By Bas van Geffen, CFA, Senior Macro Strategist, RaboResearch

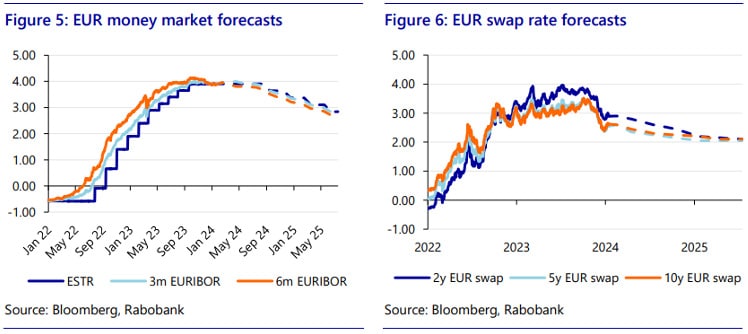

Just like 2022 was the year of the global hiking cycle and 2023 was the year of peak rates, this year will undoubtedly be the year of rate cuts. The question is not if central banks will cut rates this year, but rather when and how quickly. We maintain the view that this may not be as early, nor as fast, as markets are pricing.

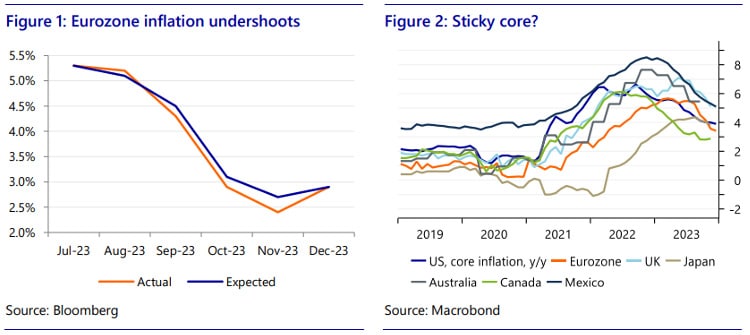

Inflation is heading in the right direction, but the process could drag on for some time still. Prices are no longer growing at the high pace that required continuous rate hikes. And disinflation has proven to be somewhat more vigorous than expected. Not only in the UK (page 23), but also in the Eurozone the disinflationary process has surprised in the final quarter. Through the second half of 2023, Euro area inflation has cumulatively undershot expectations by 0.6 percentage points. Still, inflation has yet to converge to 2%, with headline inflation in the major economies about 1 percentage point above target. Above-target core inflation makes that process sluggish.

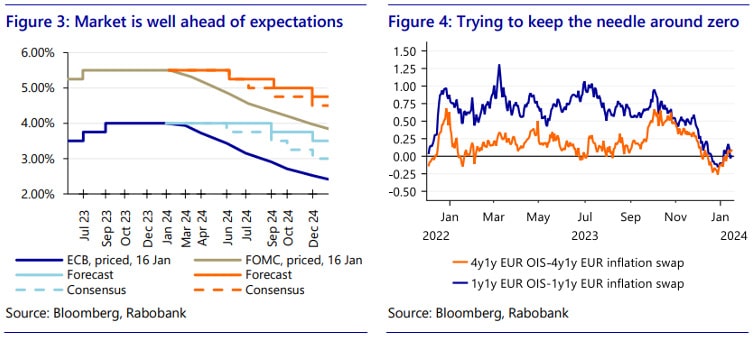

Despite the remaining hurdles to get inflation back to target, markets have embraced these positive developments: is inflation transitory after all? Market-implied expectations have plummeted over recent weeks. For the Fed, a first rate cut is still priced by May, if not March, and EUR money markets imply that the ECB will have made its first move by April. And it seems difficult to convince markets otherwise. Recent pushback from policymakers, who urge for a bit more caution, has done little to change this belief. Neither has the stronger-than-expected labour market data in the US.

There’s undeniably a risk that central banks move earlier than we currently forecast. Particularly, we are not entirely unsympathetic to the consensus view that the ECB may join other central banks in a concerted easing effort in June. However, even if we were to move the timing forward to market consensus, that’s still well behind the current market pricing. And we haven’t done so yet because there are several key risks that –at least for now– warrant a more cautious approach from policymakers.

First off, labour markets remain tight, and especially in Europe it is as yet unclear to what extent this will still translate in (further) wage gains – and to what extent businesses will pass these costs on to the end consumer. The restoration of purchasing power is expected to gradually boost consumption demand, which may offer some scope for higher price setting. Add to this the fat tail risk that the conflict in the Middle East could still upend supply lines, which would particularly affect the European continent. This all transpires after a period when policymakers around the globe severely underestimated inflationary pressures. This will likely make them more hesitant to embrace the recent inflation data than the market seems to be.

What’s more, the recent shift in market pricing has significantly eased the effective monetary policy stance. Parallel improvements in measures of inflation expectations offset some of this, but policymakers will be mindful that the recent decline in (real) interest rates doesn’t inadvertently cause a renewed flare-up of inflation pressures.

Unsurprisingly, such caution is not just a theme in Europe, but apparent across the countries covered in this Monthly Outlook, from Canada to the United Kingdom. As such, March rate cuts still seem quite unlikely. Yet, given the stubbornness of rate cut pricing, we’re not convinced that the omission of such a hike will lead to a significant retracement in capital markets.

In fact, given the markets’ willingness to believe in a transitory-like narrative again, they may embrace the moment when policymakers do start (discussing) cutting policy rates in earnest. We therefore see interest rates continue the downward trend as the global cutting cycle commences, albeit in a more gradual manner.

That said, there is scope for disappointment. Pricing implies quite some urgency on the part of central banks, with more or less back-to-back cuts once the easing cycle has started. Yet, judging by the market-implied terminal rate, this is not informed by fear of a policy overshoot or a severe recession. Again, it seems as though markets have jumped back on the transitory bandwagon.

Certainly, current policy rates are unsustainably high. Yet, the markets’ expectations of rapid pace of cuts may not match the reality of the disinflationary process. Given that inflation remains above target, central bankers will want to avoid that the effective policy stance becomes too accommodative. This means keeping (forward-looking) real policy rates around the neutral level.

The ECB’s Villeroy suggested that the central bank gauges this to be around 0% for the Eurozone. Real policy rates are currently roughly around these neutral levels – after they dipped into accommodative territory around the turn of the year. That figure is, however, based on the markets’ optimistic view of the disinflationary process.