By Nachu Chockalingam, Senior Portfolio Manager, Federated Hermes Limited

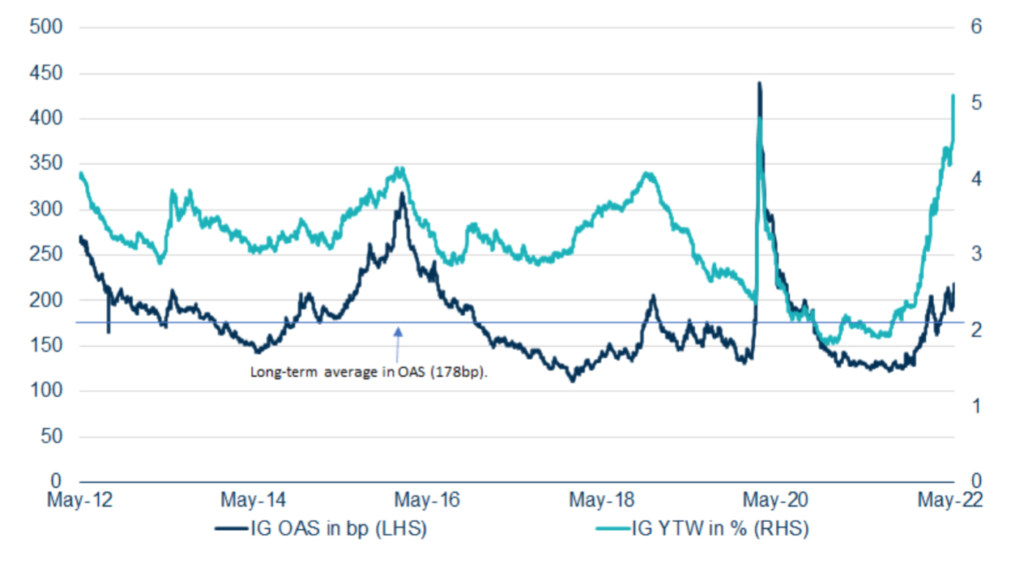

Indiscriminate selling over the past ten days has pushed credit spreads modestly wide to long-term averages and yields very high. The chart below shows a 10-year history of global I-investment grade (IG) spreads and yields. It is possible spreads see further downside as global central banks unwind further, but we anticipate that additional widening for IG bonds and BB-rated high yield (HY) bonds will be limited relative to their already wide valuations.

We believe that credit fundamentals are generally in good shape but do acknowledge that the path to maintaining this will not be easy. Companies have, in general, weathered the storm to date well and have options to bolster liquidity should they need too.

Interest rate volatility remains the key driver for spreads here and a faster Fed brings forward this volatility, raising the likelihood of some stability later on in the year.

We prefer IG and BB-rated HY bonds currently as the risk of a mild recession and the higher yields now available are likely to keep investors up in quality. We continue to have a preference towards more defensive sectors and not to those that at risk of a weaker consumer and cost pressures from labour markets and supply shortages.

Many companies have bonds now trading at “stressed” levels that is less than $75 face value, but these are not stressed issuers – they have plenty of cash and we think many companies will use this as an opportunity to re-optimise their capital structures and buyback bonds, which will be to the benefit of all stakeholders. Ultimately, we cannot forecast when the credit market will bottom out but we think current levels are a good entry point for long-term investors to re-look at their credit allocations and scale back in.

Note: OAS – (spreads between an OAS IG index and a spot Treasury curve), YTW- Yield to worst. Source: Bloomberg, Federated Hermes