Australian non-bank lender Wisr has launched A$225 million of asset-backed securities (ABS) as the company “aggressively” pursues its growth target.

ABS is a form of investment collateralised by a pool of assets that usually generate a cash flow from debt, such as loans.

ABS are an alternative to other debt instruments and takes the form of a bond or note, paying income at a fixed rate for a set amount of time, until maturity.

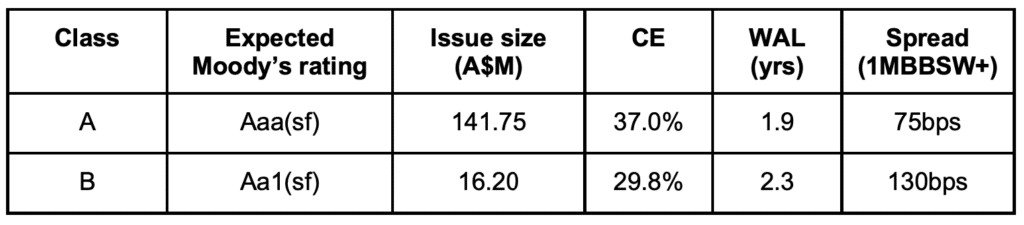

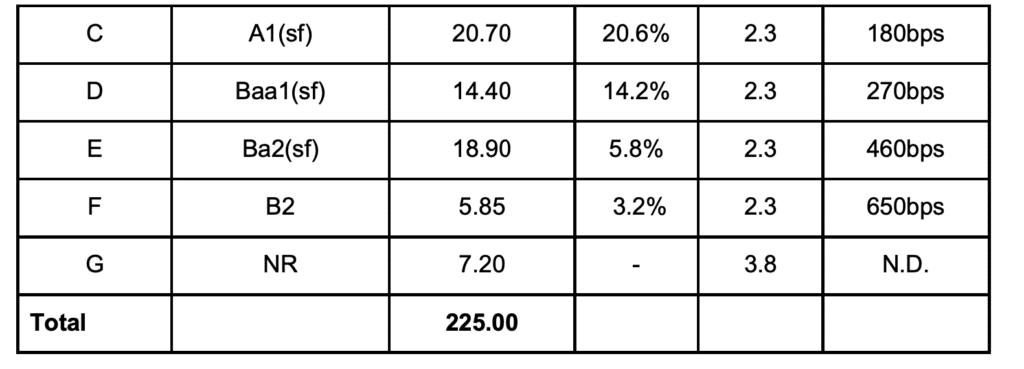

In the case of Wisr (ASX: WZR), the A$225 million of ABS is supported by a pool of fully amortising unsecured consumer personal loans. Known as the Wisr Freedom Trust 2021-1, it is the inaugural ABS transaction for Wisr, and strong investor demand saw the issuance significantly oversubscribed across all tranches.

Highlights of the ABS launch include:

- Top tranche AAA rating (Moody’s) which is exceptional for an inaugural issuer, providing strong external validation of the quality of the Wisr business operations and the underwriting platform

- The introduction of new high-quality investors, both domestic and international, to the Wisr funding platform

- A day one weighted average margin of 1.5% + 1m BBSW which is a material reduction in current cost of funds (reduced by circa 1.5% or 50%)

- – Release of capital for Wisr given the size of the equity contribution relative to the Wisr Warehouse.

Wisr Chief Financial Officer Andrew Goodwin said the ABS transaction signified a coming of age for Wisr as the company commenced access to the global debt capital markets.

“We are extremely pleased with the market appetite, it’s a very strong testament to the quality of the Wisr loan book and overall business.

“The strong demand and pricing achieved across all tranches reflects that investors continue to seek high quality assets originated by high quality companies.

Also read: Statewide Super Awards Asset-Backed Securities Mandate To US Firm

“There is a huge opportunity in front of us to grow market share in-line with our risk appetite and this transaction is an important and strategic step for Wisr.

“We’re in a prime position to aggressively grow our revenue with significant room to scale towards our medium-term target of a $1B loan book.

“We have the right ingredients to deliver a highly profitable, differentiated business that is well capitalised and with market leading metrics.”

The Wisr ABS Freedom Trust 2021-1 includes:

And:

The transaction is due for settlement on 31 May 2021.