By Johann Plé, Green Social and Sustainability Bonds Strategy Manager at AXA Investment Management

Over the past few years, the green bond market has grown from a niche market to a credible alternative to the conventional bond market.

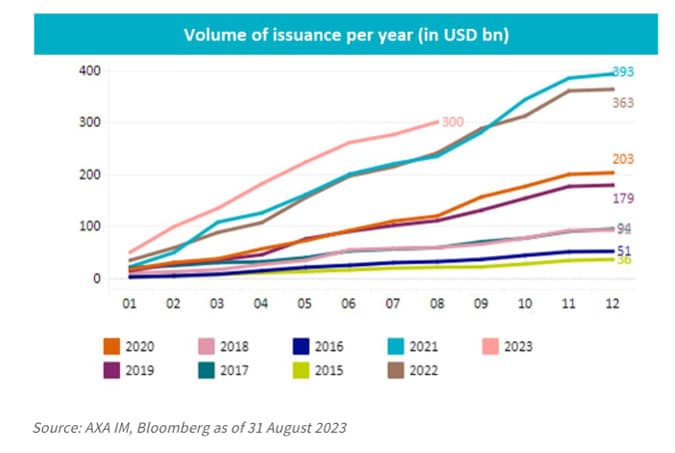

So far this year, green bonds issuance is up 25% of the previous record levels reached in 2022 and 2021 thanks to continued credit sector diversification and increasing sovereign issuances.

Historically, investors have been attracted to the asset class due to the benefit of higher transparency, the ability to track the projects financed, assess their environmental benefit, and measure it with clear key performance indicators (KPIs).

Now, this trend of strong issuance levels allows green bonds to offer investors a global and diversified universe worth more than $1.4 trillion from more than 700 issuers.

Also read: US bonds—Dealing With Deficits, Debt and Demand

Strong investors’ appetite

Institutional investors were the first to grasp the potential of the instrument in a context of growing awareness around climate change risks, increased demand for transparency and regulatory scrutiny.

Yet, it did not take long for wholesale and retail investors to be won over by green bonds as well in a rush for credible sustainable investment solutions.

As rates hit multi-year highs, green bonds now also offer the possibility to capture attractive yields levels and a decent pick-up compared to the conventional universe, at a moment when central banks are reaching their peak rates.

While the green bond market may have converged towards the conventional bond market when it comes to average duration or ratings, some differences remain. The green bond universe is more concentrated towards euro and dollar currencies and offers higher exposure to credit debts than the conventional market.

These differences imply a close to 200bps tracking error between a global green bond and a global aggregate index. This did not translate historically into major performance differences with a correlation between the two universes over the past five-year standing at around 91%. Yet, the rebound in rates volatility seen in 2022 has highlighted that these differences should not be ignored when considering a green bond allocation against a conventional aggregate benchmark.

Combining green bonds with US treasuries

We believe there is a very simple way to allocate to green bonds while addressing this dilemma. We found that combining green bonds with US Treasuries should increase the performance correlation and decrease the tracking-error against a global aggregate universe. This combination addresses the two key differences we highlighted between green bonds and the conventional market with a very liquid and low-cost approach.

In order to define the most optimal allocation, we ran a series of portfolios combining green bonds with up to 40% US Treasuries. The results demonstrated that with up to 25% allocation to US Treasuries, tracking error should decline and performance correlation improve while maintaining a higher, or similar, yield level. Yet, when continuing to allocate more to US treasuries, it is likely the correlation will hit a cap before declining, and tracking error hits a floor.

We believe that a 75% allocation to green bonds combined with 25% US treasuries would be a potentially optimal way to gain exposure to green bonds, minimise tracking error, maximise correlation and preserve the yield of the resulting allocation. Indeed, such combinations should offer a 98% correlation with a global aggregate universe (up from 91% for green bonds alone) with 1% tracking error (half of what the green bond universe exhibited).

Looking forward

The green bond market has become increasingly dynamic and should continue to offer interesting investment opportunities going forward. The benefit of transparency, the measurability, competitive yields both in absolute and relative terms make this well-balanced universe particularly attractive for investors looking for attractive valuations and a credible sustainable solution. Whether they opt for a custom approach to the green bond universe or a combination strategy, we believe investors can take advantage of the universe with approaches that are innovative and yet straightforward.