Amundi, part of the Credit Agricole Group and Europe’s largest investment manager with EUR1.729 trillion in assets under management, has released its outlook for the second half of 2021. Here we republish key takeaways. Make sure you read to the end! There are some excellent portfolio allocation notes, risk scenarios and main investment themes.

Amundi suggest:

Central Banks will let the music play on, they will neglect inflation risk for as long as possible… Investors believe they will wake up in the 30s, while they will end up waking up in the 70s.

Key Convictions

1. We are already reaching the peak of economic acceleration. What matters going forward is what will be left of this bounce in growth and inflation.

2. Markets are pricing in a Goldilocks scenario: low inflation and higher growth at trend, but we will likely end up with higher structural inflation and lower growth instead.

3. For the first time in decades, there is a desire for inflation. Central Banks will let the music play on, they will neglect inflation risk for as long as possible, and they will archive it as a temporary effect.

4. We are moving away from the great moderation, with the end of the rule-based monetary and fiscal regime.

5. It takes time before institutions adapt to a new regime. The next Volker is not around the corner. Higher inflation and the volatility of inflation will be key features of this new regime. Investors believe they will wake up in the 30s, while they will end up waking up in the 70s.

6. The de-anchoring of the system may come at some point: the main risk is seeing the yield curve go out of control. The direction of real rates is key. The first sequence is for real rate to move down, and this is still positive for risk assets. The second, which is less benign, is for higher real rates.

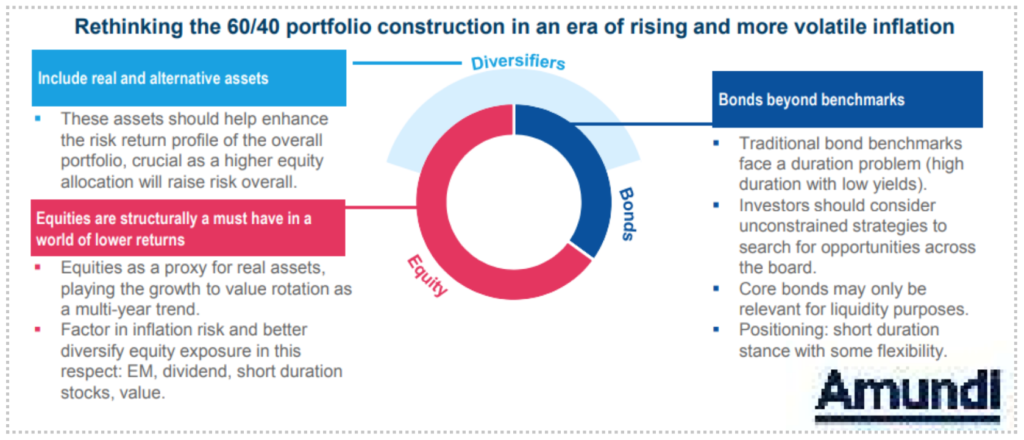

7. The new regime challenges the traditional 60/40 allocation. Investors will have to factor in inflation and enhance diversification to face the challenges of a higher level and volatility of rates.

8. In our view, government bonds are no longer the efficient diversifier of balanced portfolios, but they retain a role for liquidity purposes.

9. Duration should remain short. Investors should resist the temptation to go long duration too soon, as the direction of rates is upwards.

10. We believe that equities are a structural engine of returns, a sort of real asset. Investors should play equities through an inflation lens: value, dividend, infrastructure.

Where are we today? Goldilocks is priced in, but stagflation risk is on the rise.

Currently, markets are priced for perfection. Both bonds and equities are expensive versus their long-term equilibrium level.

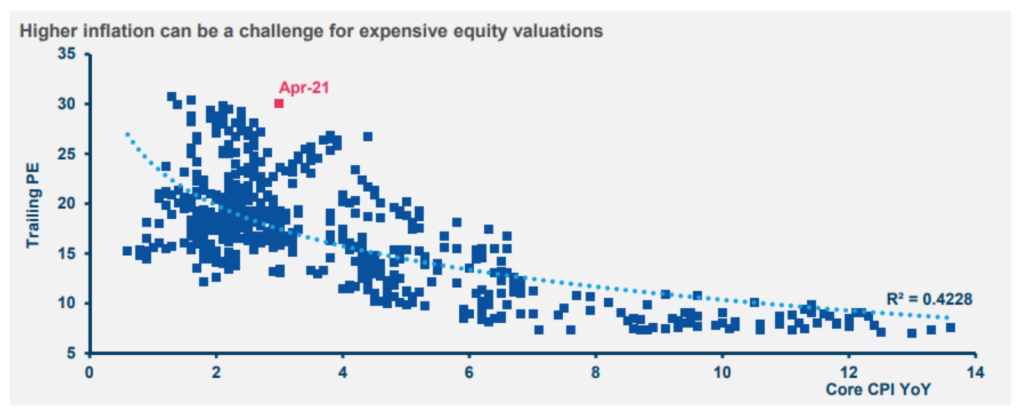

On the bond side, the secular stagnation narrative is the only one that can justify stretched bond valuations otherwise we should assume that yields will rise further. On the equity front, valuations are in excess of what the long-term expectations for earnings can justify unless we embrace the “roaring 20s” narrative of higher productivity growth, reflecting the one experienced at the beginning of the last century. If this is not the case, as we believe, a pause in equity growth is expected. Higher inflation also challenges high market valuations (see the chart below).

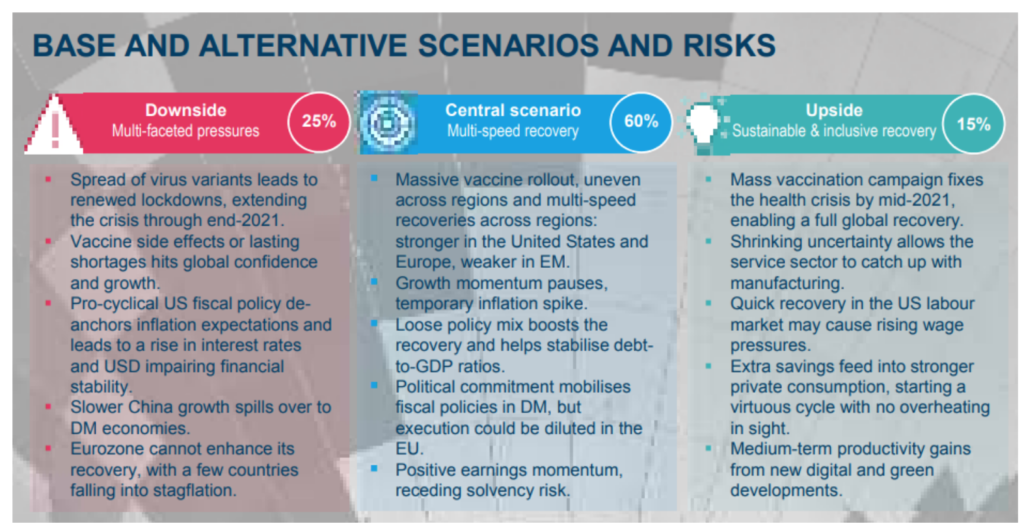

Markets are pricing a goldilocks environment with temporary inflation and lasting higher potential growth. We could be left with the opposite situation, stagflation, with structurally higher inflation and lower growth.

Market direction ahead will depend on how much further we have to go in terms of the peak in economic activity and how much of the temporary bounce in growth and inflation will become structural. Currently, there is growing evidence that companies are passing on price pressures and that consumers are continuing to buy as the economy fully reopens.

In addition, the mantra of overcapacity all around (too much of everything) is a thing of the past: scarcity is coming across as a theme driving inflation higher. In the end, structural is just something temporary that has lasted. Fear of inflation can become inflation: if the rush to buy and the move to increase prices continues, they will prolong the inflation uptrend, forcing the Fed to act.

The Fed Is Walking A Tight Rope

The big questions in the market are how and when the Federal Reserve (Fed) will start tapering and/or increase rates and what, effectively, is an average inflation approach (especially after 10 years of below-target inflation). The Fed will certainly try to keep rates as low as possible for as long as it can. The recovery is built on a huge debt pile and the system should hold as long as liquidity remains ample and the cost of debt does not increase too much. A controlled increase in bond yields as a consequence of economic growth is good, but if inflation gets out of control and rates rise while growth falters, that would have nasty consequences on most indebted areas and affect market sentiment overall.

The Need To Reinvent The Balanced Allocation

Higher inflation challenges traditional diversification, as correlation between equity and bonds turns positive. This comes at a time of lower expected returns for a traditional balanced portfolio as the contribution of the fixed income component, in terms of performance, will likely be very little. Hence, investors should structurally increase equity exposure through an inflation lens, and build more diversified portfolios, beyond the traditional benchmark allocation, including real, alternative and higher yielding assets (i.e. EM bonds). In doing this, investors will have to consider three dimensions: risk, return and liquidity.