Franklin Templeton’s Andrew Canobi highlights perception versus reality

The 1999 cult movie Matrix explores the theme of perception versus reality in this world.

“A bit like financial markets today,” says Andrew Canobi, Franklin Templeton Fixed Income portfolio manager.

Canobi has analysed Australia’s second quarter GDP numbers to draw parallels between the current state of Australian economy and Matrix.

“Like much of art that imitates life, Australia is nonetheless living in a Matrix economy of its own doing. When released, the second quarter GDP numbers at face value looked fine. 0.4% expansion Quarter on Quarter and 2.1% Year on Year.

“But on closer examination we expect the RBA will be only too aware of the cracks beneath the headline number. Digging deeper reveals an alternative truth that suggests the illusion of the solid headline numbers is just that.

“For all the headline positives Australia is now seeing growth slow, per capita growth tank and the full impact of rate hikes still working their way through the economy. The interest rate sensitive parts of the economy are responding to the RBA’s medicine, be it the household numbers themselves or the clear skew toward essential spending. It would take a material reacceleration to see the RBA move higher from here,” says Canobi.

Also read: Soft Landing? Central Banks Trying To Thread The Needle

Conobi lists four areas that reflect the Matrix moments of perception versus reality.

Matrix moment #1: household consumption

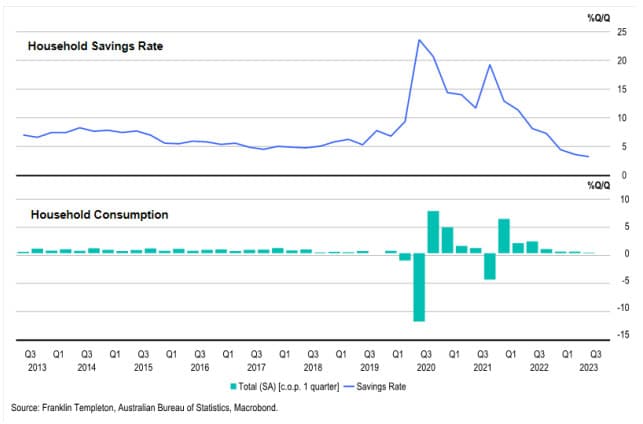

Household consumption is much weaker than the headline GDP number. Like other developed economies, the largest component of growth is the household sector, so we always go straight to this figure. Growth in consumption barely registered a positive at all at +0.1% over the quarter. At the same time the savings rate continued to fall to multi-year lows. Even drawing down on savings couldn’t save household behaviour as real income growth remains under pressure. Consumption was weakest in Victoria (-0.2%) and New South Wales (0%) for the quarter, which should surprise no one given the indebtedness of households in these two states.

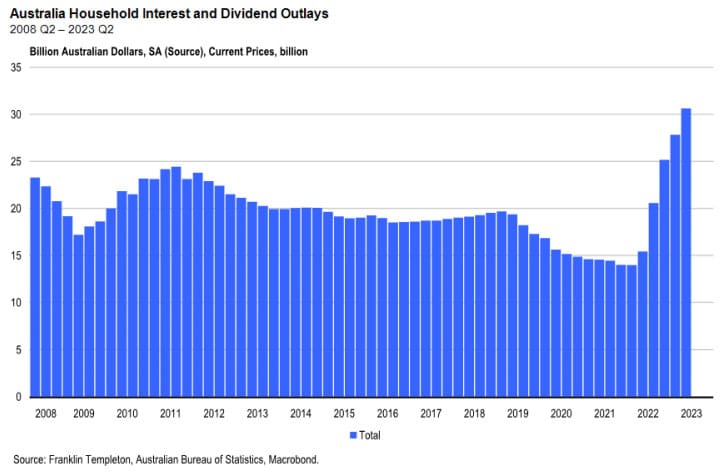

The best visual as to why consumption has hit stall speed is the below chart showing the quarterly interest bill being metered out to the household, which is going parabolic. Relative to mid-2022, an additional ~$60bn in interest is being sucked out of wallets on an annualised basis.

Matrix moment #2: consumption

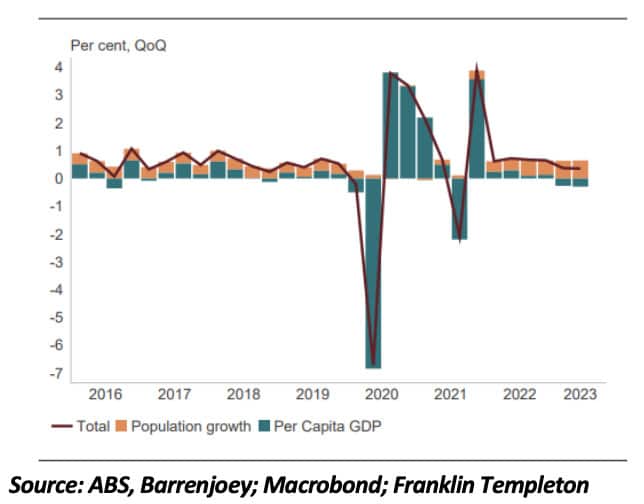

What is perhaps even more remarkable than the tiny consumption number above is that it comes against the background of roaring population growth such that the per capita recession isn’t coming. It’s well and truly here. The GDP numbers are being boosted by the surge in the size of the population which grew by 0.7% in the quarter alone or 2.4% YoY. This is a massive figure.

GDP per capital fell for a second quarter in a row again contracting 0.3%. The chart below shows total, per capita GDP growth and population growth. The two negative green blocks confirm the per capita recession is now officially here.

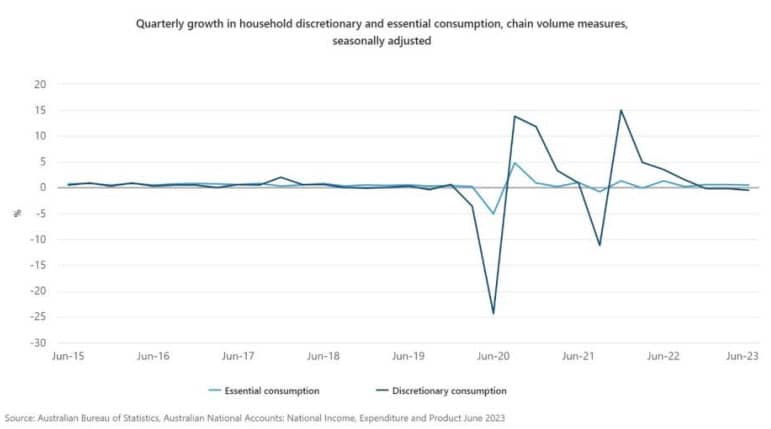

Matrix moment #3: spending

Even what little household spending growth there is reflects a growing redirection of spending to essentials away from discretionary items. The poor beleaguered household is now responding to the monetary belting of 400bps of hikes.

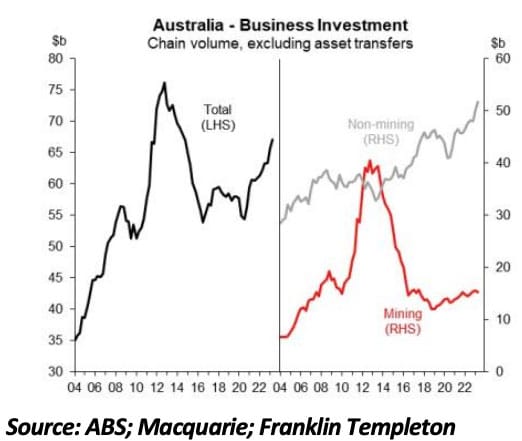

Matrix moment #4: The illusion of business investment.

Business investment was strong in the quarter increasing by 1.6%. At face value that’s a positive and boosts the outlook for productivity. But there’s business investment and then there’s business investment. Whilst doubtless some quality decisions were made, we know the resolution of previously interrupted supply chains and government policy to extend the instant asset write-offs for work vehicles was a significant driver of investment in ‘machinery and equipment’.

In the words of the Australian Bureau of Statistics (ABS) “New private investment increased 1.6%. New machinery and equipment investment rose 4.3%, boosted by the improved availability of motor vehicles and other equipment following supply chain disruptions and processing backlogs at ports in prior quarters.”

This is polite speak for lots more overpriced Ranger and Hilux utility vehicles being bought by trade workers to take advantage of the last hurrah for the instant asset write off tax provisions. Hardly a GDP champagne cork popping moment unless you own stock in Toyota or Ford.

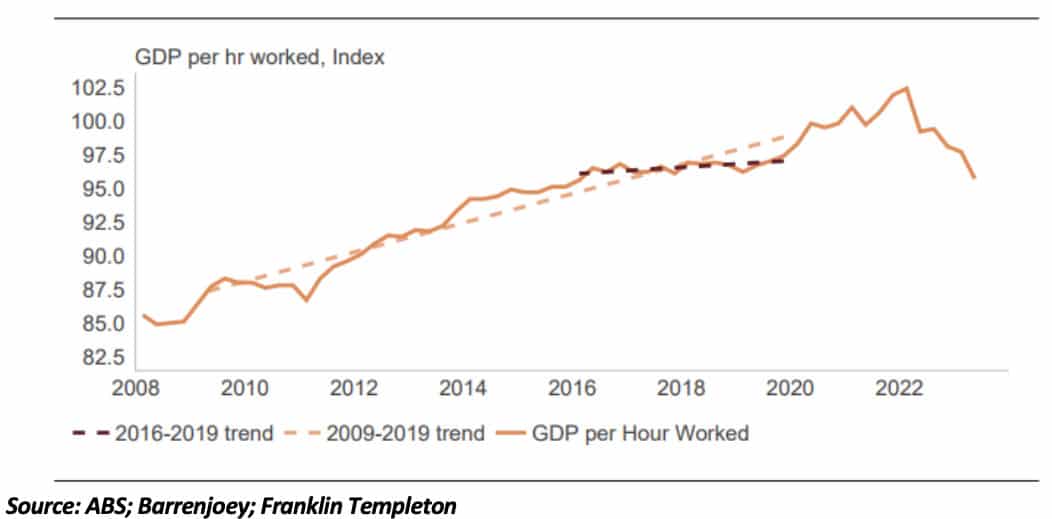

There are more holes we can point to from the continued overreliance on net exports to boost headline GDP. There is still healthy government consumption even as the RBA has the fire hose out pointed at spending and others. The productivity numbers themselves optically still look average. Hours worked grew strongly in the quarter relative to GDP so productivity still looks poor.

The RBA has cited poor productivity as a concern as it essentially means labour costs are too high relative to output. We aren’t worried.

Firstly, measuring productivity in a service-based economy is notoriously difficult so it is possible, if not likely, the sharp fall normalises in coming quarters. Secondly, and more importantly, corporates aren’t stupid. If you hire someone that isn’t adding any value their longevity is unlikely to be great.

Poor productivity isn’t sustainable in a free market economy as companies will make decisions that maximise their return on equity.

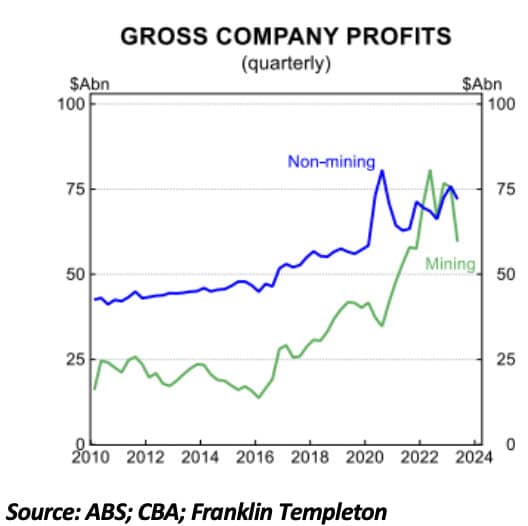

The fact that company profits fell over the quarter tells us that corporates will help solve some of the productivity problems themselves.