Andrew Canobi, Director Franklin Templeton Fixed Income, says that the contrast couldn’t be starker between Australia and the American GDP growth.

“In Q1, 2023 the US economy grew at 1.3% on an annualised basis. Forecasts for Q2 are lower but still positive. Next week, we get the equivalent Q1 GDP data for Australia and already forecasts are centered around whether it will even be positive at all. Two major banks forecast 0.2%. Another high-profile investment bank projects 0%. Another still expects -0.2%.

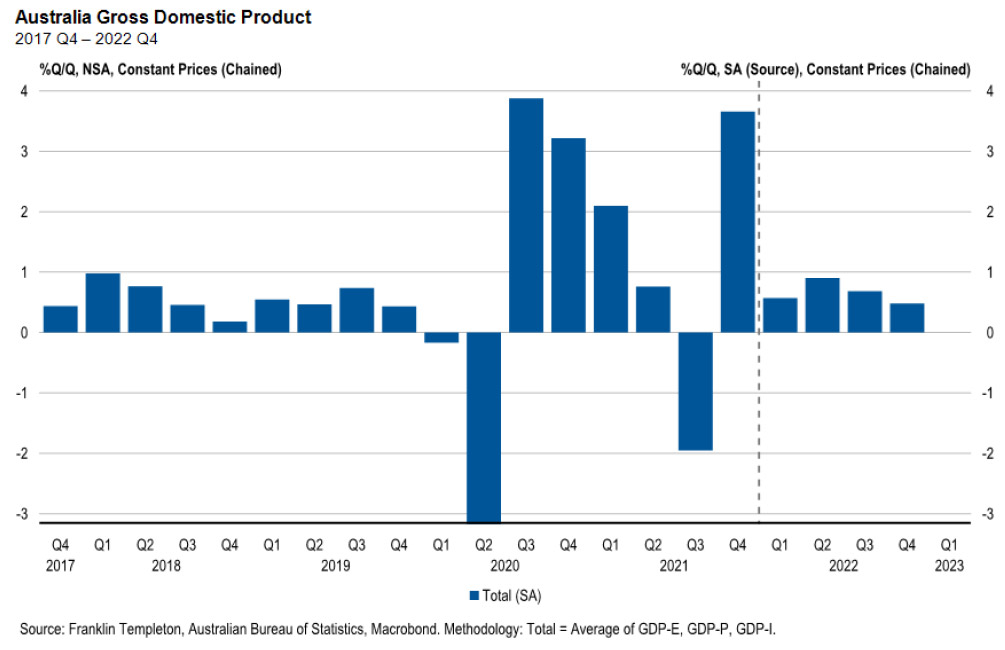

“We will see. But the charts below show the sequence of quarterly real GDP growth over the last two years.

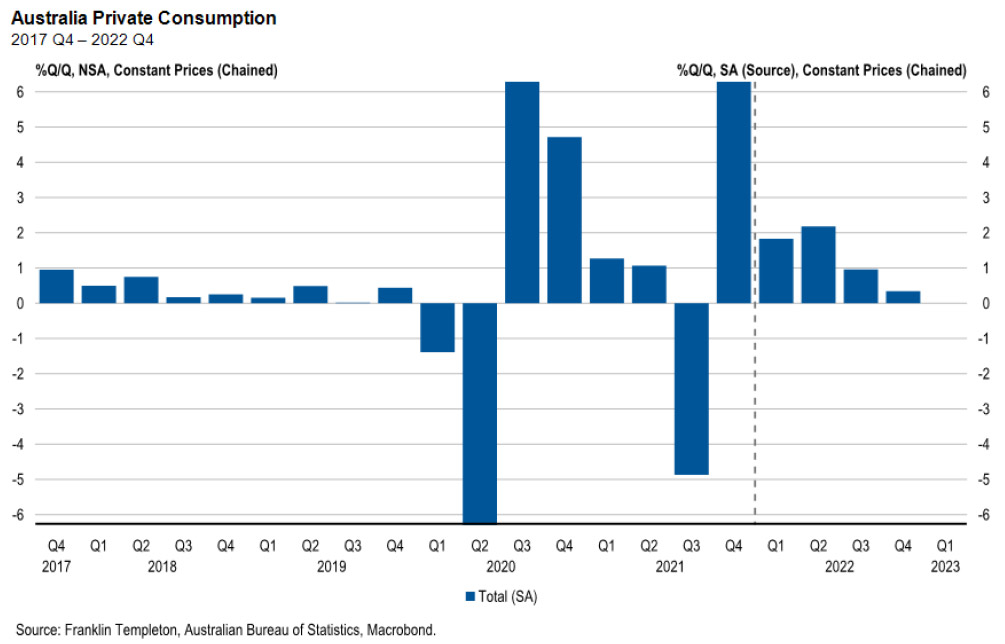

“Two things are clear. One, that GDP growth is decelerating quickly and, as the second chart shows, secondly, consumption (the largest part of the economy) is leading the way down.”

Mr Canobi adds: “The second chart above is particularly concerning. Consumption is ~50-60% of the economy and in Q4, 2022 that this hit stall speed, alarmed the RBA, and was a key reason why they pivoted ‘dovish’ (at least momentarily) at their March meeting. The GDP data next week comes out after the RBA meeting on Tuesday. As well as the detail on consumption, the data will contain information on prices and wages which are of course front and center to the RBA’s thinking.

Also read: Nine High Yield Managed Funds to Beat Inflation

“That makes holding off on today logical but calling individual RBA meetings of late is a fool’s errand.

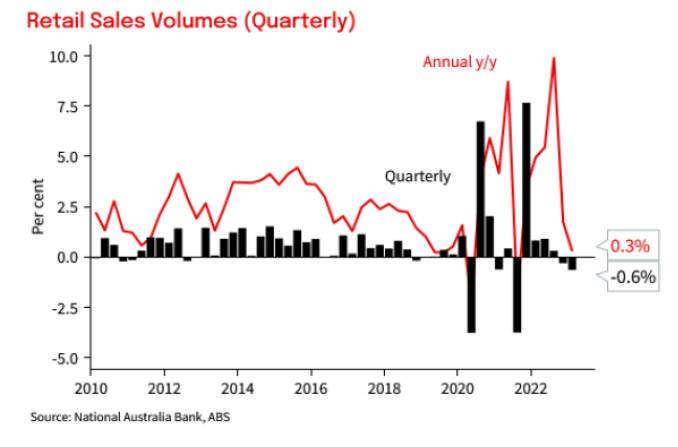

“One element of domestic consumption (but not all of it) is retail sales. We know that volumes adjusting for inflation fell in Q1 as the chart below shows. In context, the Q1, 2023 contraction is the largest quarterly decline (excluding COVID) since 2009! Granted we know spending on services has been more resilient, but all the warning signs are there that the Australian consumer is retrenching and fast. The retail trade volume contraction is even more alarming considering the strong population growth in Australia (running at close to 2% annualised) compared to the US.”

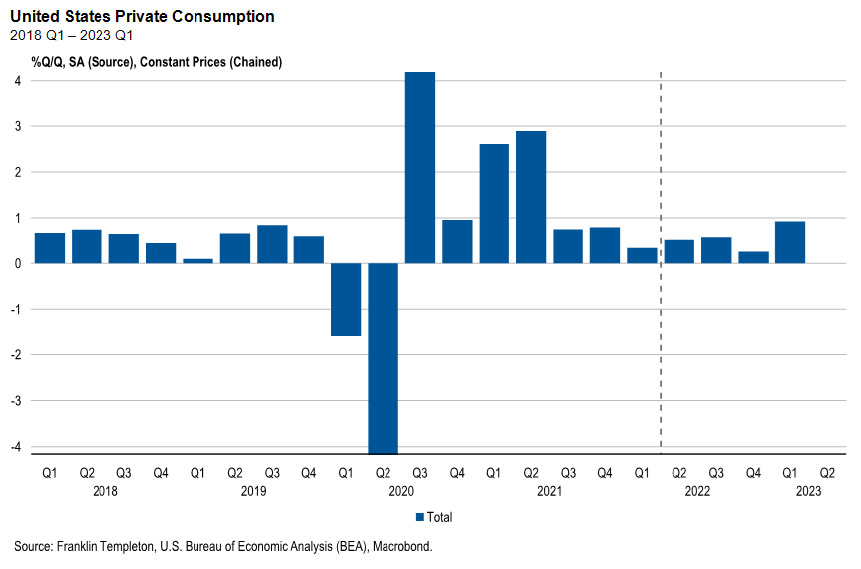

“By contrast to Australia, the US has already released Q1 GDP, so we already have the Q1, 2023 data. As the chart below shows, the consumption component of US GDP has been more resilient than in Australia. Which should surprise few given that Americans enjoy much lower household leverage, insulation from rate rises via long term fixed rate mortgages as well as all the other drivers from solid employment conditions. The US economy is slowing for sure and the punitive credit conditions are weaving their way steadily through the economy. But the US consumer has been more buoyant so far than the beleaguered Aussie.

“Both economies are slowing but Australia is doing so more quickly.

“That is more alarming considering that population and labour force growth is going to materially outpace the US (again) this year which should act as a support for headline GDP.

“If next week’s GDP number comes in close to zero, we’re happy to ring the bell. As Wesfarmers CEO, Rob Scott, recently said at the company’s strategy day, when commenting on domestic consumption, “the honeymoon is very much over”.

“We think that’s an understatement. Chances are the RBA has already overtightened, but this might only become clear in Q3, when consumption really hits the skids.

“We don’t know whether the GDP result will be north of zero or not. And of course, a recession is defined as two consecutive quarters of negative growth.

“With Q4, 2022 being tepid though, a result for consumption in Q1 2023 that’s close to zero or only marginally positive represents a sharp deceleration in the engine room of the economy. If it’s negative, the storm clouds are already here,” says Mr Canobi.

Andrew Canobi is a Portfolio Manager for the Franklin Templeton Australian Absolute Return Bond Fund (ASRN 601 662 631).