Many commentators question the protective qualities of long dated fixed rate government bonds with very low interest rates. This article shows long dated government bonds still can protect portfolios, given recent yield increases. Hence, while longer dated government bonds might have slipped off your radar, they should now be back on your radar.

Here, with a view to providing a context to the discussion on a portfolio of equities and bonds, Stephen discusses fiscal and monetary policy, as well as the inflation outlook.

At present, global governments, and central banks have set a highly stimulatory setting for equity markets, as a way of offsetting the depressing impact of the recent pandemic; both in terms of fiscal and monetary policy.

Fiscal policy

In terms of domestic fiscal policy, the Federal government has increased spending substantially. Federal net debt is expected to now grow to around 43 % pf gross domestic product (GDP), peaking in 2023-24. Large stimulus measures, such as Job-keeper, which will stay in place until March 2021, is just one example that, alone, will cost around AUD 90bn by the time it expires.

In terms of US fiscal policy, several packages have been provided, some of which are as follows:

- The USD 8.3 bn Coronavirus Preparedness and Response Supplemental Appropriation Act, initiated on March 6, 2020

- A USD 3.4 bn package was initiated on 18 March 2020

- Another stimulus package of USD 2.3 trn that quickly followed the $3.4bn package

Other measures were also initiated by the Trump administration. Furthermore, on 21 December 2020, even more stimulus was created with a USD 900 bn relief package. Currently, President Biden is currently seeking to provide another USD 1.9 trn of stimulus, at this time, and in Europe, similar fiscal stimulation measures have been put in place, meaning, among other things that the fiscal stimulus is about as large as it possibly could be.

Monetary Policy

Domestic monetary policy has been eased to completely unprecedented levels in the domestic economy, with the RBA also now embarking on quantitative easing, where the RBA is fixing 3-year Commonwealth bond rates, as well as leaving short borrowing costs at very close to zero. To emphasise the scale of this easing, the RBA has committed to leaving rates low for the next 3 to 4 years, and similarly, the US central bank has eased rates to close to zero and has made similar commitments about rates staying low for the next few years. In addition, Europe has extended prior easing of monetary policy, in an effort to stimulate growth. Many other programs have been initiated by the US central bank, and the European Central Bank, in addition to the easing of monetary policy; programs which contribute to very a strong monetary stimulation impact.

What does this mean for equity valuations?

Fiscal stimulation is generally aimed at improving the growth of an economy, and the daunting size of the current fiscal stimulation, has led the equity market to come to a consensus view; full steam ahead. More specifically, the vaccine is seen to build a bridge, from the current situation of high unemployment and low growth, to a higher level of economic growth and lower unemployment.

As this consensus view has gradually been adopted, by more and more market participants, a higher, and higher, level of growth has gradually been built into the pricing of equities; especially the S&P 500.

One measure of the long-term valuation of the S&P 500 is known as the Shiller PE, where price is divided by the average of ten years of earnings, while also being adjusted for inflation. In the past, prior to all the monetary easing of the last decade, a good rule of thumb was to buy the S&P 500 around levels of 5, on the Shiller PE, and then to sell equities, as they exceeded 25, on the Shiller PE. Yet, much easier monetary policy, now combined with very strong fiscal stimulus, has elevated the Shiller PE, to the extent that the old range, of 5 to 25, seems to have been skewed upwards; possibly to a new range between 15 and 35.

However, the current Shiller PE even exceeds this adjusted range. In addition, if the current stimulation is withdrawn, and interest rates revert to longer term averages, then the Shiller PE range could then adjust back towards the older range, of 5 to 25.

Will stretched valuations lead to volatility?

In other words, even if we take account of the current tsunami of stimulation as described above, current valuations are still very elevated. Now, given this elevation, we can expect that markets will magnify even trivial issues, and possibly decline more than they would, in the absence of such an elevation. Possible challenges to economic growth forecasts include the following:

- Antitrust and Technology: Regulation of the large technology companies in the US, especially with regard to anti-trust regulation. This debate has been developing for some time, and is nothing new, however, it may become a focus of the market at some point.

- Pandemic variants: The efficacy of certain vaccines may come under increasing scrutiny, as variations of the pandemic become more apparent, and as those variants resist the existing suite of vaccines.

- Default acceleration: It may be the case that business defaults may begin to accelerate, much more than currently expected, once existing relief measures are eventually withdrawn, both domestically and offshore.

- Inflation rises: recent increases in commodity prices are significant, and these increases have been largely absent over the last decade. One might argue that the rise of commodity prices might be more about the declining US dollar, however, the fact remains that commodity prices should tend to support higher inflation, all else being equal. Now, if inflation does break out substantially, then rates will rise, meaning current equity valuations will be revised downwards.

- Underestimation of virus impact: In general, markets may be underestimating the impact of the virus on the economy, and a recent series of US jobless claims releases, where the market has underestimated the size of the jobless claim numbers, is indicative of a somewhat complacent attitude to the size, and scale, of the virus impact on the economy.

This is not an exhaustive list, and to clarify, the author is not maintaining that any of these triggers will occur in the short term, as these are tactical issues that are not addressed herein. Rather, the more important, strategic point here is that current valuations are going to elevate volatility, as stretched valuations generally tend to do.

Role of Bonds as a means of cushioning equity volatility

Given the prospect for volatility in equity pricing, the typical institutional portfolio would have a dedicated allocation to long dated bonds. However, of late, the level of bond yields has been somewhat depressed, which had presented that idea that the defensive power of bonds might have collapsed. To explain, if bonds are already low in yield, then expecting large declines, possibly in reaction to an equity market decline, was seen as not being feasible. Even put more simply, if 10-year rates are at 5%, then they can fall a lot, but if they are at 50 basis points, then they can still fall; just a lot less.

Now, the essential point to note of late is that long bond yields are now back to where they were, just before the pandemic occurred. Among other things, this means that the recent rise in long bond yields reflects optimism, and the deflation of that optimism should enable yields to now fall substantially, from current levels, in the event of a decline in equity pricing. Essentially, the optimism that currently exists in bond pricing, which has seen yields rise, will be replaced with much more caution, in the event of a decline in equity pricing, and that injection of caution will see bond rates move lower; possibly a lot lower, all else being equal.

Just to clarify, for the sceptics out there, the author is not saying that bond yields have peaked and that they will not rise for years, as that is a tactical issue; an issue not considered in this article. Rather, the author is arguing that bond yields now reflect the optimism in equity markets, and that optimism is increasingly seen to be ephemeral, given the elevation in the Shiller PE. More importantly, and from a strategic perspective, bonds now provide a viable and feasible equity volatility cushion. If equity pricing comes under pressure, a small portfolio should have what every institutional portfolio has; a long bond allocation.

Now, if you have a long bond, with a ten-year modified duration, then for every 100 basis points that the bond moves in yield, the capital price of bond will vary by roughly 10%. Equally, if the modified duration is 20 years, then the impact on bond prices, as yields decline, is roughly double what is if for the 10 year; the reverse is true as well.

An example of how long bonds helped the portfolio last year

Now, if equity pricing declined by, say 20%, it is likely that long bond yields will follow that decline in yield, which means that capital prices will rise. A decline of 50 basis points in the long bond yield might a reasonable estimate of how far a bond yield might decline in a 20% equity decline, although each situation varies, and bearing in mind that estimates of bond yield declines in situations of economic stress are usually unreliable. However, in this situation, where the long bond declines by 50 basis points, the capital price on the 10-year modified duration bond, would rise 5%. Hence, the rise in price of the long bond helps to partly offset, to cushion, your loss from equities; to some extent.

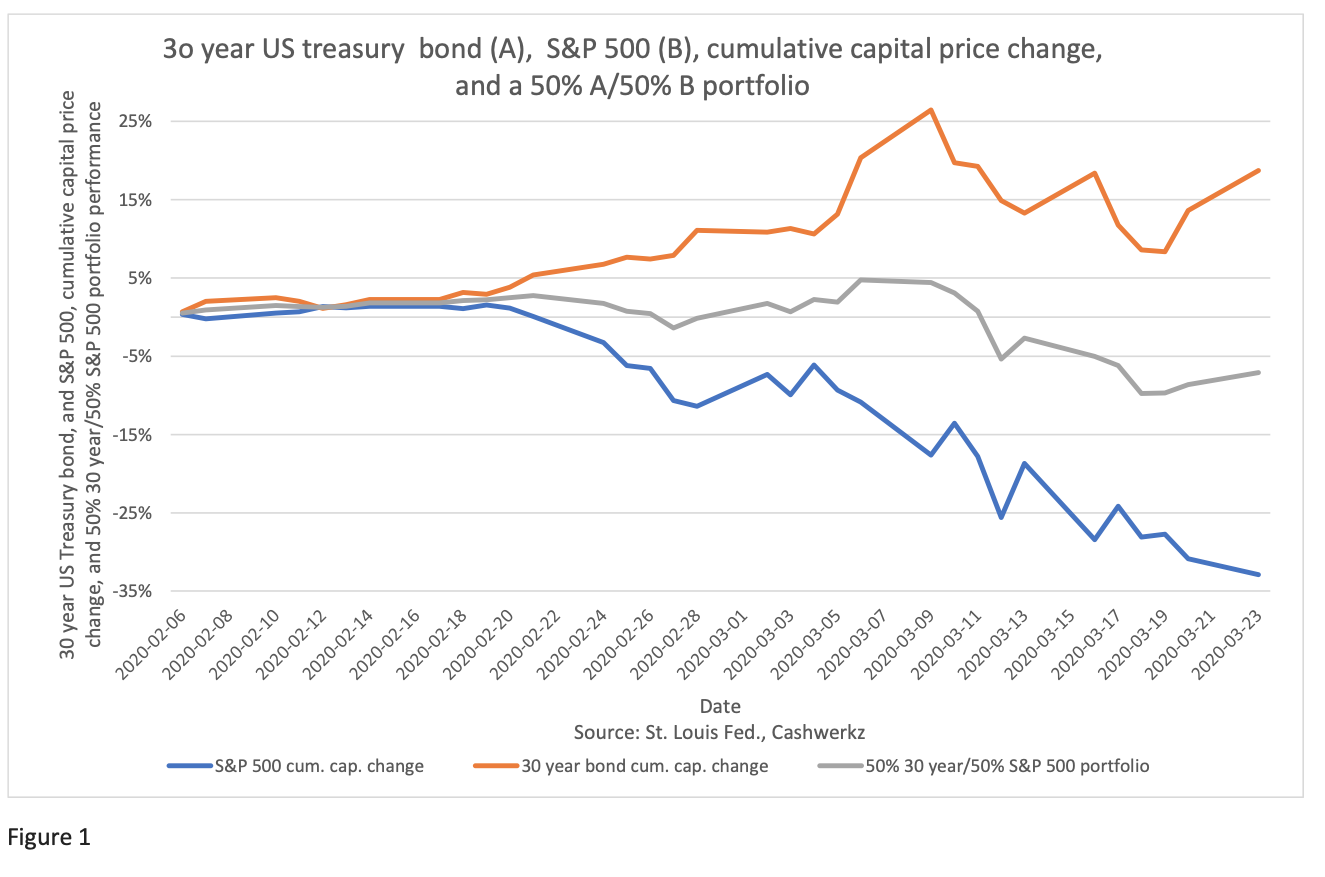

While the above sounds all very well, in a theoretical sense, one might ask if there any recent examples. Here, as Figure 1 indicates, in the crisis period of February 2020, 30-year bonds went up strongly in price, as shown by the orange line, and that price increase really assisted portfolios, which were experiencing losses from equity positions. If we use a 50/50 portfolio, as an example, split between 30-year fixed rate government bonds and S&P 500 equities, then the portfolio would be still experiencing losses at the end of the period considered in Figure 1. However, the losses would be significantly moderated, as shown by the grey line, relative to a portfolio without long bonds, as shown by the blue line in Figure 1.

Conclusion

Looking at your portfolio strategically, the essential point to note is that equity valuations are currently lofty, mainly because of the general context of significant economic stimulation confronting investors.

However, long bond rates have now returned to where they were before the pandemic crisis of March 2020. Once again, long bonds are providing a cushion to your equity portfolio.

Hence, if you do not have any long bonds in your portfolio, then you should begin the procedure of building positions in long dated fixed rate government bonds. In the alternative, if you only have short-dated bonds, it might be an idea to switch some of those shorter bonds to longer dated bonds.