Would you like to take a guess at just how big the bond market is?

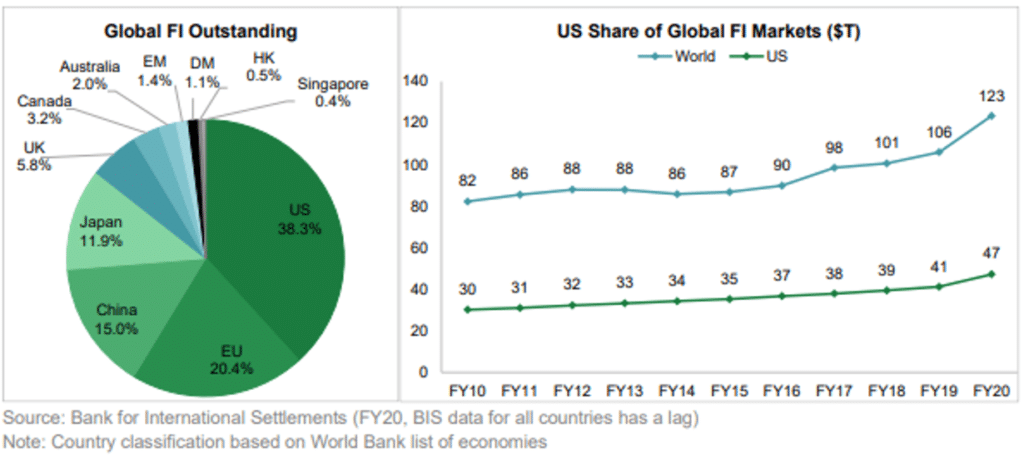

SIFMA, a US trade association for broker-dealers, investment banks and asset managers operating in the securities industry, has released its 1Q21 Fixed Income Outstanding report and according to the report, the global bond market was worth US$123 trillion as at the quarter end.

No points for guessing that the US is the largest global market, comprising US$47 trillion as at year end 2020, or 38.3%. In second place is the EU with 20.4% and third, China with 15%.

Australia scrapes in as 7th issuing 2% of the world’s outstanding bonds.

The report focuses on the US market and there are a couple of sub sections worth delving into.

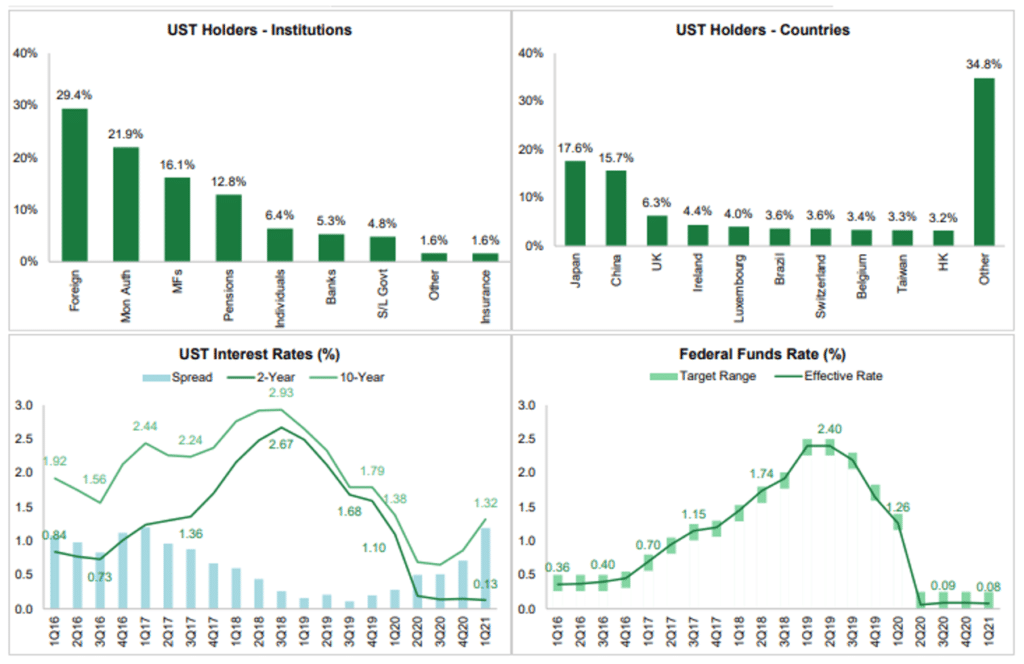

US Treasuries (UST)

COVID related stimulus and support has seen US government debt increase significantly to reach US$21.4 trillion, at the 1Q21, a massive 24.6% increase. Of the total, 29.4% is held by foreign investors and the largest country holdings are by Japan with 17.6%, then China with 15.7% and the UK holding 6.3%.

Other investors include: monetary authorities, monetary funds, pensions, individuals and banks.

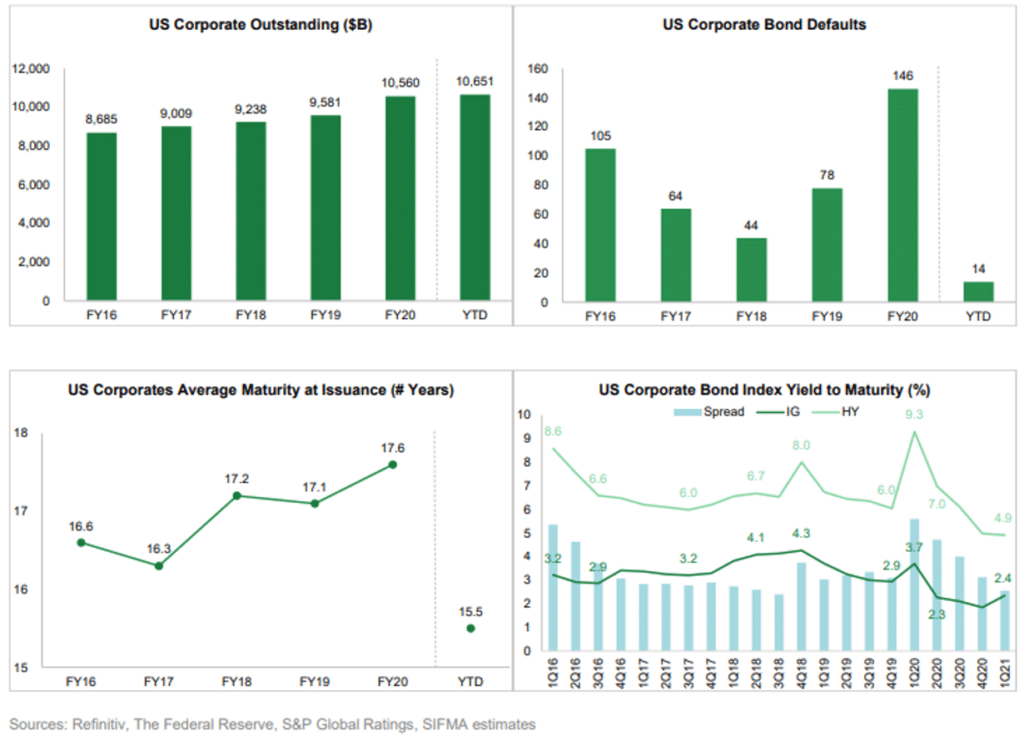

Corporate bonds

US corporate bond issuance was US$10.7 trillion as at 1Q21 and this was up 7.6% over the previous year. Corporate bond defaults increased in 2020 to 146, up from 78 in 2019 and for the quarter to date there have been 14 defaults.

Corporate bond terms until maturity are much higher than in Australia, averaging 17.6 years in 2020 but lower at 15.5 years for 1Q21.

Perhaps most interesting is the US Corporate Bond Index yield to maturity which was 2.4% for investment grade securities and 4.9% for high yield or sub investment grade.

For more information see the SIFMA website.