The recent risk market rally reflects hope for a sharp recovery as economies slowly reopen. However, bond markets are once again diverging from equities and predicting a different future. Call me biased but my bet is on bonds. Bond markets are seldom incorrect in the long run. For now investment grade credit is best placed to navigate risks without foregoing too much return.

Dislocated markets

As a credit strategist, my preference for downside risk management is stronger than my desire for capital gains. While capital gains are a nice to have, for private clients the benefit of investing in bonds is to get a well-defined, regular income stream to meet their requirements.

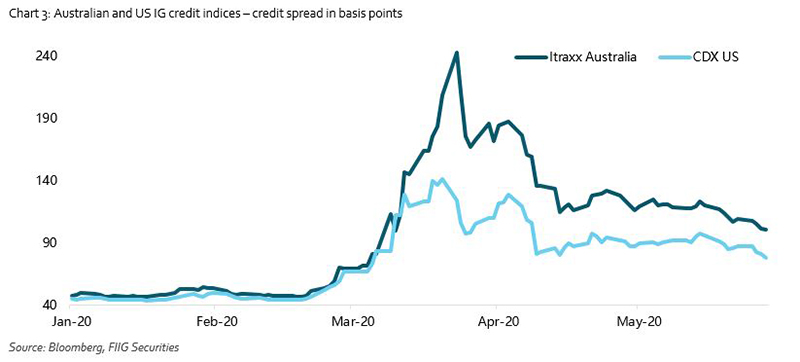

What we are presently seeing is a dislocation between bond and equity markets (Chart 1). The rally in equities is painting a bullish picture of the economic future, whereas bond yields are reflecting the likelihood of a more muted global growth.

It is difficult to explain the current overall ‘risk-on’ sentiment, which is mainly based on hope that economies reopening will lead to a sharp recovery in growth. However, bond markets are erring on the side of caution as geopolitical tensions are starting to rise and the pandemic related risks haven’t yet subsided.

Tensions between the US and China are rising once again with the US calling Hong Kong’s autonomous status into question. COVID-19 cases are also increasing in some of the US states that have already reopened their economies and civil unrest over the past few days could further escalate the number of cases. The threat of a second wave of infections can’t yet be ruled out.

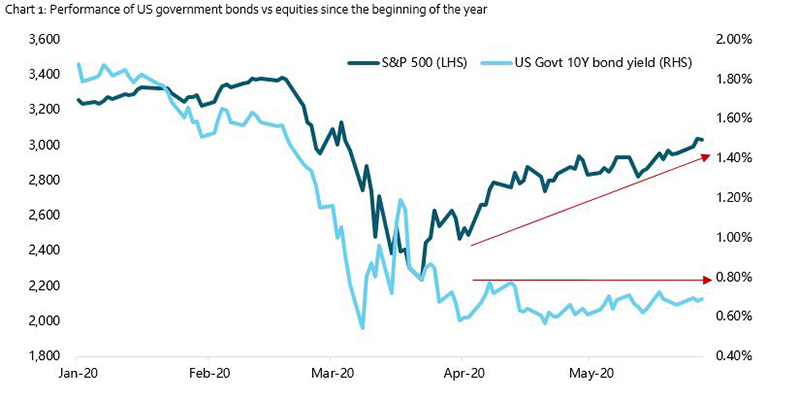

The chart below from Bloomberg is of the forward looking earnings estimate for the S&P 500 stocks. According to this data, the market is estimating that it will take at least two years from now to reach 2019 earnings levels. Currently the price to earnings ratio of the index is above 20-times, which is quite elevated given the economic outlook.

The one thing that possibly explains the difference in the performance of bonds and equities over the recent past is that central banks globally have injected a huge amount of liquidity into markets, which needs to be invested. Again, as the chart above shows, it will take many years for this stimulus to turn into recovery. As the RBA Governor Phillip Lowe recently reminded us “even as the recovery gets under way, there will still be a shadow cast by the pandemic. As a country, we will need to turn our minds as to how to move out of this shadow”.

It is also interesting to note that government bond yields are remaining low despite the high expected government bond issuance volume required to finance the economic stimulus. This should put upward pressure on bond yields, however, the surplus liquidity in the market is balancing this out and resulting in yields trending sidewards.

Bonds to invest in during this period

The lasting impact from COVID-19 will likely see lower growth and inflation, lower corporate earnings and higher default rates. Government bond yields are low (and negative in some countries) compared to historical levels and the economic outlook would suggest being cautious at this stage with higher risk bonds, which offer higher yield. It is my opinion that investment grade (IG) corporate bonds are presently best placed to provide an income source while protecting the invested capital. These bonds tend to be more liquid and hold their value better. Also they are now repo-eligible with the RBA.

Take the example of the recent issuance of the Macquarie Bank Tier 2 sub-debt and the two Woolworths bonds. All three of these IG bonds were oversubscribed, meaning there was more demand for the deals than the actual issue size, but were attractively priced. All of these bonds are already trading at a premium to where they were issued.

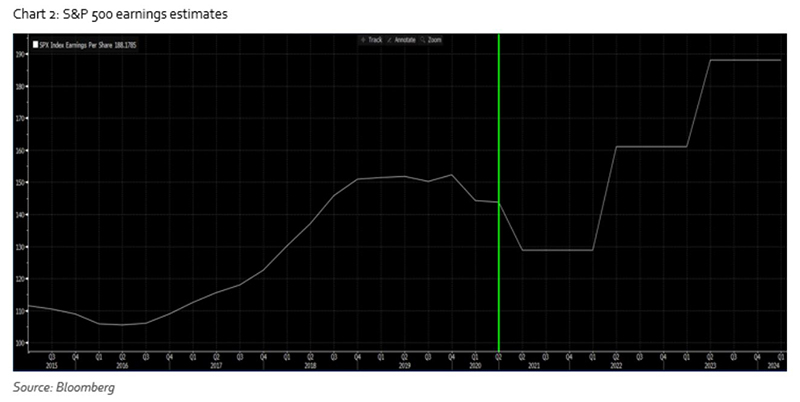

While Australian IG credit spreads have tightened compared to levels seen in March, these levels remain elevated, especially when compared to the performance of IG credit spreads in the US (Chart 3). While US IG corporates have issued over USD1tr of bonds so far this year, our market has only just reopened to issuers.

We expect more transactions to come to the primary market as issuers take advantage of this window, which will provide our clients with investment opportunities.

This document has been prepared by FIIG Investment Strategy Group. Opinions expressed may differ from those of FIIG Credit Research. For the illustrations below we have used US government bond and S&P 500 equities data, however the same is valid for Australian government bonds and equities also.