Summary

Lower interest rates will support asset performance. Interest rate cuts in 2025 will continue to support improving asset performance in the Australian residential mortgage-backed securities (RMBS) sector in 2026. In the ABS sector, performance will remain sound and in some cases improve for deals with prime-quality assets. However, asset performance risks will persist where ABS deals are heavily exposed to underperforming areas of the economy, such as parts of the construction sector. In terms of new issuance, we expect strong volumes for both RMBS and ABS in 2026. Momentum will also continue to build toward the securitization of data centers in Australia.

Lower interest rates will support asset performance

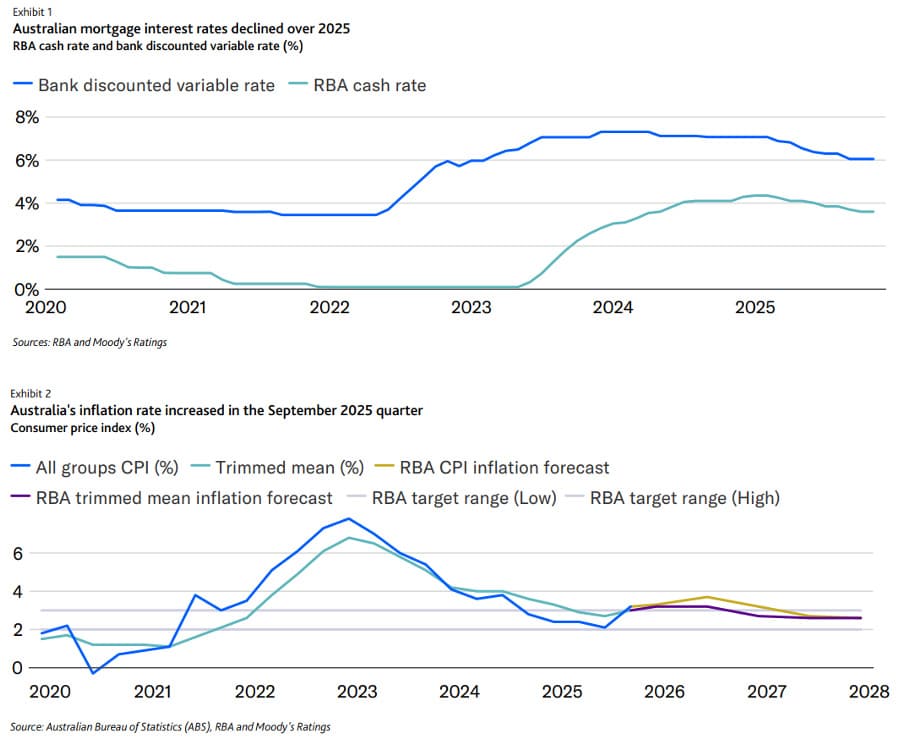

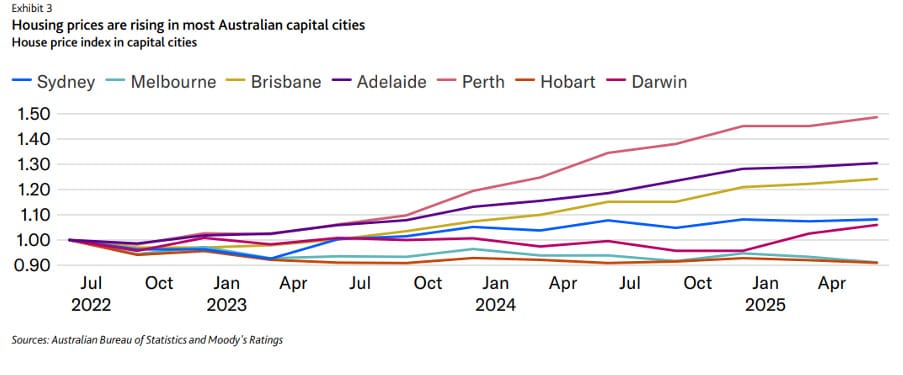

In Australia, RMBS asset performance will continue to improve over 2026 because of lower interest rates. The Reserve Bank of Australia (RBA) lowered the official cash rate to 3.6% from 4.35% in 2025 (Exhibit 1), reducing mortgage repayment amounts for floating-rate home loans. The headline rate of inflation exceeded the RBA’s target band in the September quarter (Exhibit 2), which has reduced the likelihood of further imminent interest rate cuts. However, even if there were no further rate cuts in 2026, the monetary easing in 2025 will continue to support improving asset performance for RMBS deals over the next 12 months.

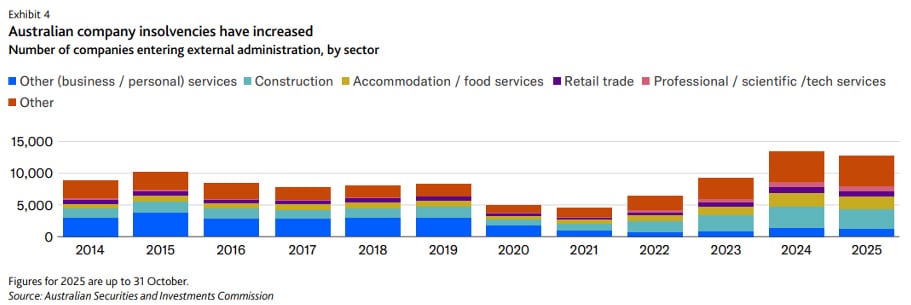

For the RMBS we rate, mortgage delinquency rates declined over 2025 as interest rates eased and we expect this positive trend to continue into 2026. Additionally, lower interest rates will support strong housing market conditions (Exhibit 3), which will limit losses for RMBS deals when mortgage borrowers default. The Australian government’s 5% deposit scheme for first homebuyers, which took effect in October, will also support borrowing capacity for first homebuyers, increasing demand for housing. Meanwhile, population growth and low building approvals will continue to challenge housing supply.

We expect asset performance to improve for both prime RMBS and nonconforming RMBS,1 given the supportive interest rate and housing market conditions. However, delinquency rates will decline at a slower pace and remain much higher for nonconforming RMBS than prime RMBS. Intense competition for prime home loan customers has led the nonbank lenders that issue nonconforming RMBS to increase lending in higher-risk segments of the mortgage market over recent years, including alternative documentation, interest only and investment loans. The riskier lending is unlikely to materially weigh on asset performance over the next year because of lower interest rates and strong housing market conditions. However, asset performance risks will increase for nonconforming RMBS if rates rise or housing market conditions deteriorate in future.

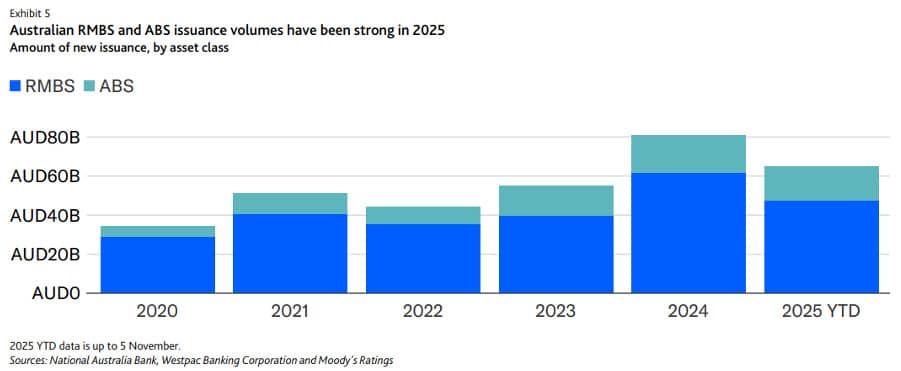

In the Australian ABS sector, asset performance will continue to vary from deal to deal across the auto ABS, personal loan ABS, and commercial auto and equipment finance ABS we rate. ABS assets are mostly fixed-rate loans, so there will be no direct benefit from the rate cuts in 2025. However, lower interest rates will support the economy in general and the credit quality of borrowers. For ABS deals with mostly prime-quality assets, performance will remain sound over 2026 and in some cases improve, given the economic backdrop. But asset performance risks will persist where underlying asset quality is weak or the deals are heavily exposed to underperforming areas of the economy, like parts of the construction sector for example. We expect business insolvency rates (Exhibit 4) to gradually decline but remain high in 2026, so ABS deals with exposure to commercial auto and equipment loans will pose a larger risk than deals that securitize loans to consumers.

In terms of new issuance (Exhibit 5), we expect strong volumes for both RMBS and ABS in 2026. In the RMBS sector, the rate cuts in 2025 and investor demand for yield will make for favorable funding conditions in 2026, spurring issuance. In the ABS sector, the need for nonbank financial institutions to fund lending in areas like auto loans, personal loans and equipment finance, will underpin strong issuance. Additionally, novated leases will continue to grow as a share of assets for auto ABS in 2026, given the popularity of these leases for financing electric vehicles.

Momentum will also continue to build toward the securitization of data centres in Australia. Data centre capacity in Australia could more than double by 2030 to meet growing demand for cloud computing, social media and artificial intelligence services. The rollout of data centres in Australia will increase the need for funding, including through securitization.