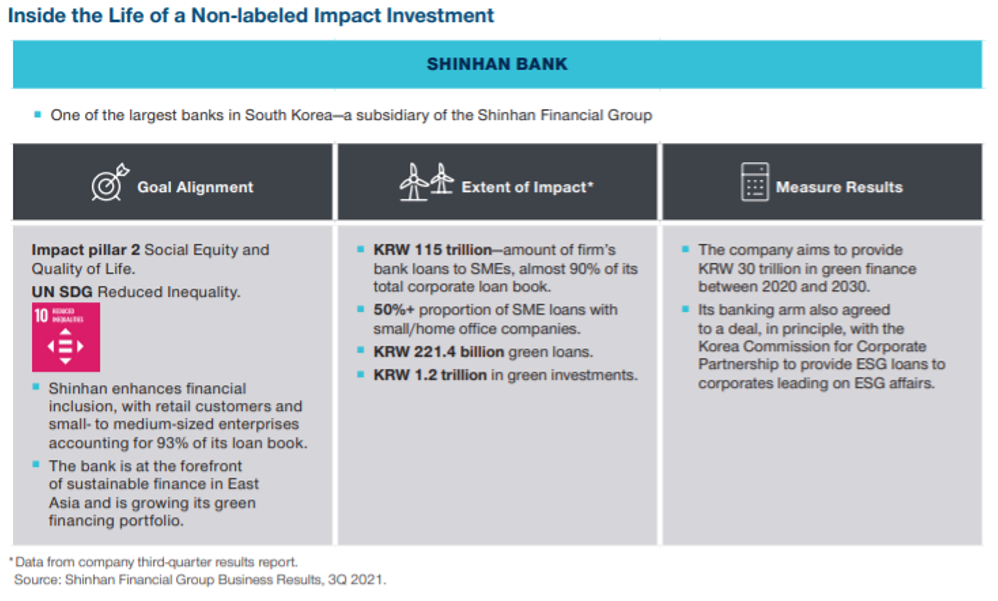

T.Rowe Price argue investors need to look beyond the ‘green’ label for companies making ESG advances as vanilla, non‑labelled bonds can have a greater impact at both societal and financial levels. Further, investors can earn higher returns by investing in vanilla bonds.

Environmental, social and governance (ESG) considerations have become a cornerstone of the investing landscape. These include green, social, and sustainable bonds—a range of debt instruments issued to fund projects that seek to have a positive effect on environmental and/ or social issues, such as climate change or social inequality.

Yet, while these instruments have amplified investor interest and increased capital flows towards ESG‑conscious companies, they are not the only instrument for investors seeking to make a positive impact.

Companies issuing bonds outside of ESG‑labelled bond markets can uncover significant opportunities in terms of delivering both positive impact and financial targets. Not only does this broaden the opportunity set, supporting companies directly—rather than being limited to funding specific projects—it can also help craft a portfolio that is better aligned with long‑term impact goals.

Why ESG Financing Goes Beyond Labels

ESG‑labelled debt has become a significant feature of the global bond market in recent years. According to T. Rowe Price analysis, green, social, sustainability, and sustainability‑linked issuance eclipsed the USD 1 trillion mark in 2021, compared with just USD 442 billion in 2020. This growth is one of many reasons why public debt markets play an increasingly important role in channelling the investment capital needed to make desired environmental and social impacts, such as those conveyed in the United Nations’ Sustainable Development Goals (UN SDG).

However, ESG‑labelled bonds do not have a monopoly in fixed income markets when it comes to impact investing. For many issuers, everyday activities—from energy resource transformation to lending decisions at a financial institution—can yield material and measurable environmental and social benefits. However, these companies choose not to tag their bonds with a label. And, given that last year corporates and governments raised more than USD 24 trillion in non ESG-labelled debt in bond markets, according to Bloomberg, it pays impact investors to look broadly across the debt capital markets for compelling investment opportunities, let alone “impact” or “compelling impact” investment opportunities.

Broadening the Opportunity Set Improves the Potential to Make an Impact

On the one hand, widening the search area for impact investments may seem counterintuitive. Use‑of‑proceeds bonds are intrinsically linked to distinct projects, whether at an individual level or as part of an SDG framework. This means that the outcome, be it a project or target, can be clearly traced back to the initial ESG‑labelled investment, and the impact can then be quantified.

However, the notion that companies issuing ESG‑labelled bonds have more of an impact than those issuing non‑labelled bonds is flawed. In our view, confining impact investments to use‑of‑proceeds bonds would forgo the impact potential from funding issuers whose everyday activities contribute to the UN SDGs.

If we consider the desire to limit or slow the onset of climate change, for example, we may associate green bonds where proceeds fund projects such as electric vehicle research. However, looking at the SDG of combating climate change— measured partly by the pathway to reach “net zero” carbon emissions by 2050—a more holistic view of the fixed income space is needed. For instance, it could be more impactful to invest in a renewable energy company, whose everyday activities are working to accelerate the decarbonization of the global economy by shifting energy production away from fossil fuels and toward low‑carbon alternatives.

Indeed, this scenario describes NextEra Energy Operating Partners (NEOP), a firm that operates a portfolio of wind, solar, and battery storage assets. On the surface, the company might be overlooked by impact investors purely focused on ESG‑labelled bonds as NEOP has not historically issued such instruments.

NEOP operates a portfolio of renewable energy assets comprising 6,250 megawatts of net capacity and, through its development pipeline, is targeting 17,300 megawatts by 2023–2024. So, although its bonds do not carry a “green” or ESG designation, investing in NEOP directly supports an issuer whose everyday activities are generating meaningful and measurable environment impacts.

Making an Impact, Avoiding the “Greenium”

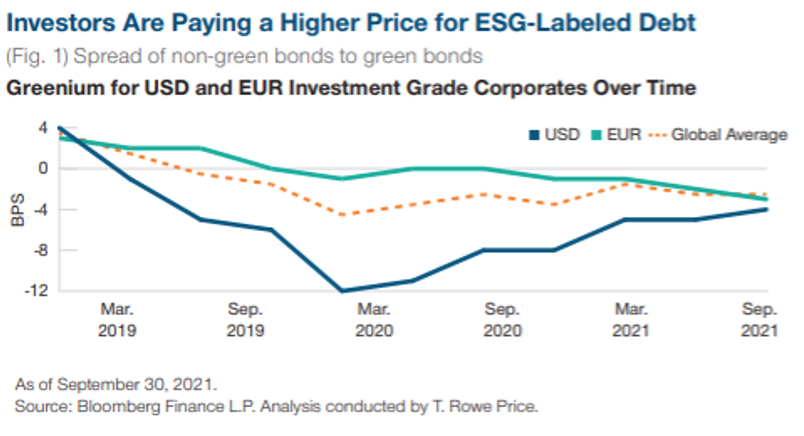

Non-‑labelled bonds have another advantage for impact investors: the fact that they trade at a discount compared with ESG‑labelled debt. This so‑called “greenium”—the spread of an ESG‑labelled bond compared with the issuer’s non‑labelled curve— has widened over time in conjunction with rising demand for the asset class. ESG bonds denominated in euros, for example, have gradually become more expensive and, according to T. Rowe Price analysis, are trading at roughly a three‑basis point premium over vanilla bonds. And while U.S. dollar‑denominated ESG‑labelled debt has cheapened in relative terms since last year, nine months into 2021, they were still priced, at an average, five basis points more expensive than non‑ESG equivalents.

This makes sense at first glance, given that the point of ESG‑labelled bonds is to reduce the cost of capital for green and social projects by preferentially allocating capital to them. However, looking deeper, if impact investors can achieve the desired environmental or social effect without paying the usual premium associated with an ESG label, it is likely that investment will drift toward the non‑labelled segment.

Bigger Market Demands Deeper Research

Wading into non‑labelled bonds from an impact perspective is not necessarily simple. Debt with a green, social, or sustainability moniker provides a direct linkage from investment capital to measurable outcomes. In non‑labelled bonds, however, investors need to engage directly with the company on a forensic basis to ascertain whether the issuer is heading toward an impact that they are willing to finance.

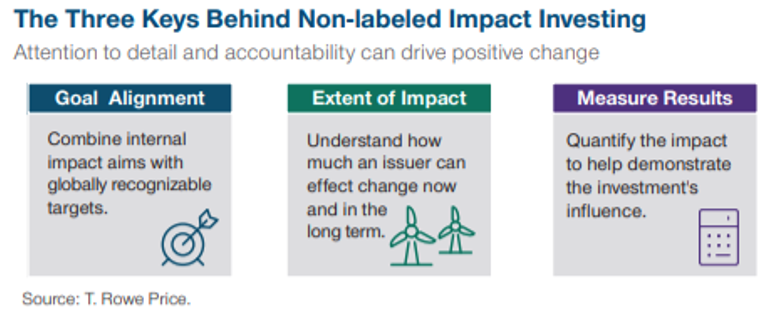

Achieving this requires a methodical approach that appreciates impact investing outside of predefined, labelled bonds and necessitates deep research as well as long‑term commitment. In our view, there are three key steps along the way:

-

Align with impact goals

Impact measurement is complex. A present‑day analysis of the company’s activities, as well as a conceptualization about its potential influence, can help shape views on possible outcomes from an impact perspective.

-

Understand the level of impact

While alignment is a good starting point, it’s also important to conduct impact due diligence on an issuer to gain a deeper understanding of its impact footprint.

-

Measure and report on outcomes

Quantifying tangible results of an impact investment is vital to demonstrate how investment decisions have direct positive consequences. This needs to be undertaken through quantitative, external data, where possible, to help demonstrate an objective reflection of an investment’s impact.

The specific securities identified and described are for informational purposes only and do not represent recommendations.