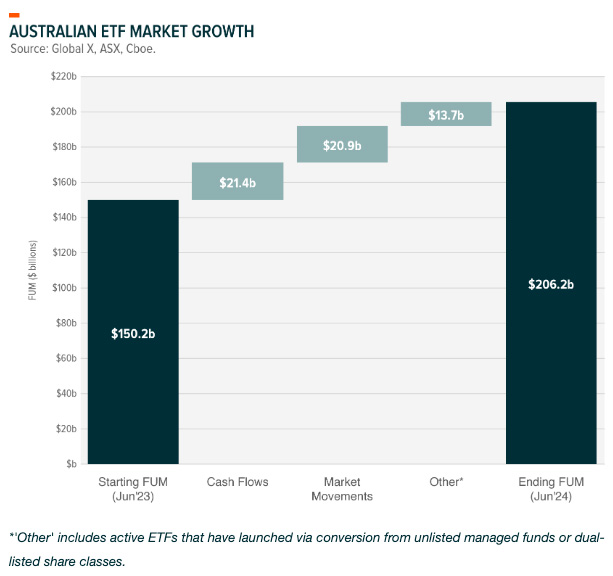

The Australian Exchange-Traded Fund (ETF) market grew 37.3% over the past year to $206.2 billion across 380 products, according to a Global X ETFs Australia ETF report.

Growth was driven by more than $21.4 billion in net inflows, positive market movements, and the conversion of numerous unlisted active funds into active ETFs.

Product and Investment Strategist, Marc Jocum said, “It’s the strongest start ever for the Australian ETF market. In fact, we could surpass the calendar year record of $23.6 billion set in 2021, and potentially reach an industry valuation of $1 trillion by 20301 if this momentum continues.”

“It took nearly 20 years to reach $100 billion, but the next $100 billion was achieved in just over three years. Today, the Australian ETF market is growing at a faster rate than the US and has quadrupled its share in the Australian funds market over the past six years.”

Global shares ETFs were the year’s most popular asset class as Australian investors shifted to a ‘risk on’ position. Approximately $6 billion has been allocated to this category in 2024, representing 55% of the total market net flows. In 2023, bond ETFs were one of the most popular asset classes, capturing 37% of annual net flows.

“Artificial intelligence, regional pockets of investor interest, and fixed income are the three main trends which we expect will accelerate into the second half of 2024,” Jocum said.

Also read: Australian US-dollar Debt Issuers To Benefit From Strong Fundamentals

Global X expects investment vehicles which are generally lower cost, like ETFs, will continue to steal market share over the next decade at the expense of traditional managed funds. Still, the market is in its infancy, with ETFs accounting for just under 5% of the total Australian funds market.

Marc Jocum also provided some forward-looking insights:

AI Momentum: Investors may continue capturing the AI theme through ETFs as AI enters its commercialisation phase after over 70 years in the making which will significantly impact enterprise productivity and consumer interactions. Investors may choose to focuson the broader AI ecosystem, including technology, semiconductors, infrastructure, and data centre renewable energy sources.

Regional Pockets of Interest: Although the US has outperformed other global regions since the start of the 2010s, other countries and regions may begin to catch up. European ETFs may attract more interest due to attractive valuations and similar sales growth profiles, while India continues to thrive and could overtake China as the main emerging market in investor portfolios.

“Income” is Back in Fixed Income: Despite some central banks cutting interest rates, the Reserve Bank of Australia (RBA) may maintain higher rates amidst persistent inflation. If this scenario eventuates, it makes fixed income securities with yields higher than traditional government bonds or term deposits an attractive proposition. With Australia’s share market dividend yield declining over the past year, high-quality fixed income securities offer opportunities to enhance portfolio income. We anticipate continued strong momentum in fixed income flows throughout 2024.

[1] Global X, ASX and Cboe