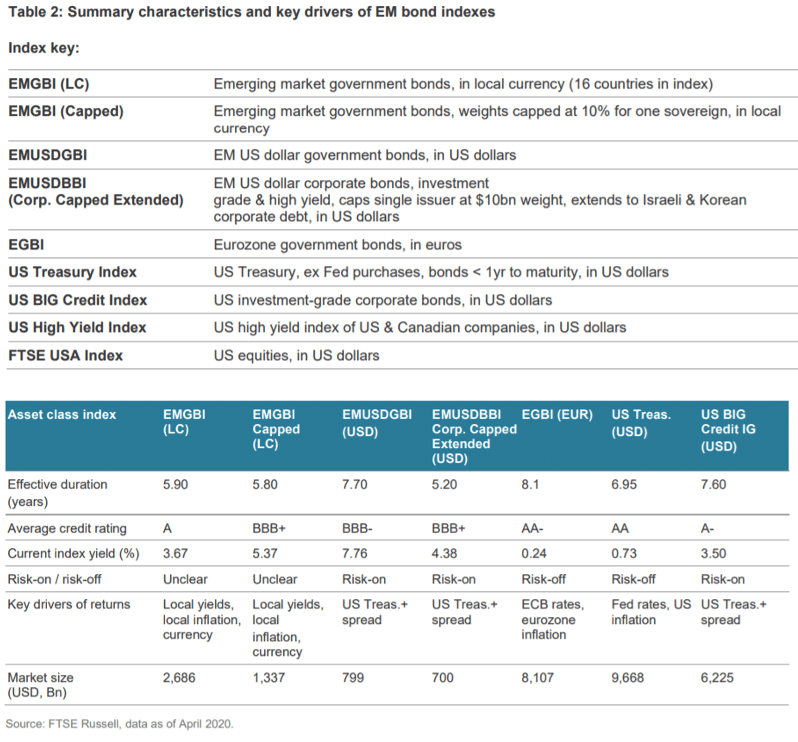

The EM (local currency) government debt index is a much more concentrated index than the EM dollar debt index, as Chart 2 shows, with a very small number of constituents (only 16 sovereigns*), although the regional weights between Asia, Europe and Latin America are fairly even. China’s arrival in some EM (local currency) debt indexes has also been a transformational event and caused some investors to focus more on indexes with country capped weightings.

- Emerging market issuers in hard US dollar debt

Hard EM corporate debt is debt issued by sovereigns, quasi-sovereigns and corporates in US dollars. Yields are higher in EM US dollar debt than in EM local currency debt partly because default risks are much higher, as Table 2 shows. This is because issuers immediately face a currency mismatch on their borrowings, given the debt is in US dollars, and their assets are in local currencies.

FTSE Russell is a leading global provider of benchmarks, analytics and data solutions with multi-asset capabilities, offering a precise view of the markets relevant to any investment process. For over 30 years, leading asset owners, asset managers, ETF providers and investment banks have chosen FTSE Russell indexes to benchmark their investment performance and create investment funds, ETFs, structured products and index-based derivatives. FTSE Russell indexes also provide clients with tools for performance benchmarking, asset allocation, investment strategy analysis and risk management.