From Seema Shah, Chief Markets Strategist, Principal Asset Management

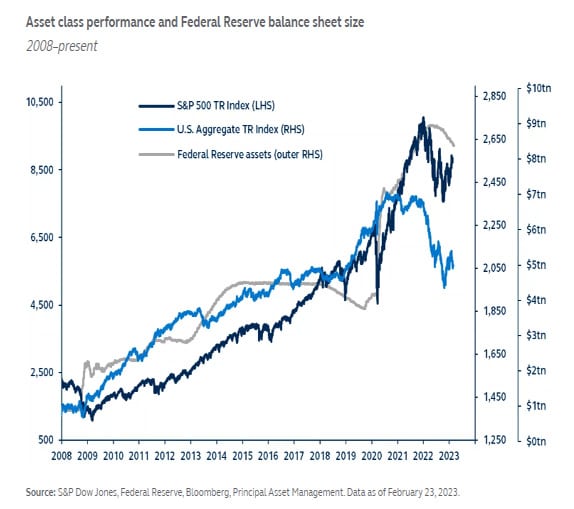

With the fruitful tandem of low central bank policy rates and muted inflation no longer carrying asset prices higher, as they did in the decade following the Global Financial Crisis, investors need to thoughtfully reconsider their portfolio construction process, and reallocate their positioning to both take advantage of market inefficiencies and minimize exposure to macro-driven threats.

Unlike the golden era of the past decade where low inflation and low interest rates were suppressing volatility and lifting asset prices, it’s now higher inflation and higher interest rates that will likely be dictating market dynamics in the decade ahead. Investors will need to consider key market risks that will be crucial to portfolio construction in what is likely a new investment era:

- Decrease equity risk: It’s becoming increasingly clear to the market that the Federal Reserve is not yet finished with rate hikes. Relentless monetary tightening will eventually weigh on both the economy and earnings—a headwind that will, inevitably, renew and extend the equity market drawdown.

- Increase interest rate risk: After a particularly tough 2022 and the latest global bond sell-off, U.S. 10-year Treasury bonds now yield more than twice the estimated dividend yield of the S&P 500 Index. This presents investors with the opportunity to lock-in income with a less volatile asset.

- Increase alternative beta: Alternatives have strong defensive characteristics which are important in today’s macro environment. In addition, they offer diversification benefits against traditional equity and fixed income.

The era of expanding central bank balance sheets and ultra-easy monetary policy has come to an end, leaving an almost unrecognizable global investment landscape. Expectations for returns need to be lowered, expectations for volatility need to be raised and, above all, additional investment discipline will be required.