US inflation came in higher than expected overnight, with prices climbing 8.3% compared to a year ago. The acceleration points to a stubbornly high cost of living for Americans and increases the likelihood of another 75 basis points rise to the US Federal Funds rate. In this piece, Seema Shah, Chief Global Strategist, Principal Global Investors explains his expectations.

Markets rallied this summer as investors mistakenly connected the inflation peak with a likelihood that the Fed would soon wrap its monetary hiking cycle. Instead, the Fed has remained steadfast in not letting a deteriorating economy get in the way of additional monetary tightening—sending the summer rally into reverse.

The summer market rally, which had reversed more than half of the S&P 500’s 2022 losses, was built on misplaced dovish Federal Reserve expectations, and has recently taken a significant hit.

In mid-June, as oil prices started to decline, many investors began to believe that the oncoming peak in inflation would permit the Fed to wrap up its rate hiking cycle. Markets also reasoned that an economic slowdown could prompt the Fed to stop monetary tightening early.

Also read: Are Investors Compensated For Risk Premia In The Current Environment?

However, at the Jackson Hole Symposium in late-August, Fed Chair Jerome Powell pushed back against expectations for a near-term policy pivot, delivering a painful reality check:

- The Fed needs to see a string of softening inflation and wage growth numbers—one month’s worth of encouraging data is insufficient.

- Economic pain will be an unfortunate, but necessary, evil in the path towards achieving price stability.

- Prematurely calling victory over inflation is dangerous and could lead to even more severe and prolonged economic struggles.

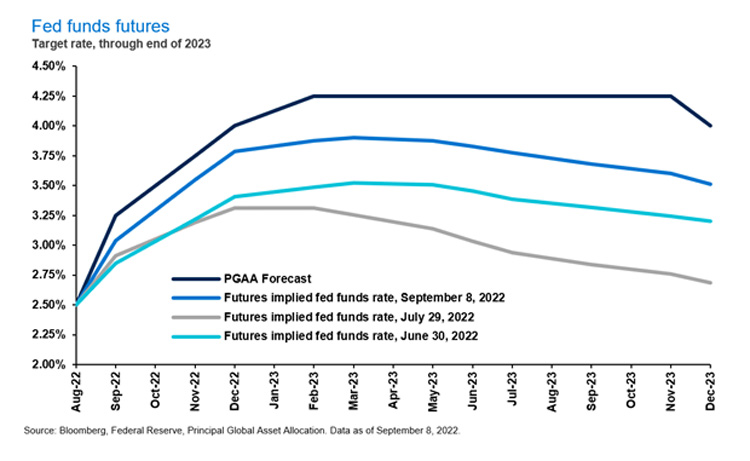

The Fed’s stance is quite clear. Due to the enormity of the inflation task ahead, a weakening economy cannot stand in the way of further monetary tightening, and rates will need to remain at a restrictive setting for a prolonged period. For investors: Position portfolios for a more sustained monetary tightening campaign.