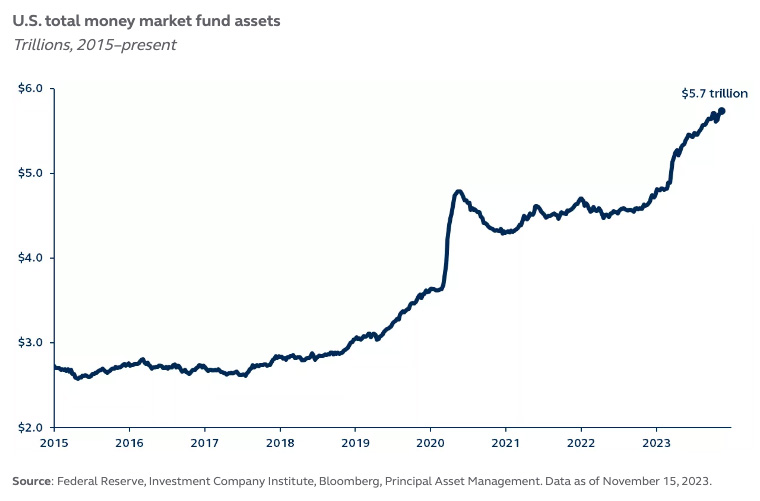

Money market fund flows have surged recently—as investors sought refuge from economic uncertainty while enjoying elevated yields—and now sits at a record US$5.7 trillion. As an economic downturn quickly comes and goes, conditions stabilize, and the Federal Reserve potentially reduces rates in the year ahead, this substantial pool of cash is poised to fuel a significant rally in risk assets, offering investors an opportunity to potentially capitalize on improved sentiment and market dynamics.

Assets in money market funds have ballooned to a record US$5.7 trillion, with investors attracted by elevated yields as well as partially hiding from an uncertain U.S. economic outlook. This may represent a potential tailwind to risk assets as the focus on cash starts to shift.

Also read: The Fog is Finally Lifting in Credit Markets

Economic conditions over recent years have created the perfect environment for money market funds (MMFs). In 2020, the COVID outbreak, lockdowns and resulting concerns about the U.S. economy drove a spike in safe haven flows. Investor interest in MMFs was maintained as the subsequent surge in inflation and aggressive Federal Reserve response moved yields sharply higher. Furthermore, there was an escalation in MMF inflows earlier this year as the regional banking crisis sparked another flight to safety.

In recent months, even as banking sector concerns have eased, inflows have broadly persisted, driven by the “higher-for-longer” rates narrative as well as ongoing uncertainty about the economic outlook.

2024 should see many of the concerns and questions of recent years finally resolved. The long-awaited economic downturn should arrive and depart without leaving much destruction, and inflation should continue to decelerate. Most importantly, the Fed is likely to open the door to rate cuts, reducing the attractiveness of cash. Investors get ready: improved economic conditions should ignite a surge in sentiment—and there’s a massive US$5.7 trillion mountain of cash to fuel the resulting rally in risk assets.