Elizabeth Moran takes a look at BetaShares’ new Interest Rate Hedged Australian Investment Grade Corporate Bond ETF (HCRD) and suggests some advantages and disadvantages.

It’s always exciting to see new fixed income products come to market and last week, BetaShares’ announced its new fixed income ETF, HCRD, which hedges a portfolio of fixed rate, senior investment-grade bonds, designed to reduce interest rate risk.

The ETF invests in another BetaShares ETF, its Australian Investment Grade Corporate Bond ETF (ASX: CRED). HCRD reduces interest rate risk by selling bond futures contracts, mitigating the potential negative impact of rising interest rates on the performance of the corporate bond portfolio.

Hedging interest rate risk sounds great, but why hedge an existing fixed rate portfolio, why not just opt for a floating rate portfolio instead? A possible reason is that high demand for floating rate securities, which are a smaller part of the fixed income market, have led to lower yields and that it may make sense to use hedges to achieve high rates of return instead of investing direct.

Also read: Fixed Income ETFs Are Precision Instruments

The other immediate thought I have is that much of the adjustment to interest rates and certainly the most brutal part, has likely already occurred. Will the ETF still hedge if interest rates start coming down? The answer is yes, this quote is taken from page 16 of the PDS:

As a result of the Fund’s interest rate hedging strategy, the Fund can be expected to under-perform an equivalent unhedged investment over a period when government bond yields covering a 5 to 10 year maturity are falling, or remain unchanged (due to the impact of ongoing hedging costs and other factors).

So, like a completely fixed rate portfolio like CRED, if you chose to invest in HCRD, you’ll need to keep an eye on the market and watch for a change in the direction of interest rates.

Let’s look at the details.

Underlying ETF (ASX:CRED)

CRED’s portfolio includes up to 50 bonds, with eligible bonds requiring a minimum $250 million outstanding and a term to maturity of between 5.25 and 10.25 years.

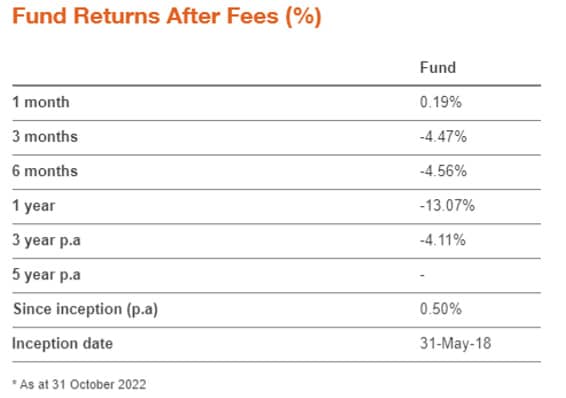

Recent performance has been poor given its 100% fixed rate portfolio. Increasing interest rates have seen fixed rate bond prices fall and over the last year to 31 October 2022, the fund returned negative 13.07% and around negative 4% over three and six months. Sadly, since inception, the fund is barely positive at 0.5%. That is a very different return than what the fund would have achieved at the same time last year and illustrates why it’s important to stay in touch with the market.

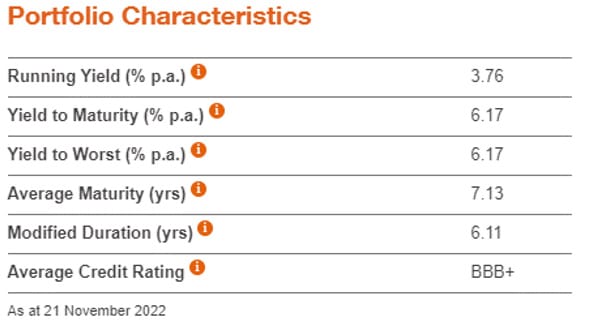

Positively, the metrics of the fund are now much improved with a yield to maturity of 6.17% as at 21 November 2022. Modified duration, that is the impact of interest rate rises or falls is high at 6.11 years. The fund is solidly investment grade. The new HCRD which will invest in CRED aims to reduce duration and interest rate risk.

HCRD details

Even though HCRD was only launched last week, BetaShares has released past index performance in its HCRD factsheet. It shows a negative 3.70% return over the last 12 months and negative 0.50% and 1.58% over three and six months respectively – a much-improved performance over CRED, albeit still negative returns.

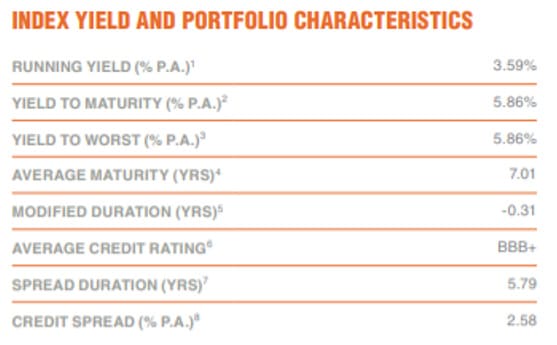

Betashares HCRD investors can expect a running yield of 3.59% and yield to maturity of 5.86%, slightly lower than if you were to invest in CRED now. The difference would largely be the cost of the futures contracts to reduce the impact of further interest rate rises.

Advantages of Betashares HCRD

- The ETF reduces the interest rate risk of investing in a portfolio of fixed rate bonds

- Modified duration, a measure of the portfolio’s sensitivity to interest rates, is -0.31 years as at 14 November 2022

- Monthly income

- Bonds used in the fund are based on expected returns rather than the debt outstanding, trying to negate the typical index fund allocation to the most indebted issuers in the fixed income universe

- Investment grade portfolio

- Low transaction costs estimated at 0.01% of the fund’s net asset value

- You can invest on the ASX

- No minimum investment

Disadvantages of Betashares HCRD

- New to market

- The fund still hedges when interest rates are falling, so will not take advantage of rising fixed rate bond prices. The fund would likely underperform an equivalent unhedged investment when interest rates are falling

- Hedging the portfolio is an additional cost

- An ETF that invests in another ETF.

For more information on Betahres HCRD see the BetaShares website.