Bullish on bonds as new paradigm emerges. By Gregory Peters, Co-Chief Investment Officer PGIM Fixed Income

The end of the Great Moderation is introducing an era of volatility in growth and inflation. Investors are adjusting to the contours of the new global paradigm, but ultimately, a new regime of higher bond yields makes fixed income assets attractive for long- term investors.

Global economy: Despite mounting macro challenges, the global economy has managed to remain resilient. In the U.S., weakflation—the combination of weak growth and elevated but falling inflation—remains our base case. We expect real GDP growth of between 1.0-1.5% and inflation to descend to 2.5-3% in 2024.

In the euro economy, we see headwinds from higher global interest rates, high energy prices, and persistent inflation as ongoing challenges and expect a mild contraction before some improvement in 2024. In China, our expectations of increasing fiscal stimulus are now materialising, supporting our still-above consensus GDP forecast.

Also read: World Bank AU$2bn Australian Dollar Global Bond Priced

Interest rates: With interest rates now near multi-year highs and economic growth and inflation finally moderating, we’re likely near the end of central bank rate-hiking cycles.

While we expect the Fed to implement ~50 basis points of “fine-tuning” rate cuts in 2024, the economy’s neutral long-run interest rate may gravitate to the 3.0% area (up from previous estimates of 2.5%).

Fixed income outlook: Despite a challenging macro environment, we believe we’re entering a golden age in fixed income investing. The traditional characteristics of fixed income investing—roll, carry, and income—are moving to the fore.

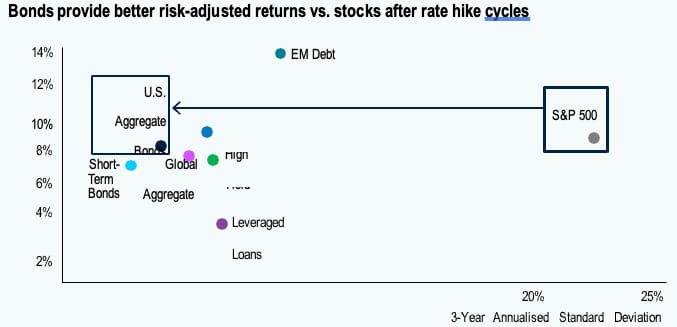

Bonds play a key role in long-term portfolio allocations, and higher yields allow them to reassert their roles as critical income provider and equity market diversifier. These aspects can generate performance that meets or exceeds investors’ objectives. Furthermore, if economies hit a surprise air pocket, ample room now exists for yields to decline and provide an additional boost to returns.

Broadening dispersion brings alpha opportunities

Increased credit dispersion adds to alpha- generating opportunities. A broad range of fixed income sectors appear well positioned for solid risk-adjusted returns over the long term, creating a constructive outlook for adding value through active management. But as elevated macro uncertainty remains, we prefer to stay up in quality and to avoid leveraged structures that are vulnerable to high interest rates.

Key investment ideas for 2024 include:

Step out of cash: Many investors spent most of 2023 on the sidelines given rising interest rates and mounting macro uncertainty. An unexpected shock or a continuation of rate normalisation in 2024 could push short-term yields downward. Shorter duration assets may provide more attractive income with a cushion against further volatility.

Extend duration: Yields have retreated from recent highs in the aftermath of recent geopolitical events. While too early to know for sure, we could be entering a protracted normalisation period, offering investors a short window of opportunity to lock in higher rates for the long term.

Seek high-quality relative value opportunities: Extreme volatility since 2022 has compressed valuations across fixed income sectors, creating attractive relative value opportunities in key spread sectors such as high yield bonds and emerging market debt. After central banks abandoned their outsized rate hikes, credit sectors have seen improved performance—a trend we generally expect to continue to benefit diversified fixed income portfolios.

Source: Morningstar. Average returns following the end of each of the past four Fed rate hike cycles (end dates used: 1/2/1995, 16/5/2000, 29/6/2006, 19/12/2018). U.S. Aggregate Bonds = Bloomberg U.S. Aggregate Bond Index, Short-term Bonds = Bloomberg Credit 1-5 Year Index, Global Aggregate Bonds = Bloomberg Global Aggregate Index, Leveraged Loans = Credit Suisse Leveraged Loan Index, High Yield Bonds = Bloomberg U.S. Corporate High Yield Index, U.S. Treasury = Bloomberg U.S. Treasury Index, IG Corporate = Bloomberg U.S. Credit Index, EM Debt = JP Morgan EMBI Diversified Index. Past performance does not guarantee future results.