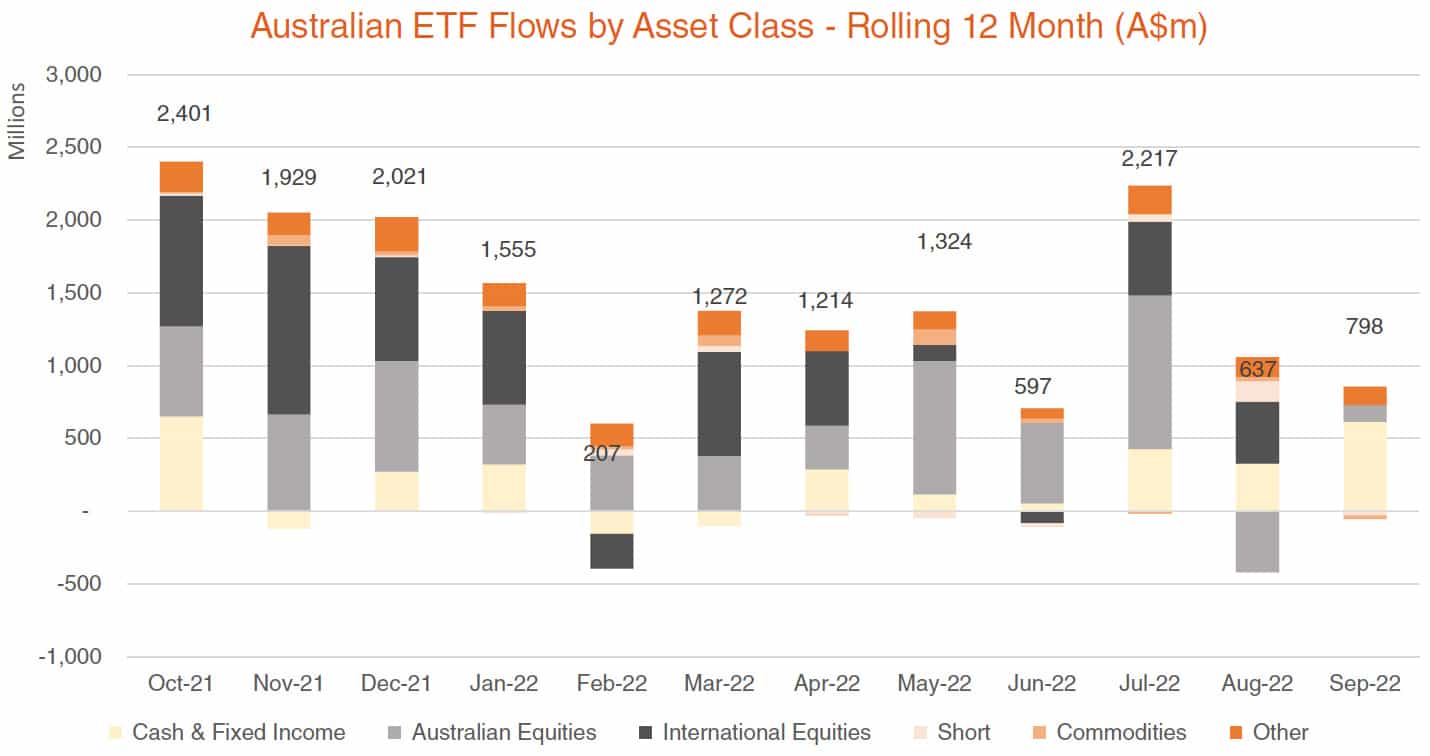

The Australian ETF Industry declined in value in September, driven by sharemarket falls, with Fixed Income and Cash ETFs attracting the largest share of industry flows according to Betashares Australian ETF Review.

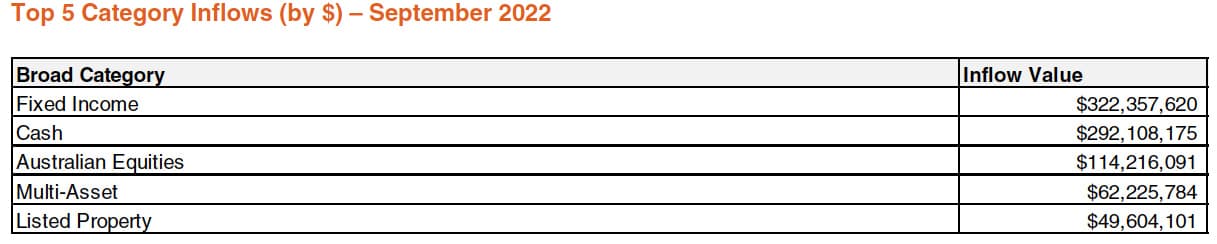

Fixed Income & Cash ETFs received the lion’s share of industry flows with over 50% of the industry’s monthly net inflows between them. With investors remaining cautious on equities and yields continuing to rise it was High Interest Cash and floating-rate Australian bond exposures that saw the highest level of investor interest in September.

Overall industry AuM fell 4.3% (-$5.6B) month on month, with total industry market capitalisation at $124.4B at end September.

Notwithstanding significant global market volatility, industry flows remained positive, although as per last month, were muted – with $0.8B of net flows for the month.

ASX ETF trading value decreased 11% month-on-month for a total of $9.1B.

Also read: Global X ETFs Reduces Fees on Two US Fixed Income Funds

The top three products with the most inflows were Vanguard Australian Shares ETF ($250 million), Betashares Australian High Interest cash ETF ($229m) and Betashares Australian Bank Senior Floating Rate Bond ETF ($102m).