Investment platform provider iPartners has opened up its first basket to investors, which includes bonds from three ASX-listed corporations and Australia Post.

A basket is a collection of multiple securities, for example stocks or currencies, which share certain criteria or themes.

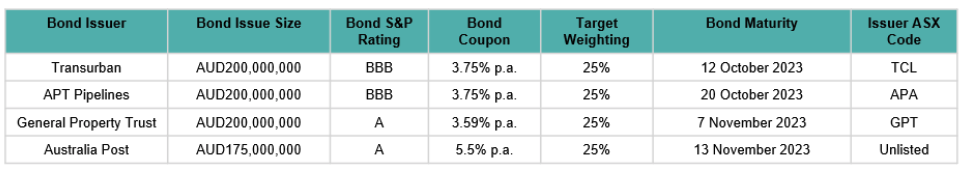

The iPartners Bond Basket Secured Note Series 1 is made up of four investment grade Australian corporate bonds that includes bonds from Australia Post and three ASX-listed corporations Transurban, APT Pipelines and General Property Trust.

The expected interest rate is 4-4.5%pa with monthly distributions and a maturity of 16 months.

iPartners Bond Basket Secured Note Series 1 Constituents

- Transurban (ASX: TCL) is a road operator company that manages and develops urban toll road networks in Australia, Canada and the United States.

- APT Pipelines provides gas transmission pipelines, gas storage facility, and wind farm for power generation throughout Australia. APT pipelines is a subsidiary of APA group (ASX: APA), Australia’s largest natural gas infrastructure business, which owns and operates natural gas and electricity assets in Australia.

- General Property Trust (ASX: GPT) is a real estate investment trust that is one of Australia’s largest diversified property groups with a real estate portfolio valued at more than $20bn.

- Australia Post is an unlisted government owned enterprise that provides postal services in Australia.

According to iPartners, investors traditionally have found it challenging to gain access to corporate bonds with minimum parcel sizes of $500,000 typically a requirement, but through the iPartners structure, wholesale investors are able to invest and gain diversification with a minimum of only $10,000.