This morning we expected a cash rate cut from 0.25% to 0.10%, but it didn’t happen! It is easy in hindsight, why would the RBA cut when billions of dollars in stimulus was being announced by the government? We need to be drip-fed the good news to keep our spirits up and continue spending.

Still, I was in good company with well known economists Shane Oliver and Saul Eslake, also expecting the cut.

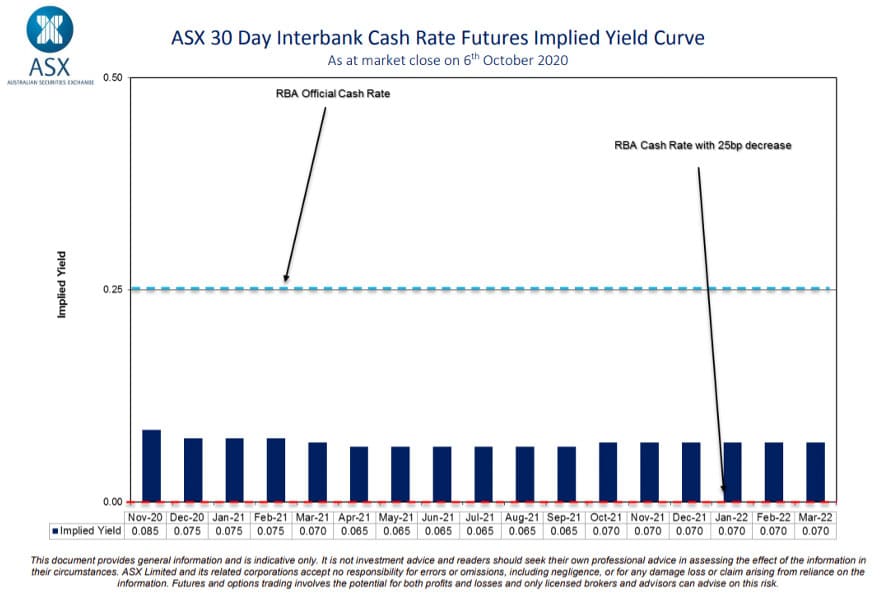

What is interesting is that the market has already factored in the cut and this can be seen in the ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve graph – one of my favourite references.

You can see the monthly forward rate expectations, well under half that of the pale blue dotted line showing the current 0.25% cash rate. Assuming the cash rate is cut next month, there’s little left on the horizon to get excited about.

While the RBA has just about come to the end of its interest rate cutting cycle, as it continues to state it will not entertain negative interest rates, it can still influence the market and one of the actions being suggested it that it buys government bonds in the 5-10 year maturity bucket to force rates on those bonds lower.

We will have to wait and see, there is a long way for this recession to play out and it is now time for fiscal policy (government spending) to take the reins and help the economy.