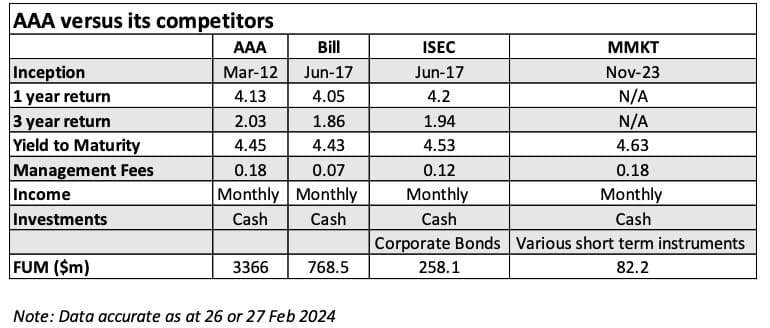

BetaShares Australian High Interest Cash ETF (ASX:AAA) is the largest fixed income ETF in the market with $3.366 billion in funds under management as at 26 February 2024.

AAA is a cash fund that invests in deposits with NAB, Bendigo and Adelaide Bank, Bank of Queensland, Rabobank, Bank of Tokyo-Mitsubishi UFJ, JP Morgan Chase Bank and Citibank NA. AAA aims to achieve attractive interest rates with ‘at call’ bank deposits and term deposits without the need for investors to open a bank account.

There are different risks between the list of depository banks with Bank of Queensland being the highest risk, likely paying better returns for deposits. AAA does not report on various allocations between its list of possible banks. Higher percentages held with lower ranked banks will provide higher yields at higher risk and there could be some concentration risk. AAA does not disclose the allocations between the banks.

The AAA ETF provides monthly income and the liquidity of shares, there is no lock-in period.

The interest rate earned on the Fund’s bank deposits net of management costs is 4.45%p.a. as at 26 February 2024. The 12 month distribution yield of the fund for the last year is 3.9%. The management fee is 0.18% per annum.

AAA ETF Competitors

AAA has three cash ETF competitors:

- iShares Core Cash ETF (ASX:BILL)

- iShares Enhanced Cash ETF (ASX:ISEC)

- BetaShares Australian Cash Plus Fund (managed fund) (ASX:MMKT)

BILL is the closest rival to AAA, investing only in instruments that can be sold on the same day. Given that AAA invests in term deposits, where funds are locked away, BILL has greater liquidity and is thus lower risk, consequently showing slightly lower returns compared to AAA. It’s interesting to note BILL’s fees are less than half of those of AAA.

ISEC and MMKT are deemed cash ETFs but include small allocations to other assets.

ISEC has 82% of its portfolio invested in cash or derivatives and an 18% allocation to corporate bonds as at 23 February 2024. A total of 10.38% of the bonds are A rated, 6.1% AA rated and 1.56% BBB rated.

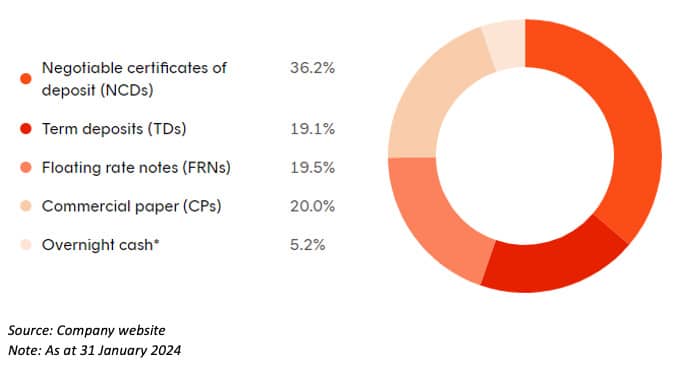

MMKT is a new fund, designed to be a core cash allocation in investment portfolios. It has 36% allocated to NCDs, a highly liquid, short term investment, 19% in term deposits, 20% in commercial paper, again a short term debt instrument, 19% in floating rate notes and 5% in overnight cash. More than 55% of the fund matures in under three months, as at 31 January 2024.

While all four ETFs are very low risk, this fund could be considered the highest risk given its allocation to floating rate notes and commercial paper. However, the very short term nature provides much confidence.

MMKT Asset Allocation

Note: Not all cash ETFs are the same. Past performance does not guarantee future returns. None of the ETFs are recommendations, do your own research before you invest.