Investment-grade credit has had an encouraging start to 2024 – but are these really “Goldilocks” conditions for the asset class? In their latest Q&A, James Vokins and Chris Higham from Aviva Investors credit team discuss opportunities and risks in this market.

After a big rally in the last two months of 2023, global bond markets started 2024 in a more sober mood. Given the backdrop of tight labour markets (particularly in the US), rising consumer prices, still-high inflation, continuing geopolitical concerns, and uncertainty surrounding the timing and the number of interest rate cuts this year, investors were taking a cautious view.

Nevertheless, investment-grade (IG) corporate bond markets saw record levels of debt issued over January in both Europe and the US, as borrowers took advantage of falling yields at the end of last year. In the US, a new all-time January record was set with $194.3 billion of new IG bonds issued – surpassing 2017’s total of $172 billion, according to Deutsche Bank figures. IG issuance in Europe also finished at its highs in January, with €39.5 billion and £4.7 billion of new corporate bond issues in the euro and sterling markets, respectively.1

After a slight wobble early in January, where low new-issue premia resulted in meagre orderbooks and poor initial performance for many deals, demand has picked up and some investors are even whispering of a potential “Goldilocks” market in 2024 – conditions that are “just right” for bonds. This may be too optimistic, given the lingering uncertainty on the macro outlook.

There is potential for active managers to offset risks through good credit selection and an understanding of market dynamics

However, with IG yields remaining attractive, there is potential for active managers to offset these risks through good credit selection and an understanding of market dynamics in order to generate enhanced returns in this environment. As an example, in the US, technical factors at the long end of the IG maturity spectrum look favourable, given the supply of longer-dated debt remains relatively low, with companies looking for cheaper issuance opportunities as yields fall.

Also view: Fed’s Sticky Wicket As Investors Brace For More Volatility

In this Q&A, James Vokins (JV), global head of investment-grade credit, and senior portfolio manager Chris Higham (CH) share their views on developments in the markets and where they see the key risks and opportunities emerging throughout 2024.

What are the main issues markets have been grappling with since the start of the year?

CH: Fixed-income investors are still grappling with some of the themes that shaped markets towards the end of 2023. Inflation uncertainty remains a big concern and has been the source of some volatility so far in 2024.

The next big theme is the interest rate outlook and how much has been priced into the markets. Over the last few months, markets have been pricing in a lot of rate cuts from central banks for 2024, which we believe are excessive.

Then there is geopolitics – continuing wars and regional conflicts, especially in the Middle East, alongside a heavy schedule of elections globally, in both emerging markets and developed economies. The most high-profile will be the US presidential election, which looks to be a replay of the 2020 vote. Changes in fiscal policy in the run up to these votes, or after them, could have major implications for government and corporate bond markets.

Investors are also focusing on the technical forces of supply and demand in the market. The supply backdrop coming into this year was one of the big unknowns. In 2024 so far, we have seen a lot more issuance than over the same period last year. Nevertheless, big question marks surround the level of supply over the coming months, given current yields make it rather expensive for companies to issue new debt, and over how much demand there will be going forward.

Investors are also focusing on the technical forces of supply and demand in the market – Chris Higham

While demand is currently matching supply, we wonder how sustainable that will be. It is difficult to judge how much of the supply has been front-loaded, and also, given where yields have reached, whether demand levels will fall due to the potential alternatives on offer to investors, notably cash instruments.

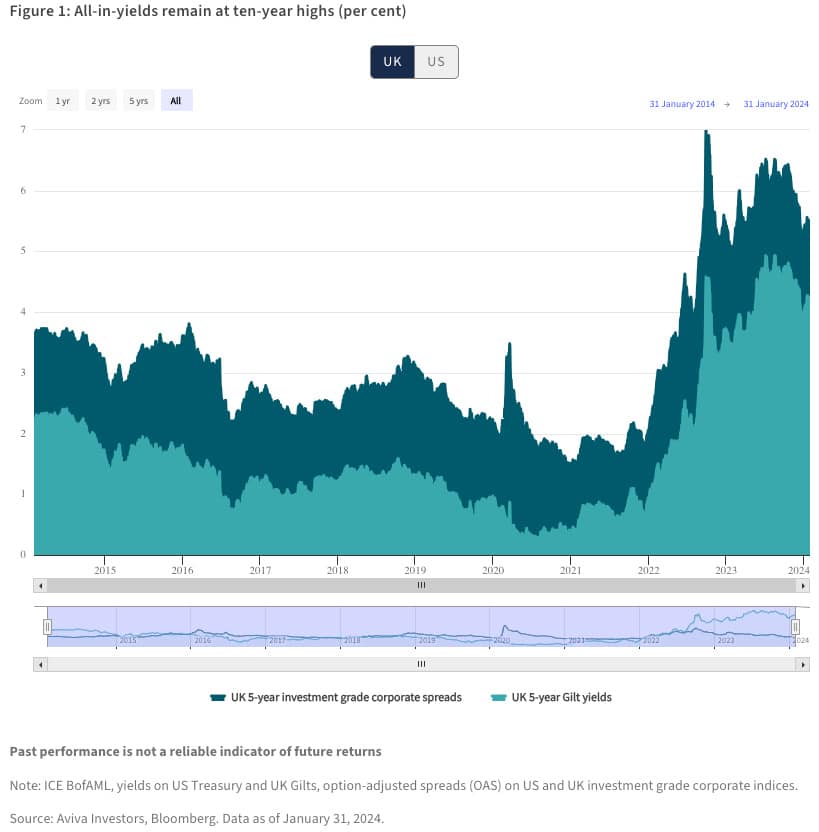

To sum up, there are a lot of sources of potential volatility. Nevertheless, we are constructive on the total return outlook for IG bonds. We started the year once again with the highest all-in starting yields in over a decade, providing a useful buffer against volatility and making it difficult to see a scenario in which total returns turn negative (see Figure 1).

How are companies in the investment-grade market adapting to this environment?

CH: The answer to this question is somewhat surprising. One would expect higher interest rates to be bad news for companies. But in the US, corporates’ net interest expenses have decreased even though interest rates have risen dramatically. In fact, the US is the only developed economy where interest costs have gone down sharply since 2021.2

One reason for this is that investment-grade companies tend to have strong balance sheets and lots of cash. While returns on cash have increased rapidly, the cost of debt has not changed at the same speed, given the average duration of seven to eight years on IG debt. It takes a long time for the cost of debt to increase.

This phenomenon is important and links to the uncertainty about supply coming to the market. Companies only borrow money if they actually need to. With most IG businesses generating strong cash flows, the need to borrow – to repay debt, pay dividends or invest – becomes less imperative. Most importantly, these firms can pay debt down if they wish.

With most IG businesses generating strong cash flows, the need to borrow becomes less imperative – Chris Higham

At this point, it is not clear whether the large amounts of issuance so far are the result of front-loading future debt maturities; a view on yields, which have come down from their highs over the last few months; or the start of an ongoing trend where we will continue to see a strong stream of new bonds coming to the market. For example, in the healthcare and tech sectors, big deals are expected through increased mergers and acquisitions (M&A) activity. Hence, supply is one of the big question marks for the year.

We believe that, overall, IG companies are in reasonably good shape. Any concerns would only be over certain pockets of the credit markets. While at an aggregate level the picture remains healthy, clearly there are areas where borrowers are more vulnerable to higher interest rates – typically weaker, sub-investment-grade-rated issuers or specific sectors of the economy.

For example, worrying trends have recently emerged within the credit card and auto loans sectors and indeed the leveraged loan markets. Many blue-chip large-cap companies, however, look set to enter a period of weaker growth with strong balance sheets, which should enable them to navigate a slowdown and adapt to higher interest rates.

JV: There is also an interesting technical factor at play here. IG companies are able to navigate the market by issuing at different points in the credit curve. And there has been quite a large move higher across all maturities for obvious reasons. US companies tend to issue debt all the way out to 30 years, but given the current higher yields, they seem unwilling to lock-in those long-dated yields as they would have to pay the interest burden for a long period of time. Thus, we have seen a fairly big shift away from long-dated issuance.

While there are still a few longer-maturity issues, there are far fewer than in the past. Most companies are issuing much shorter-term debt. Therefore, the technicals, particularly at the long end of the IG credit curve, are very strong.

IG companies navigate the market by issuing at different points in the credit curve – James Vokins

On the demand side of the equation, matters are also helped by pension funds shifting some of their allocation away from equities and into fixed income over the last year or so, locking in the positive funding status delivered by higher interest rates (and lower liabilities). So, there is an interesting demand/supply balance at the long end of IG bond market.

Do you see any patterns emerging in company earnings so far this year?

CH: Earnings are out in the most important and largest sector: financials. For most of the US banks, they echo some of the trends already mentioned. Overall, the numbers have been really strong, showing the best ever quarter for a number of banks. However, we are now entering a period where we expect net interest margins to have peaked and will start to come down.

Many of the banks have also been provisioning for what they expect to be a tighter credit environment across the board, or at least for certain sectors such as credit cards and auto loans. Others have also made provisions on mortgage arrears or against their exposures to real estate, in particular, offices.

While the US banking sector is likely to face challenges, it benefits from strong capital positions and strong liquidity and we believe it is as well placed to weather a storm as it has been in the last 30 years or so.

Are there any particular regional markets that are more attractive this year?

CH: We believe euro IG bonds have the potential to deliver better value over those issued in dollar or sterling. The US dollar market is still the most expensive part of the IG market overall, which could continue to be the case for some time. The difficulty is to know when that is likely to change and the likely.

JV: The two largest and most liquid markets in investment grade are the euro and the US dollar market. So, the main choice is really between the two, even though the sterling market is also important to us. Technical factors in US IG are stronger than in Europe; however, they are very well reflected in the price, making valuations less attractive. Euro IG is not as expensive, but there are a few more risks and concerns in Europe – given that certain European economies are teetering on the edge of a recession – and probably less demand for the asset class relative to the US.

Technical factors in US IG are stronger than in Europe – James Vokins

How concerned are you about the risk of recession?

JV: Many in the market are convinced of a “Goldilocks” scenario – a soft landing where growth comes down slightly, but not into negative territory, and inflation also comes down, allowing central banks to cut interest rates in line with what has already been priced in. In this scenario, credit spreads would remain contained.

We think this view misses the fact there could be a wide distribution of risks around this narrow scenario, be it from slightly better growth – or more importantly, higher inflation – or an opposite situation: a significant downturn where rates have to come down quite aggressively and credit spreads would then widen considerably. As Chris mentioned earlier, yields have moved higher, to what we think are more sensible levels, since December, when Federal Reserve Chair Jerome Powell indicated the bank was more open to rate cuts than had been anticipated. But we still believe too many cuts are priced in.

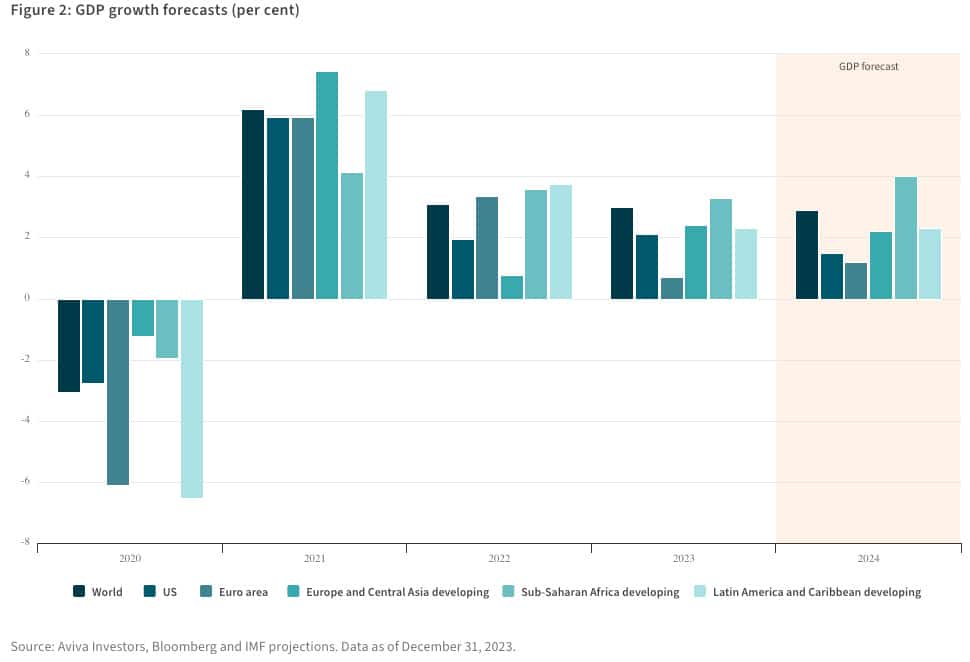

CH: The main risk to our view is if growth outcomes surprise to the upside and corporate credit spreads continue to grind tighter. But even then, growth will still be a lot lower than last year – we are still moving through an excess savings glut and the labour market is not as strong as it was. US growth is expected to be lower this year compared to last.

US growth is expected to be lower this year compared to last – Chris Higham

In the euro zone, one could argue some upside surprises could eliminate the threat of recession, but from the starting point today, the data would have to be meaningfully better than the forecasts if they were to have a constructive impact on the euro zone area. We believe risks are symmetric for both growth and inflation this year.

How does this macro outlook influence your views on sectors? Are there any areas of the market you think will be particularly attractive this year?

CH: We believe potentially attractive sectors include the technology, media and entertainment, and telecommunications (TMT) sector, asset-backed securities (ABS) and energy. In general, given expectations of lower growth this year compared to last, non-cyclical sectors should fare better than cyclicals, if and when growth slows. Albeit stronger names within cyclical sectors such as industrials and consumer could also prove interesting.

JV: Rather than picking winners or making sector calls, our focus is on avoiding troubled areas. That means not being in the sectors that we believe could be the next area of concern. So, we currently believe it best to steer clear of the more cyclical entities who tend to have more volatile earnings, or too much leverage.

Rather than picking winners or making sector calls, our focus is on avoiding troubled areas – James Vokins

CH: Commercial real estate is another example, which we believe could remain under pressure given high interest rates and the big structural changes in the sector. From the perspective of a lender, the risks look asymmetrical to the downside.

The broader point is that we are navigating a complex landscape, with a great deal of lingering uncertainty. In terms of pricing of assets, we have moved quite a long way since November last year and the big rally in bond prices powered by expectations for rate cuts. While some of that froth has started to recede this year, we believe there is a little bit further to go in the very short term – say the next three or six months. On a long-term view, however, we believe yields in the investment grade corporate bond markets will continue to be attractive.

References

- “US IG primary market review”; “Global credit chart book”; “IG corporate new issue monitor, primary market snapshot”, Deutsche Bank, January-February, 2024.

- “FX blog, the real debate”, Deutsche Bank, February 5, 2024.