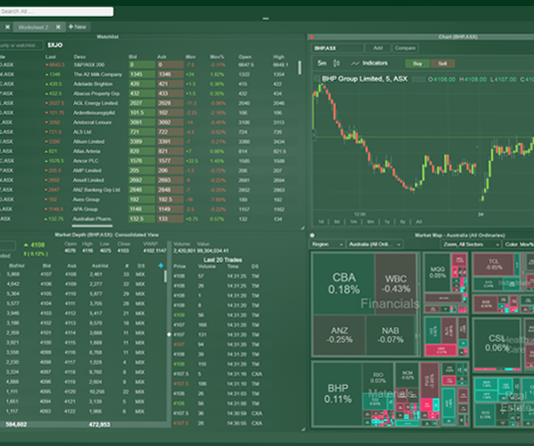

IRESS Clients Get Access To Australian Bond Exchange (ABE) Platform To Digitally Trade Corporate Bonds

Ben Ready

A new partnership between bond broker Australian Bond Exchange (ABE) and financial markets software and services group Iress will enable Australian investors to digitally...

Australia's retail corporate bond market requires much further simplification and more equitable tax treatment if it is to become more attractive to retail investors,...

Virgin Australia bond holders have learned their fate with the release of the Deloitte report to creditors which will see U.S. private equity firm...

As published in The Australian on Saturday 15 June 2020

Virgin Australia’s administration is a recent low point for Australian financial markets, with mums and...

As investors move through life, their appetite for risk and reward changes. It’s common for older investors to choose lower risk investments as they...

Income investors are flocking to bonds to shore up income.

To put the demand into perspective, consider when global investment firm, KKR launched a high...

Telstra, Transurban and APT Pipelines all issued euro-denominated bonds over the last few months, accessing the busier than usual European bond market.

In contrast, the...

It was a quiet end to the week in the US as most Americans started to leave work (home) for Memorial Day holiday, which...

As published in The Weekend Australian on 26 June 2020

In the frenzied final days of the sale of Virgin Australia, more than 5000 local...

The ANZ bank will return to the Green, Social and Sustainability (GSS) bond market in Australia, after having issued its inaugural Green Bond back...