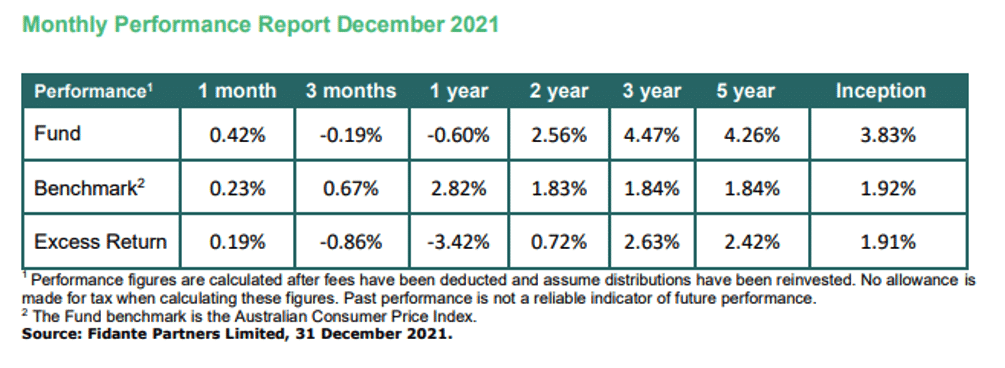

US monthly inflation reached 7% last week, the fastest rise since the early 1980s, and the FED came out and said it may have to raise interest rates faster than expected. The first US interest rate rise is expected in March and recent consensus is for three rate rises this year.

US Monthly Inflation Rate

Have central banks let the inflation genie out of the bottle? Time will tell. I’ve always advocated high net worth individuals should own inflation linked bonds as they are the only 100% hedge against inflation. But prices have risen, and I’ve thought direct investment (with minimum investment per bond around $10,000) was too expensive, but that all depends on your view of future inflation. You can invest direct via government or a very limited number of tightly held corporate inflation linked bonds. Contact one of the direct bond brokers if you are interested in direct investment, otherwise read on to learn about some of the funds that invest in inflation linked bonds to help you ward off the inflation threat.

Three Australian funds

ETFs and managed funds can be passive or active. Some of the longer operating passive funds may represent value as they would have bought the bonds when inflation was benign, and many investors shied away from inflation linked investment.

Active funds should be trading securities and at different times will hold varying levels of protection. It you are specifically wanting inflation protection, look for minimum allocations to the sub sector or funds that aim to outperform CPI. Here are three specific inflation linked bond funds.

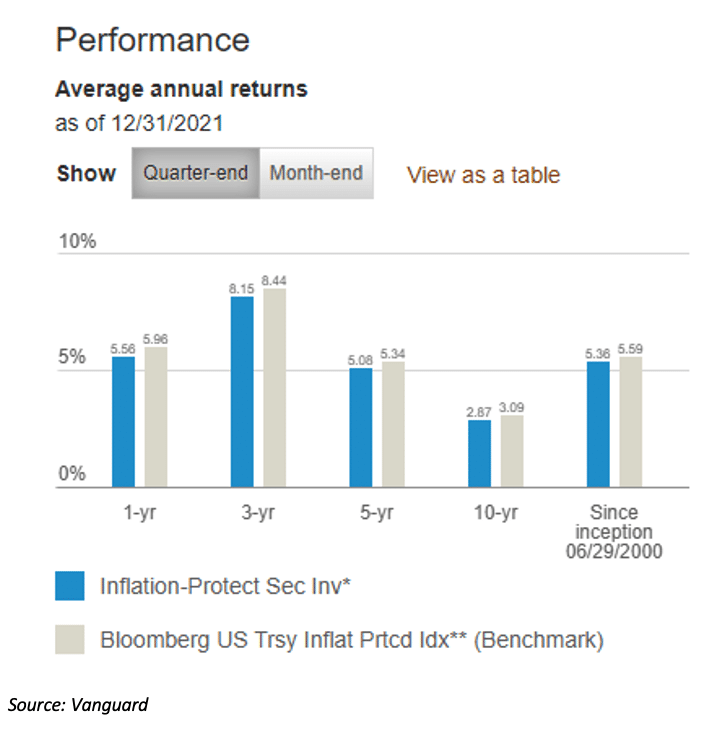

1. iShares Government Inflation ETF (ASX:ILB)

This is a simple ETF with exposure to just 14 government securities, mostly Australian Government. The fund first listed in March 2012. Yield since inception is 4.29% and net assets are $342 million. Running yield is 1.26% and weighted average yield to maturity 1.65%. The real yield of the fund is -0.66%. The fund has a long average term to maturity and duration, both over eight years, so has interest rate risk.

2. Mercer Australian Inflation Plus

2. Mercer Australian Inflation Plus

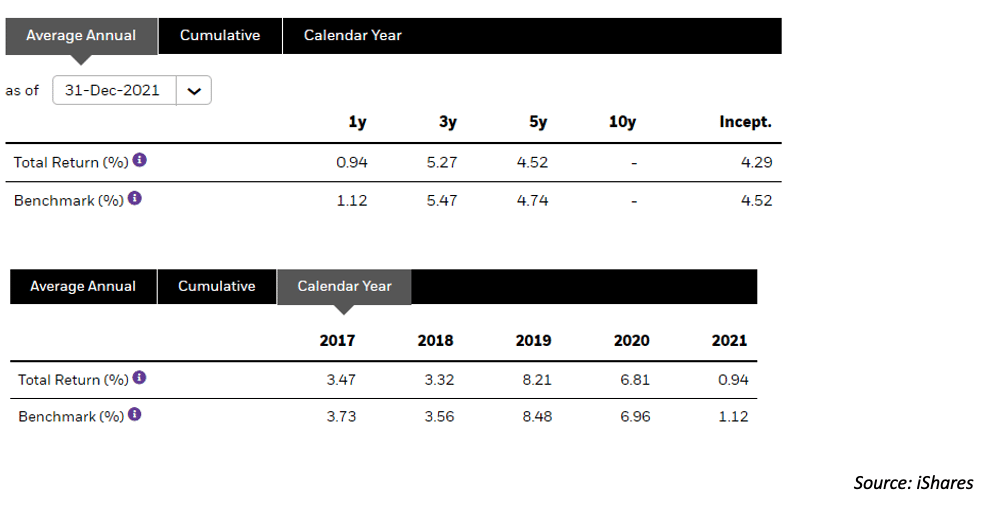

Mercer’s managed funds are outsourced. Its Australian Inflation Plus fund is 100% managed by Ardea Investment Management.

Ardea primarily invests in very liquid and high quality government and semi government bonds both in Australia and overseas. The objective is to achieve a return above inflation, through a value-style approach that utilises multiple and diversified investment strategies with a focus on accurate measurement and management of risk.

3. Vanguard Australian Inflation Linked Bond Index Fund

The Vanguard inflation linked fund is similar to the iShares fund. Inception was in the same year – April 2012, it holds just 10 securities, all being issued by the Commonweath Government of Australia, so is also a very high quality portfolio. The fund is considerably larger than its iShares competitor with net assets of $893.5 million as at 31 December 2021.

Long term performance with net return since inception of 4.42% is comparable but short term, the fund has outperformed its iShares competitor with a one year net return of 1.83%, three years 5.62% and five years 4.66%.

Yield to maturity is 1.68% with a long weighted average maturity of 11 years and effective duration of 10 years.

Two Popular US Funds

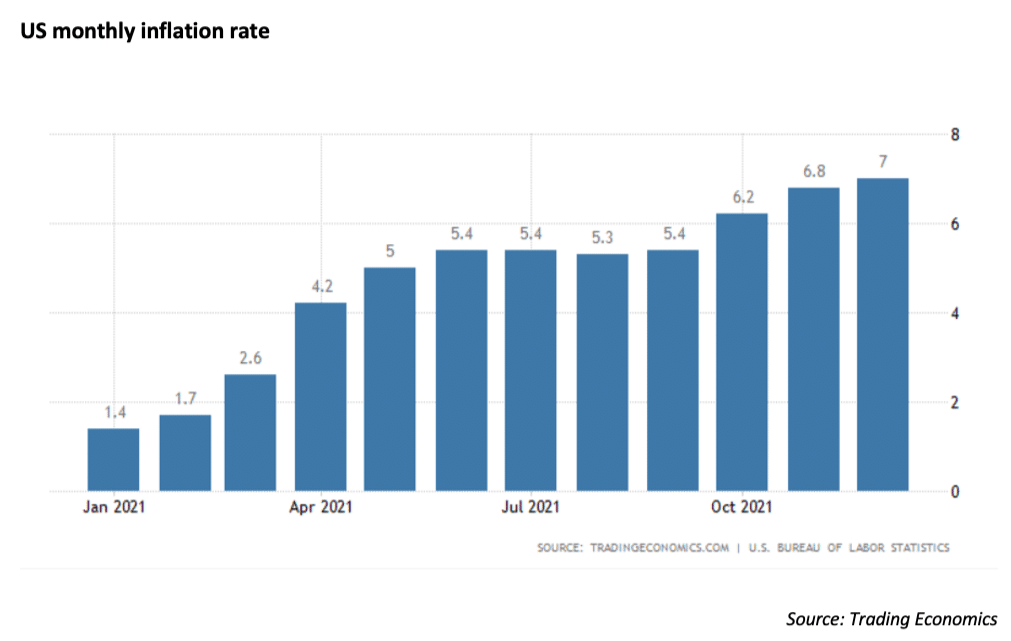

Vanguard’s VIPSX and Fidelity’s FIPDX are among the popular US inflation-protected bond funds.

VIPSX invests in 49 US Government bonds with an estimated yield to maturity of 1.2%. Average effective maturity is lower than the Australian funds at 7.9 years and average duration is 7.5 years. The fund’s total net assets are US$41.8 billion.

VISPX has returns since inception in June 2000 of 5.36% and over the last year 5.56%.

Minimum investment is US$3,000.

Weighted average maturity is eight years and duration 5.45 years as at 31 December 2021.

It has no minimum investment amount and a lower expense ratio compared to the Vanguard fund.

Two specialist fund managers that aim to beat inflation

2. Ardea Investment Management

Ardea is a long term, fundamentally driven, value investor with a focus on liquidity and diversification. It’s retail offering the Ardea Real Outcome Fund targets a stable return in excess of inflation over the medium term. The fund is available as a managed fund and as a listed ETF – ActiveX Ardea Real Outcome Bond Fund (Managed Fund)(ASX: XARO).

XARO invests in Commonwealth Government Bonds, Semi-Government Bonds, inflation derivatives, interest rate derivatives, bank bills and Negotiable Certificates of Deposit (NCDs) issued by larger Australian banks. It may have up to 25% exposure to direct offshore Government bonds. The fund may also use derivatives to gain additional exposure to non-Australian interest rates and aims to hedge any foreign currency exposure back to the Australian dollar.

The fund has $11 billion in funds under management and as at 31 December 2021, invested 39% of the portfolio in Australasia, 15% in Europe and 45% in North America.

The Fund’s highly differentiated investment approach generates returns exclusively from capturing relative value mispricing opportunities across global interest rate markets. For more information, see the fund’s detailed monthly report.

2. Fortlake Asset Management

Fortlake take a holistic view to fixed income investment by incorporating a variety of specialised techniques and strategies to deliver diversified returns. It has four funds, two of which are for retail investors – The Fortlake Real Income Fund and the Fortlake Real Higher Income Fund.

Both funds seek to protect investors against inflation risk and use various derivatives to achieve results. The Real Income Fund targets a return of 2.5-3.5% over the prevailing cash rate and the Higher Income Fund 4-5% above the same benchmark.

Interested investors must sign in to view performance metrics.

Note: None of the funds mentioned in this note are recommendations rather for general information purposes only. Historical returns are no indicator of future performance.

2. Mercer Australian Inflation Plus

2. Mercer Australian Inflation Plus