Following a challenging year for investment markets, Jay Sivapalan, Head of Australian Fixed Interest, discusses the key events and factors shaping the outlook for the year ahead.

Key takeaways:

• Whilst central banks had to act swiftly to arrest inflation, the pace of tightening in most regions has slowed and should peak in 2023.

• The defensive characteristics of the fixed interest asset class have been restored, and opportunities abound for active and selective investors.

Central banks, cash rates and bond yields

Over 2022, whilst central banks have had to act swiftly to arrest inflation early, the pace of tightening in most regions has slowed and we expect it to peak in 2023. The lagged impact of the sharp tightening in cash rates, as well as the removal of some unconventional policies should be observable next year.

Roughly $500 billion+ of residential mortgages will reset from fixed rates that are currently paying around 2-2.5% to circa 6%. The RBA will certainly need to take stock of the cumulative impact of cash rate tightening, its impact on household debt, consumers and (most importantly) unemployment, before determining its next steps.

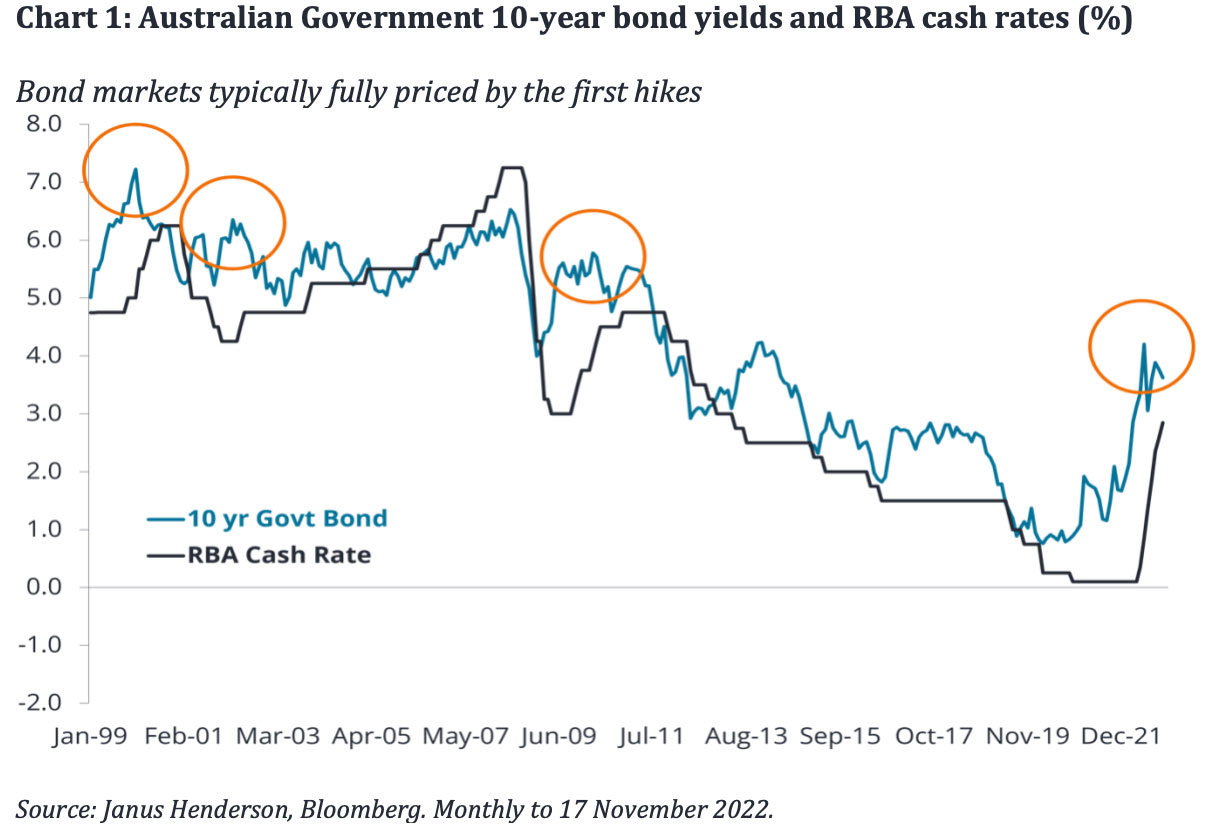

Our observation over previous tightening cycles is that bond yields peak well ahead of the final cash rate tightening and generally this happens early in the tightening cycle. This episode seems no different, with bond yields peaking on 14 June 2022, just after the second monthly cash rate tightening by the RBA. Despite remaining volatile, they have since traded sideways or lower. For this cycle, we think we’ve probably passed peak bond yields, but believe investors must be mindful of the volatility and that fixed interest and interest rate risk (duration) needs to be actively managed.

Also read: Calm Waters Turn Choppy

As one door closes, another one opens

One of the most profound distortions in markets by central bank activity over the past decade has been the influence of ultra-low (and negative) rates on risk assets such as shares, property, infrastructure and corporate debt (both investment grade and high yield).

When history books are written about this period, the experiment of negative interest rates will receive terrible reviews. As we look to 2023 and beyond, all of these risk assets need to re-price and normalise. The good news is the discount rate has done a lot of the heavy lifting already, meaning that the sustainability of corporate earnings will be important going forward.

Central banks tightening into restrictive territory will naturally act as a break on economic growth in 2023. However, the starting point for this backdrop is a multidecade low in the unemployment rate. Absent of a left field shock, we expect the unemployment rate to lift from circa 3.5% to 4-5%, rather than a more draconian 7%+. As such, whilst corporate earnings will likely be tempered and soften, it is unlikely to fall off a cliff with default rates only lifting modestly.

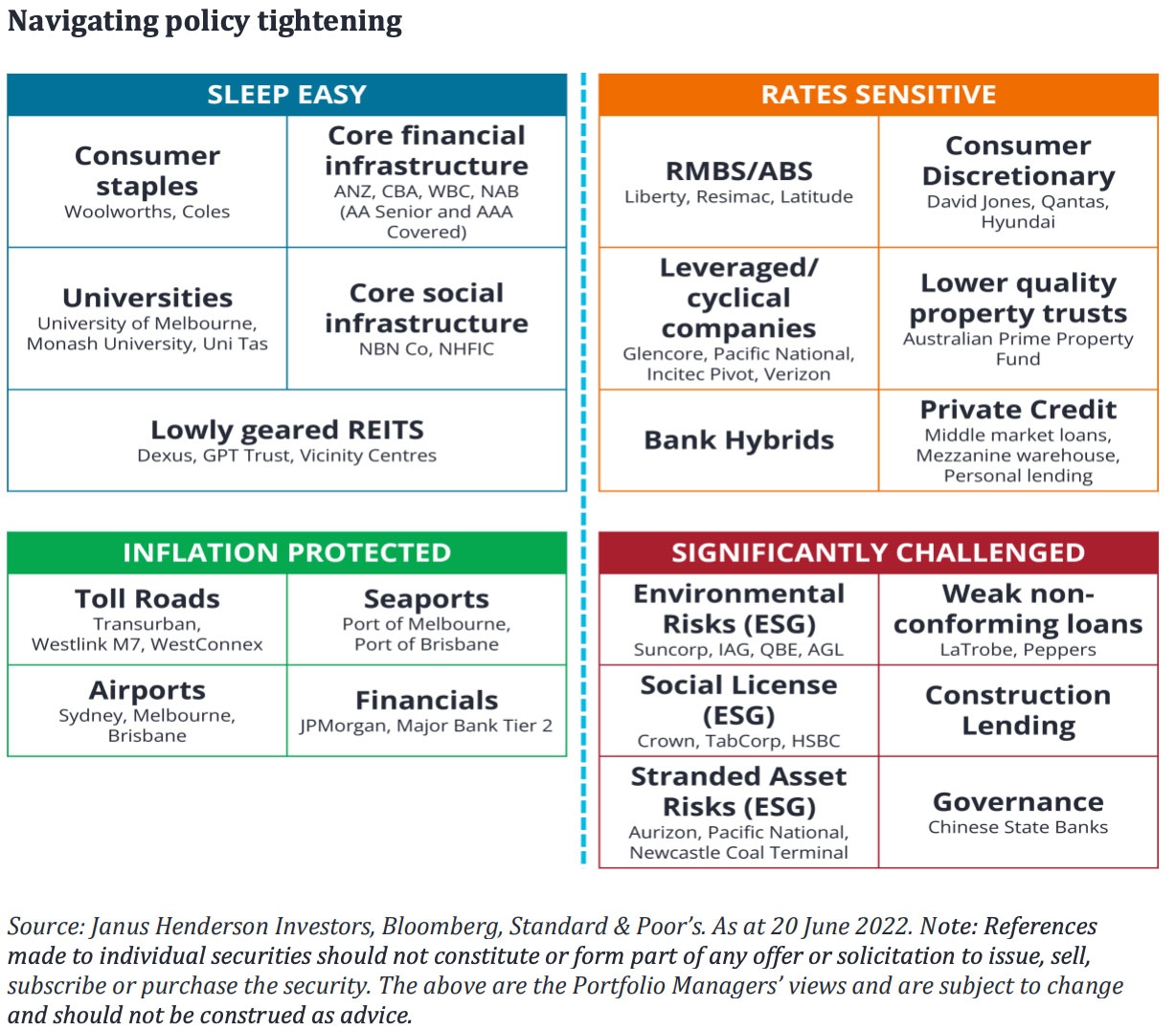

However, we expect a wide dispersion to this top-down assessment, with various industries struggling (such as construction) and others remaining more resilient (such as universities). Investors will need to navigate both a tightening of policy and a higher inflationary environment in the near-term.

In the table below, we depict our preferred sectors on the left and the sectors likely to struggle against this backdrop on the right.

Are bonds back?

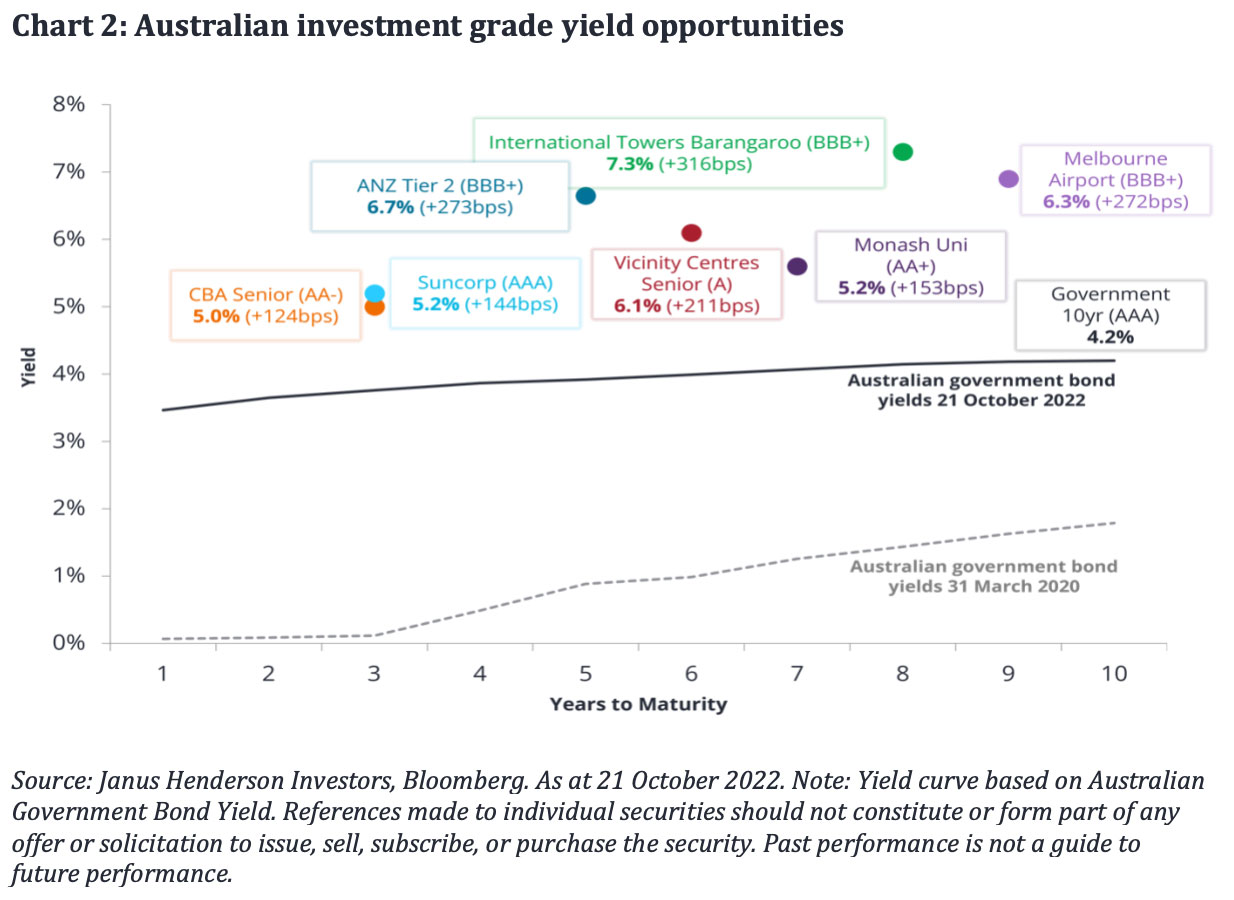

The good news for investors is that not only have the defensive characteristics of the fixed interest asset class been restored, the cost of this ‘portfolio insurance’ has materially improved, with yields on high quality assets now surpassing that of equities. Chart 2 below shows the yield available across a range of credit securities, each within the sectors we believe are likely to show resilience and growth over the years ahead.

Fixed interest investors who consider the impact of the ‘big picture’ themes when evaluating sectors, companies and securities are more likely find opportunities with resilient fundamentals, that can withstand the uncertainties ahead.

After a tough 2022, as we move into 2023 we believe ‘bonds are back’ – once again able to provide the defensive qualities that investors seek within the context of a balanced investment portfolio.